-

After Minnesota's second-largest healthcare employer was downgraded by rating agencies, the Minnesota Nurses Association took aim at Allina Health's board.

October 16 -

Supply ramps up this week to an estimated $13.361 billion, with several billion-dollar pricings on tap.

October 15 -

Florida will use its own cash, not from a refunding bond, to buy up to $500 million of bonds tendered.

October 15 -

Pension analysts are calling for higher contributions even as financial conditions improve.

October 15 -

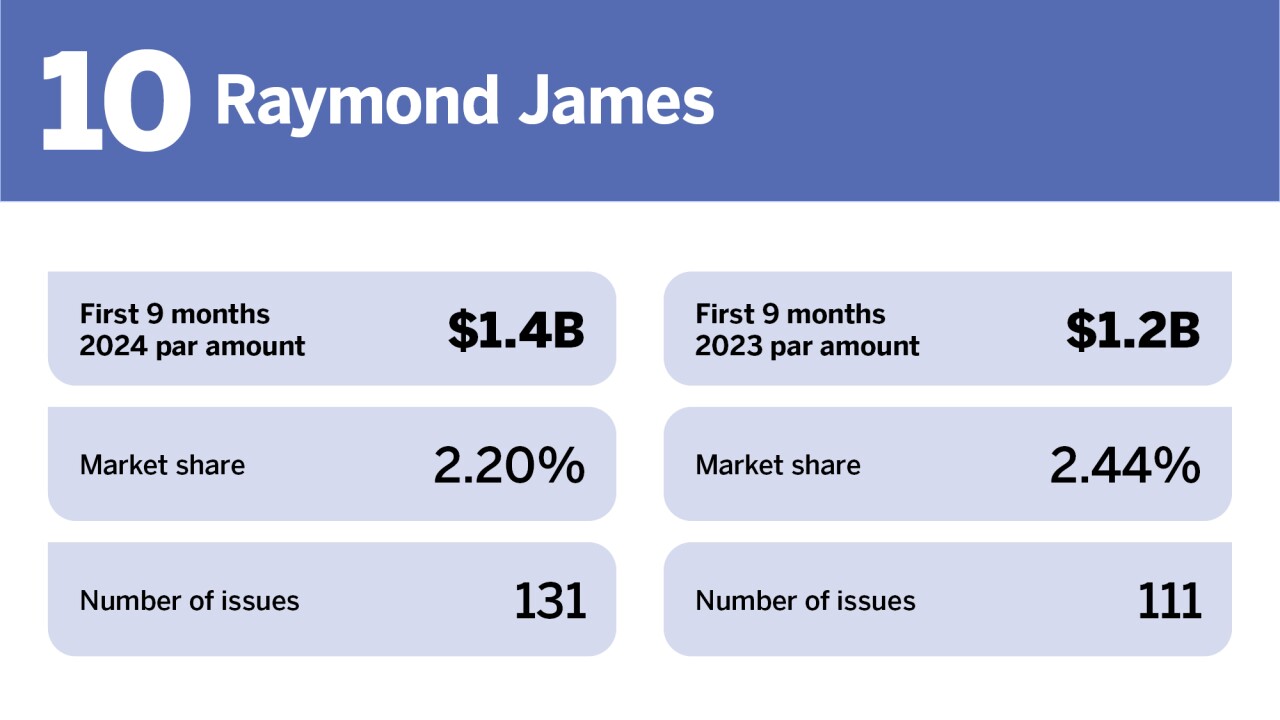

As the underwriter landscape changes, so does the competitive market.

October 15 -

Municipal triple-A yield curves played catch up to USTs Friday to close out a week of more mixed economic data that has economists constantly reevaluating their Federal Reserve policy expectations with little consensus.

October 11 -

Municipal bond insurers wrapped $28.921 billion in the first three quarters 2024, a 26.8% increase from the $22.814 billion insured in the first three quarters of 2023, according to LSEG data.

October 11 -

Analysts remain divided about what the stronger-than-expected consumer price index will mean for Federal Reserve policymakers since the Fed appears to be concentrating on the labor market.

October 10 -

Data from the Municipal Securities Rulemaking Board indicates that trade volume may stay high after a consistent third quarter.

October 10 -

With munis establishing "directional footing" in the fourth quarter of this year, the technical backdrop is still the market driver for 2024, said Jeff Lipton, a research analyst and market strategist.

October 9 -

Fitch revised upward its outlook for Marin General Hospital and affirmed its revenue bonds at BBB, and general obligation bonds at AA-minus.

October 9 -

Supply is slightly lower this week at nearly $10 billion but not by much, with the pace of supply suggesting $500 billion of issuance for the year could still happen, said Tripp Kaiser, a managing director at Municipal Market Analytics, Inc.

October 8 -

The rating is a new milestone in the state's long road out of legislative dysfunction.

October 8 -

City Comptroller Brad Lander said he's optimistic about the deal, congestion pricing lawsuits and his mayoral campaign.

October 7 -

Muni yields were cut up two to five basis points, depending on the curve, while UST yields rose five to seven basis points, pushing the 10-year UST yields above 4%.

October 7 -

Enright's passion for infrastructure and complicated deals led him to the cutting edge of municipal financing strategies.

October 4 -

Municipal bond mutual funds saw inflows of $1.879 billion in the latest week, marking the 14th consecutive week of inflows and the highest level of 2024, per LSEG data, reiterating the strong investor support for this market.

October 3 -

The biggest theme within the muni market — and what is responsible for its performance — is the amount of cash on the sidelines, with $6-plus trillion in money market funds and close to $2.5 trillion in certificates of deposits, said Julio Bonilla, a fixed-income portfolio manager at Schroders.

October 2 -

Through the integration, Investortool's clients can calculate analytics based on predictive trade levels, filter the live market based on "what's rich or what's cheap" compared to the predictive price and power automation, said James Morris, senior vice president at Investortools.

October 2 -

As managing director at Crews & Associates, Susan Reed aims to bring creative ideas and a deep well of experience to bear on challenges facing Indiana issuers.

October 1