-

Many issuers are trying to understand rating agency methodology changes that could affect more than a third of them.

June 11 -

Munis should see better performance this week as issuance falls to $5.2 billion this week and cash still needs to be reinvested, said Jason Wong, vice president of Municipals at AmeriVet Securities.

June 10 -

The ratings agency cited growing enplanement counts, expectations of resilience during future economic downturns, and strong management for its upgrade to AA from AA-minus.

June 10 -

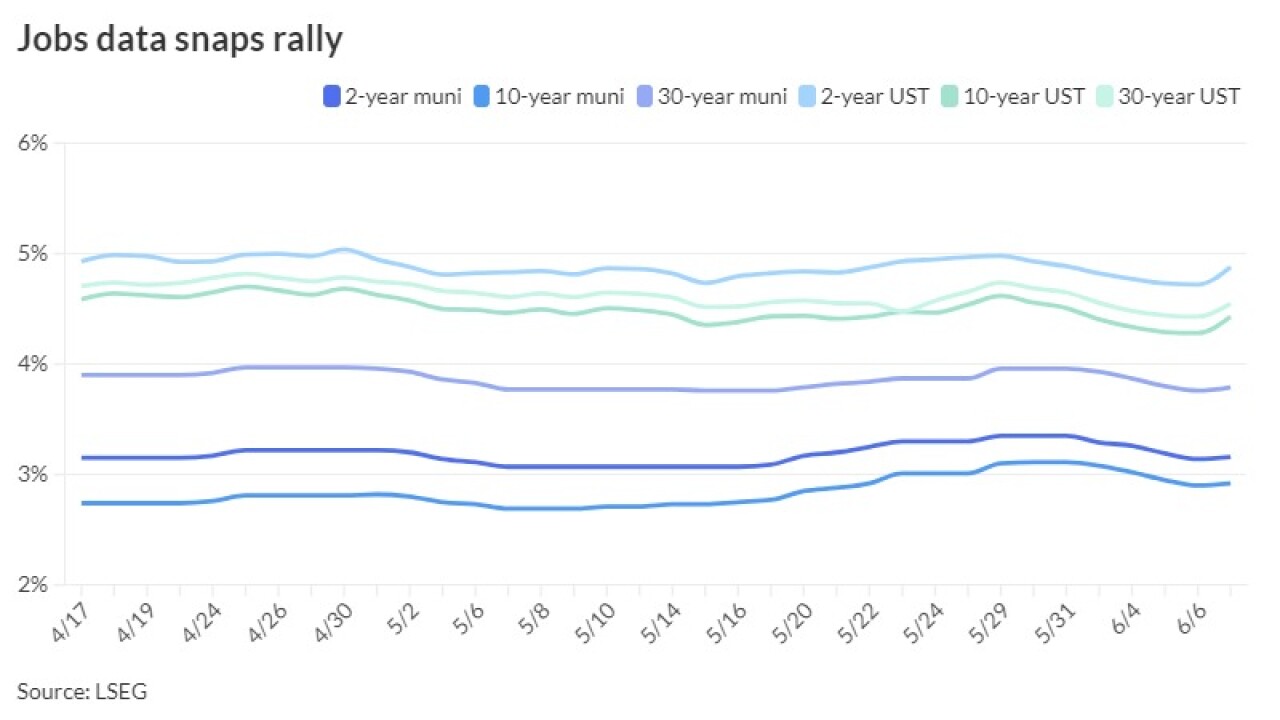

USTs spiked 17 basis points on the short end and 15 to 12 10-years and out following the release, while triple-A curves saw yields rise two to five basis points, depending on the yield curve, in a more muted and typical reaction for the asset class.

June 7 -

A $345 million taxable bond deal will support the public-private partnership arrangement that will upgrade the College Park campus district energy system.

June 7 -

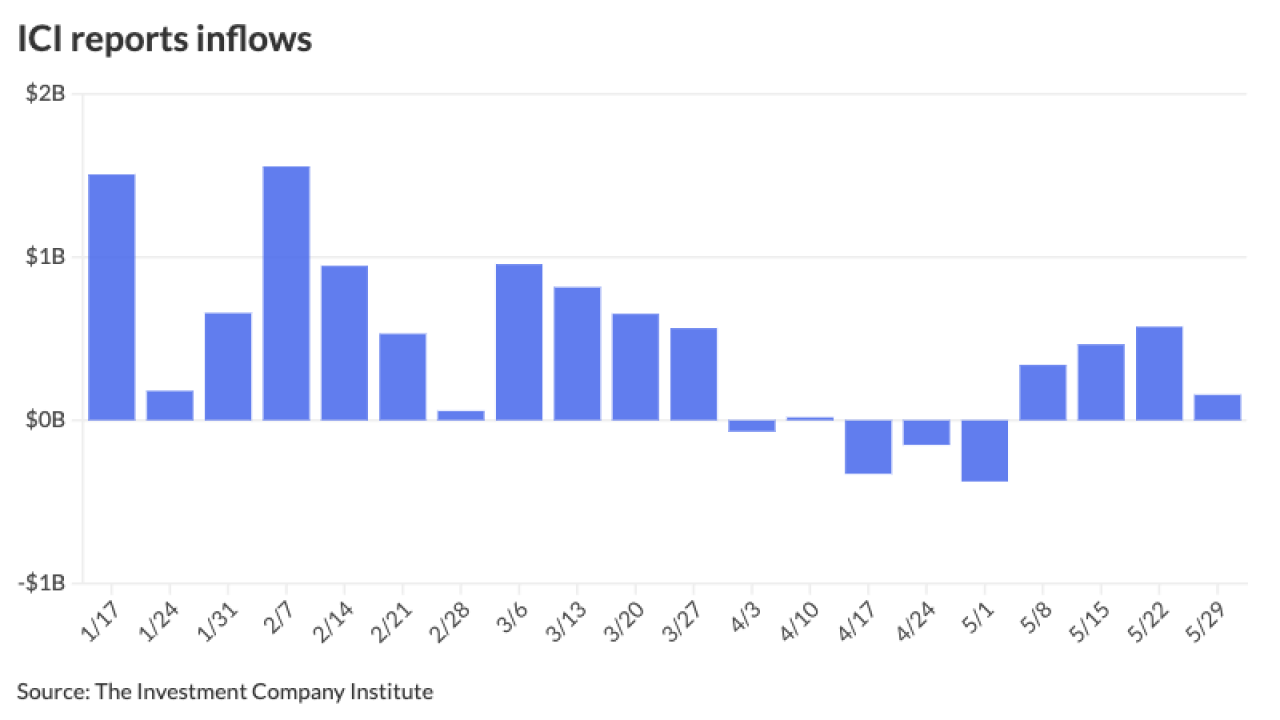

Municipal bond mutual funds saw inflows as investors added $549.2 million after $94.9 million of outflows the week prior, according to LSEG Lipper.

June 6 -

Issuance remains robust Wednesday with an estimated $5.9 billion, said J.P. Morgan strategists led by Peter DeGroot.

June 5 -

Moody's Ratings analysts revised the outlook to stable from negative on the expectation that states and locals will fill an $8 billion operations funding gap.

June 5 -

New-issue volume has topped $50 billion over the past few weeks, said AllianceBernstein in a weekly report.

June 4 -

Falling occupancy figures, staffing shortages, and rising labor costs have elevated the sector's risk, with Greenwich Investment Management's bankruptcy yet another example of how the sector requires thorough credit analysis.

June 4 -

This week's surge in issuance, which tops $14 billion, is "likely going to keep a lid on any enthusiasm," Birch Creek strategists said in a weekly report.

June 3 -

Connecticut's GO deal is expected to benefit from its improving fiscal reputation, embodied in two rating outlook revisions to positive ahead of the pricing.

June 3 -

While particpants expect some pressure in the near-term with more than $16 billion on tap, they also say the current yield and ratio levels offer investors opportunity.

May 31 -

The first chip in the state's triple-A crown comes ahead of plans to competitively auction $1.2 billion of general obligation bonds next week.

May 31 -

May volume "surprised on the high end and it has been one of the fastest starts to the year historically," said James Pruskowski, chief investment officer at 16Rock Asset Management.

May 31 -

Cabrera Capital Markets is among the firms that has capitalized on the exits of UBS and Citi from municipal bond underwriting to add senior bankers.

May 30 -

Despite losses, munis are "being set up nicely" as the summer season approaches, said Jeff Lipton, a research analyst and market strategist.

May 30 -

Muni yields rose up to 13 basis points Wednesday, depending on the curve, coming on the tailwind of a market correction, said Brad Libby, a fixed-income portfolio manager and credit analyst at Hartford Funds.

May 29 -

S&P Global Ratings revised the outlook on bonds issued for the University of Chicago Medical Center to negative from stable.

May 29 -

The California Community Choice Financing Authority was the leader in the public power sector, issuing nearly $5 billion or 28% market share in 2023. It was also one of the top 10 overall issuers of 2023.

May 29