-

Fed Chair Jerome Powell said cuts are likely this year but are not guaranteed. He added that the Fed is looking for more signs that inflation is moderating. "We are prepared to maintain the current target range for the federal funds rate for longer if appropriate."

January 31 -

The city is looking for "a diverse group of qualified firms with varied strengths and market advantages" to "provide the most cost-effective distribution."

January 31 -

"Yields are attractive, and there's going to be a lot of demand and there's not going to be a lot of bonds," said Scott Diamond, co-head of the municipal fixed income team at Goldman Sachs.

January 30 -

Moody's Investors Service cited thinning operating performance for the downward outlook revision.

January 30 -

"The market seems to be coalescing around the view that these historically rich ratios can be sustained through February, but that the market technical becomes far less favorable in March and April," said Birch Creek Capital strategists in a report.

January 29 -

Interest rates and federal elections hang heavy over the industry and municipal analysts believe certain muni sectors or subsectors will experience credit deterioration.

January 29 -

BofA expects muni yields to continue to move up and credit spreads to narrow "in a slow and gentle fashion" in February.

January 26 -

The inflows into muni mutual funds mark a reversal from 2022 and 2023.

January 26 -

LSEG Lipper reported Thursday that investors added $210.6 million to municipal bond mutual funds for the week ending Wednesday — the third consecutive week — after inflows of $898 million the week prior.

January 25 -

As ridership remains low, investors are closely watching for new funding streams and credits like the MTA's planned congestion tax-backed bonds.

January 25 -

Inflation and mandate pressures are key factors that moved the outlook lower.

January 25 -

Despite fixed-income seeing losses this month, Jeff Lipton, managing director of credit research at Oppenheimer, believes "a performance sea change is nearing."

January 24 -

After the year-end rally, "2024 bond investors have been reluctant buyers, prices creeping lower perhaps until the data and the Fed's next steps are more clear," said Matt Fabian, partner at Municipal Market Analytics.

January 23 -

This week's heavy new-issue calendar of tax-exempt supply "could lead to a modest cheapening of ratios," said Vikram Rai, head of municipal markets strategy at Wells Fargo.

January 22 -

Moody's Investors Service bumped Chicago's outlook to positive from stable, while affirming the city's Baa3 issuer and general obligation bond ratings.

January 22 -

Katz is well known for guiding operational improvement and expense control in the financial services sector, his new employer said.

January 22 -

Growing new-issue supply is "adding to bidders' 'wait-and-see' mentality with a variety of credits coming to market at favorable spreads," said FHN Financial's Kim Olsan. Next week's calendar hits $8.4 billion.

January 19 -

"Hiring Giles along with other senior and experienced hires over the last year demonstrates our deep commitment to public finance at a time when our competitors are laying off in droves or retrenching from the sector entirely," said Suzanne Shank, president and CEO of Siebert Williams Shank.

January 19 -

Altadena, California-based Episcopal Communities & Services for Seniors was able to sell bonds through a treasurer's conduit thanks to the new state law.

January 19 -

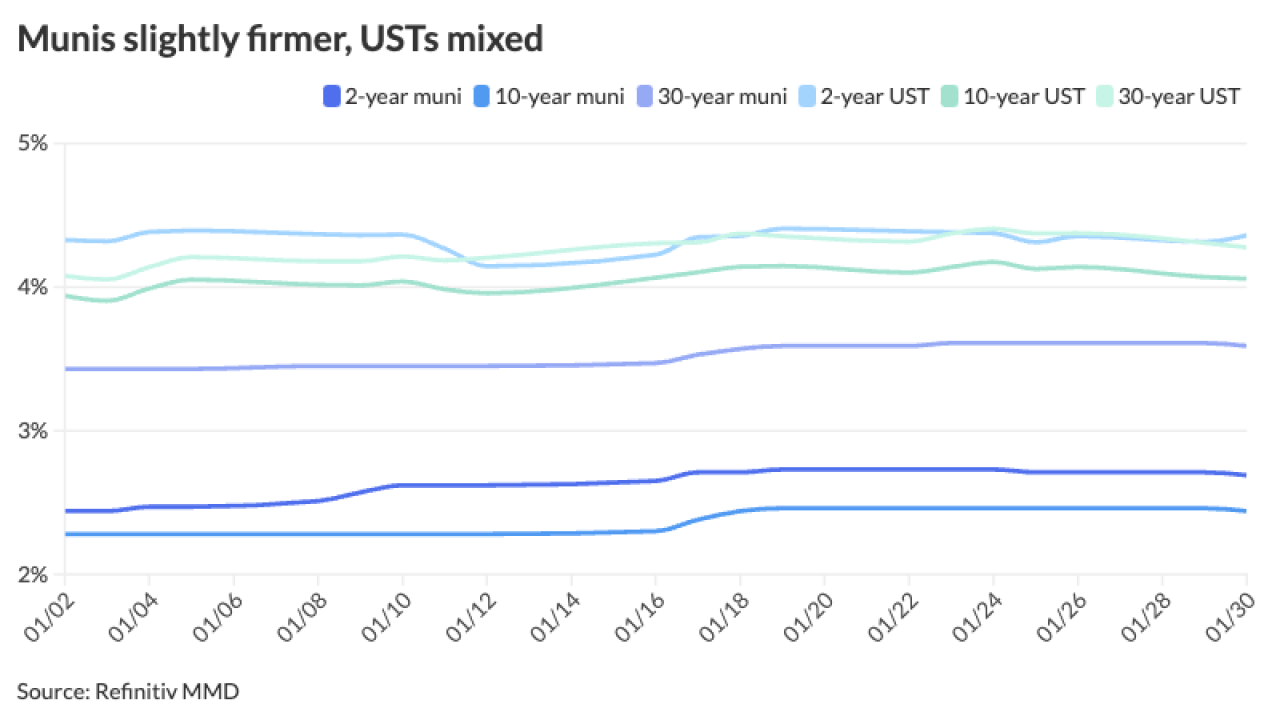

Muni yields rose up to eight basis points, depending on the scale, while UST yields rose up to six basis points at 30 years.

January 18