-

Municipal bond mutual funds saw inflows as investors added $1.258 billion to funds — the second-largest inflow figure year-to-date after $1.413 billion of inflows for the week ending Jan. 31.

September 12 -

Moodys says it is placing additional weight on the states' Aaa ratings in determining the Garvee ratings.

September 12 -

The commission approved $73 million of limited obligation bonds for Rowan County schools.

September 12 -

The August consumer price index showed inflation remains above the Federal Reserve's target level and makes a 50-basis-point rate cut next week unlikely, economists said. Further, many expect the market will be disappointed going forward, as future cuts will likely be shallower than expected.

September 11 -

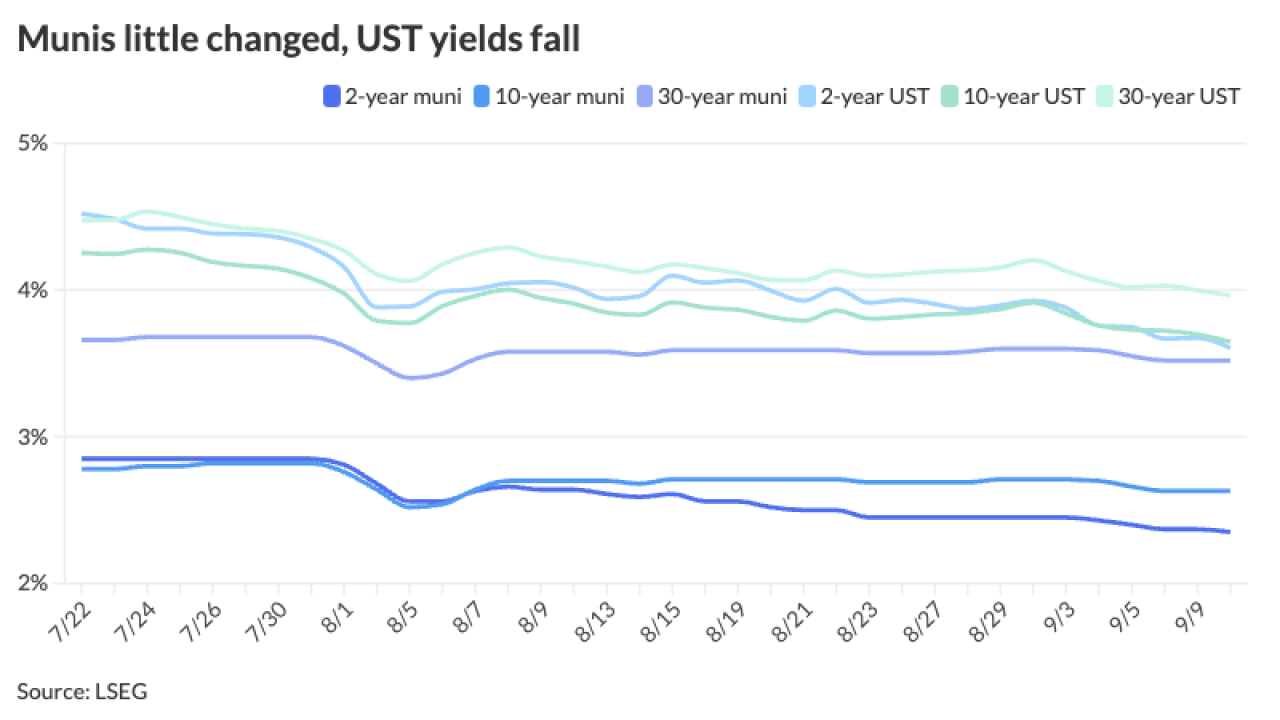

Municipals lagged the UST moves again, cheapening ratios and creating a valuable entry point for investors looking for compelling taxable equivalent yields, particularly 10-years and out.

September 10 -

Fitch also upgraded the city's Georgia Municipal Association certificates of participation (city of Atlanta public safety projects) to AA-plus from AA.

September 10 -

Stagnant per-pupil state funding amid rising costs led to budget deficits, lower reserves, and ballot proposals to raise property tax rates for some districts.

September 10 -

"Despite the underperformance of tax-exempt yields last week, we could see some more pressure on both spreads and ratios due to the heavy supply calendar," said Vikram Rai, head of municipal markets strategy at Wells Fargo.

September 9 -

Piper Sandler has hired Joe Kinder and Brent Blevins as managing directors on its public finance team. Both will focus on Missouri school districts and issuers.

September 9 -

Massachusetts drew multiple bidders for all four tranches when it sold $850 million of general obligation bonds competitively last week.

September 9 -

Municipal supply continues to grow as Bond Buyer 30-day visible supply sits at $20.02 billion and the municipal market will see one of the largest weeks of new-issuance at an estimated $13.35 billion, led by three billion-plus deals from Washington, D.C. ($1.6 billion), the New York City Transitional Finance Authority ($1.5 billion) and Illinois ($1 billion).

September 6 -

Ciraolo, who spent more than 17 years at Goldman Sachs, has been brought on as a senior vice president in corporate and municipal short-term securities to help expand SWS' taxable muni franchise through commercial paper trading.

September 6 -

Municipal bond mutual funds saw inflows as investors added $956 million to funds after $1.047 billion of inflows the week prior, according to LSEG Lipper.

September 5 -

Most weeks in September are expected to see around $10 billion of issuance, which could easily grow if a prepaid gas deal is thrown into the mix, said Jason Appleson, head of municipal bonds at PGIM Fixed Income. Bond Buyer 30-day visible supply sits at $16.46 billion.

September 4 -

House Republicans are hoping to jam through a voter eligibility bill as part of the upcoming continuing resolution in order to avert a shutdown before Sept. 30.

September 4 -

Illinois will sell up to $1.1 billion of general obligation refunding bonds and $600 million of taxable and tax-exempt GO bonds by the end of September.

September 4 -

Summer redemption season has ended, and "without the huge amounts of maturing and called bond principal flowing back to investors, demand in the last months of the year will be more reliant on new money coming into the market than it was in June, July and August," said Pat Luby, head of municipal strategy at CreditSights.

September 3 -

The $180.24 million deal comprises $76.085 million of metropolitan district bonds and $104.155 million of consolidated public improvement bonds.

September 3 -

As extreme weather events occur with more frequency across the country, Michael Gaughan, executive director of the Vermont Bond Bank, says municipal bond banks can help smaller communities deal with the effects of them. Gaughan speaks with The Bond Buyer's Lynne Funk on the effects of climate change and how the various levels of government can work together to address it.

September 3 -

Investors will see more than $7.8 billion of supply to start off September, following a record issuance month in August. The calendar is led by the North Texas Tollway Authority's $1.126 billion of system revenue refunding bonds while high-grade Massachusetts leads the competitive slate with $850 million of exempt and taxable general obligation bonds.

August 30