Assured again on the top

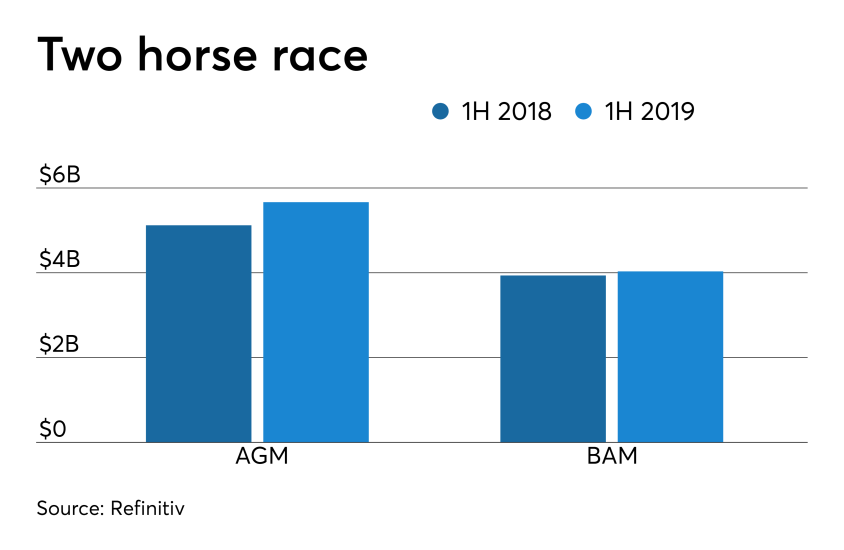

For the second quarter of 2019 only, Assured led the market, capturing 60% in terms of par insured and 51% in transaction count of the insured market. Compared with the second quarter of the previous year, Assured Guaranty’s insured par was up 27% to $3.7 billion, surpassing the 13% increase in the insured market, and up 58% to 260 new issues in transaction count.

Assured also saw its secondary market insured par rise 186% compared with last year's second quarter and its aggregate par insured totaled $4 billion in the primary and secondary markets, generated by a total of 377 primary market transactions and secondary market policies.

In the case of AA credits (defined as those credits that have a “AA” category rating from S&P Global Ratings or Moody’s Investors Service on an uninsured basis), Assured Guaranty insured 13 deals in the second quarter totaling $482 million of par.

“During the second quarter of 2019, both Assured Guaranty and the bond insurance industry as a whole performed very well in comparison with last year’s second quarter, despite the 5% decrease in municipal bond issuance," Robert Tucker, senior managing director of communications and investor relations for Assured said. "One driver of our success during the quarter was the continued demand for our guaranty on larger transactions, which typically interest institutional investors; we were selected to insure more than $100 million of par on six separate transactions.”

Some of the largest Assured transactions in the second quarter were: $200 million of the $886 million Kansas City Airport deal; $204 million of senior and junior lien Pittsburgh Water and Sewer's $214 million deal; All of $200 million of Clark County School District's deal; And all of East Side Union High School District, Calif.;s $140 million deal.

BAM increases par amount

“We saw a building preference for insured bonds from investors in the second quarter and the entire first half, benefitting BAM and the industry as a whole," Seán W. McCarthy, BAM's CEO, said. "Insured bonds outperformed the overall market, and we saw increased utilization on larger new-issue transactions as well as solid demand for adding BAM’s guaranty in the secondary market."

He added that a dozen more issuers chose to have their green bonds verified under the BAM GreenStar program during the second quarter alone. Since its launch last October, more than 40 issuers from 10 states have sold more than $500 million of BAM GreenStar bonds, which confirms that the use of proceeds from those issues aligns with the International Capital Markets Association’s Green Bond Principles.

"The quarter also saw BAM join the Federal Home Loan Bank of New York, enhancing our capital resources with a new, low-cost source of liquidity, and S&P Global Ratings complete its annual review, affirming BAM’s double-A rating and stable outlook," McCarthy said.

Some of the largest BAM transactions in the second quarter were: $106.9 million student housing revenue bonds for North Carolina Central University; $92.5 million of senior lease-revenue refunding bonds for the Anaheim, Calif., Public Financing Authority (partial wrap of a total deal size of $169 million); $59 million of general obligation bonds for the Allentown City School District, Penn.; $52.6 million of public improvement serial bonds for Suffolk County, N.Y.; and $51 million of public improvement serial bonds for Monroe County, N.Y.