-

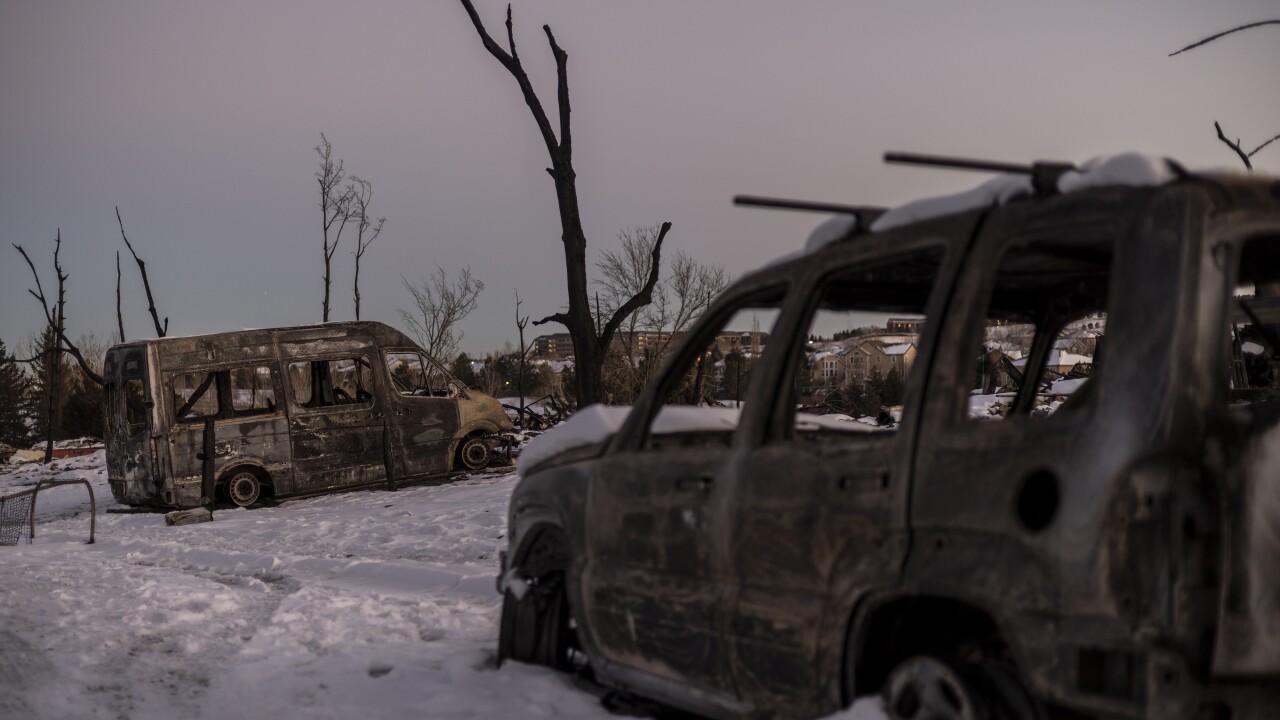

The changing climate is increasing insurance rates for residents and cities and lowering property values in areas that face more frequent and intense disasters.

December 11 -

Moody's Ratings has put McLaren Health Care Corporation's A1 revenue bond ratings under review for downgrade after Indiana ended a key Medicaid contract with the company.

November 26 -

While the cost of caring for older people can pressure municipal issuers, in states like Florida wealthy seniors can also contribute to economic vibrancy.

October 2 -

The state will charge active employees higher salary-based health plan premiums to avoid a near-term $1.3 billion deficit.

August 18 -

Even before January's fires in Los Angeles, change-of-address data shows residential moves based on fire risks and insurance availability.

June 16 -

The legislation would create a bond-financed reinsurance program to stabilize the homeowner's insurance market, which has been impacted by wildfires.

March 26 -

The issuing entity said it has collected enough money to pay all outstanding debt service.

March 7 -

A state board moved toward instituting salary-based employee premium health insurance payment system as a way to avoid a looming $1.3 billion deficit in the government's health plan budget.

February 7 -

The insurance market going into the Jan. 7 catastrophe already had been hit with non-renewals and cancellations -- and an overburdened state-supported insurance plan. A Morningstar analyst said the state insurance commissioner's reform strategy could have turned it around but now faces new obstacles.

January 16 -

Early totals on Los Angeles' trio of raging fires appear to vastly surpass devastating blazes experienced by the city over the past decade.

January 9 -

Brad Briner said the state may need to issue short-term debt in the near future to pay for Hurricane Helene expenses.

December 12 -

The agency cited the closeness of the entities to Florida's government.

November 25 -

When communities can't access affordable insurance, it can decrease home values, tank municipal bond ratings, and cripple the tax base — and this will only get worse if left unaddressed.

November 13 InnSure

InnSure -

"We were originally thinking that we would offer five-, seven- and 10-year maturities, with $500 million in each tranche. But we decided today to just offer 5s and 10s — $500 million of five-year bonds and $1 billion of 10-year bonds," said Ben Watkins, Director of Florida's Bond Division.

April 15 -

"Insurance rationing by the leading insurers is becoming the mechanism by which climate risk is starting to impact municipal issuers," said Triet Nguyen, vice president of strategic data operations at DPC Data.

March 15 -

Citizens Property Insurance Corp. reported that private insurance companies assumed 650,399 policies from the state's last-resort carrier in 2023.

January 3 -

The budget proposal keeps $16.3 billion in reserves and pays down an additional $455 million in debt. While providing $1.1 billion in tax relief to residents, the plan is $4.6 billion lower than the current fiscal year's budget.

December 5 -

Lawmakers are looking for ways to slow the rising cost of property insurance, provide additional relief to victims of Hurricane Idalia, bolster efforts against anti-Semitism and support Israel while targeting Iran.

November 6 -

The Florida Insurance Guaranty Association is getting ready to head back to the market next week with a variable-rate bond deal after successfully selling fixed-rate bonds last week to help fund claims from insolvent insurance companies.

July 5 -

Houston is one of the largest U.S. cities to set up a trust to help fund non-pension retiree benefits such as healthcare.

June 12