CHICAGO — Chicago heads into the market this week with the first piece of $1.2 billion in O'Hare International Airport refunding debt expected to generate double-digit savings while also streamlining the facility's general airport revenue lien structure.

On Wednesday the city will price $729 million of general airport revenue refunding bonds with Barclays Capital in the lead position. The deal is being offered in an A series for $446 million subject to the alternative minimum tax, a B series for $251 million subject to the AMT, and a C series of non-AMT bonds for $32 million.

The finance team faces headwinds from negative rating actions and some uncertainty over the future operations of one of the airport's hub carriers, American Airlines, which is in bankruptcy. But the airport's overall strengths and an abundance of investor cash should help Chicago's sale, and the opportunity for buyers to squeeze some extra yield out of the city should attract buyers, market participants said.

The city, which owns and operates one of the world's busiest airports as an enterprise system, earlier this year redeemed its first-lien GARBs and with the upcoming deal will pay off all of the airport's second-lien and a portion of its third-lien bonds for savings.

With the tranches pricing Wednesday, the city will consolidate all of its O'Hare GARBs into one senior lien made up of the refunding bonds and existing third-lien debt, which was the primary vehicle used by the city to issue new money for the ongoing $8 billion runway expansion under the O'Hare Modernization Program, or OMP.

"There are significant savings with the transaction given the low interest-rate environment and this gives us the opportunity also to bring all of the GARBs into a single structure," said Chicago chief financial officer Lois Scott. "Having the three liens made it a very complex structure." The transactions are both expected to generate about 10% in present value savings.

Though Moody's Investors Service downgraded the airport's GARBs to A2 from A1 in an action that affected $6.5 billion in debt, it called the lien changes a positive. "The airport's decision to consolidate debt into the senior lien adds stability to the rating," analysts wrote. The city also will bolster its debt service reserves with cash as part of the sale.

Fitch Ratings assigns an A-minus rating and negative outlook to the credit, and Standard & Poor's also rates the bonds A-minus but revised its outlook downward to stable from negative.Bank of America Merrill Lynch and Loop Capital Markets LLP are co-senior managers and another eight firms round out the team.

Chicago returns on Aug. 22 to sell $443 million of passenger facility charge refunding bonds with Citi in the lead spot. The PFC deal has an A series for $114 million and a B series for $330 million. Serial maturities tentatively run through 2027 with term bonds in 2032.

The PFC bonds and all of the city's $800 million of debt backed by PFCs levied on passenger travel are rated A2 by Moody's, A-minus by Standard & Poor's, and A by Fitch. The ratings were all affirmed recently while S&P revised its outlook to stable from positive. PFC coverage has narrowed but is expected to remain at 1.7 times.

Wells Fargo Securities and Loop are co-senior managers and another eight firms round out the syndicate.

On both the PFC and GARB bonds Katten Muchin Rosenman LLP is bond counsel and Burke Burns & Pinelli Ltd is co-bond counsel, while D & G Consulting Group LLC and Frasca & Associates LLC are advising. Ricondo & Associates Inc. serves as airport consultant.

"It's a good time for non-triple-A credits to sell since spreads are relatively narrow and yields are low," said Alan Schankel, director of fixed-income research at Janney Montgomery Scott LLC. "Investors should be able to get a little extra yield because of the downgrades, but there's a lot of money out there and all the indications are there's a lot of demand at the airport and a good management team and plan in place."

Scott said Chicago would not shy away from asking underwriters to take down bonds that don't come in at prices reflective of the city's expectations in the market, as it did with its recent GO issue.

Moody's downgrade of the GARBs stems from O'Hare's high leverage, narrow financial margins, and economic and construction risks tied to the magnitude and complexity of OMP projects. Its challenges are heightened by weak economic growth, the ongoing bankruptcy of American Airlines, and the complexity of the OMP expansion plan.

The city's finance and aviation officials have sought to highlight the positive long-term benefits of the OMP. It has "already reduced delays and increased capacity and there's more to come," said city Aviation Commissioner Rosemarie Andolino. She also stressed that the facility has added new airlines and service, and expanded its concession offerings that are expected to generate more revenue.

The credit benefits from the region's large economy and the airport's strong originations and destinations market, its unique dual hub status with American and United Airlines accounting for 80% of flights, and the on-time and on cost completion of the $3.28 billion first phase of the expansion plan.

O'Hare relies on airline revenues for 65 % of its operating revenue and its debt per passenger is $410, much higher than Moody's median of $86 for all airports. Though May, passenger levels were up by 3.7% following a decrease of 0.1% in 2011.

Fitch warned that sustained high leverage, rising costs and a contraction in traffic figures could drive a downgrade, while noting that the airport's underlying strength "comes from the passenger base that ranks among the nation's largest for both origination and destination." Annual debt-service requirements are projected to rise from $276 million in 2011 to over $600 million by 2017, Fitch said. Debt service coverage on GARBs remains at the required 1.1 times.

The GARB outlook change "reflects our belief that definite financial plans" for $2.3 billion of future OMP projects are "not likely to be finalized until 2014 or later," said Standard & Poor's credit analyst Joseph Pezzimenti.

Mayor Rahm Emanuel has pressed the airlines to jumpstart negotiations over future projects, but they have resisted.

A combination of factors — including potential future leveraging of O'Hare's PFCs, the chance that Congress won't increase the PFC cap, and possible lower coverage ratios should passenger levels remain flat or fall off — drove the outlook revision on the PFC credit. Nearly 50 carriers operate out of O'Hare handling more than 33 million passengers last year.

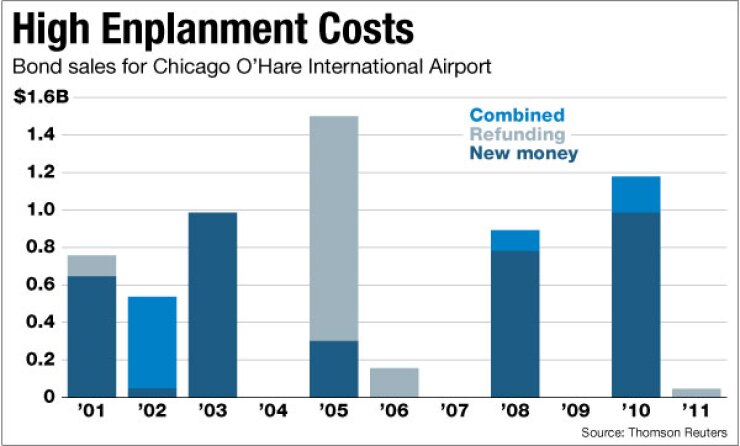

Chicago issued new-money airport debt in a $1.1 billion sale last year after a tumultuous legal battle with United and American over whether the city could legally proceed with a second phase of $3.36 billion of projects they had not yet approved. Federal authorities stepped in broker a settlement that allowed the city to begin work on $1.17 billion of projects. Former Mayor Richard Daley unveiled the expansion plan in 2001 and had wanted it completed by 2014, but that date has been pushed off and plans for a new $2 billion terminal are on hold.