-

Florida will use its own cash, not from a refunding bond, to buy up to $500 million of bonds tendered.

October 15 -

Pension analysts are calling for higher contributions even as financial conditions improve.

October 15 -

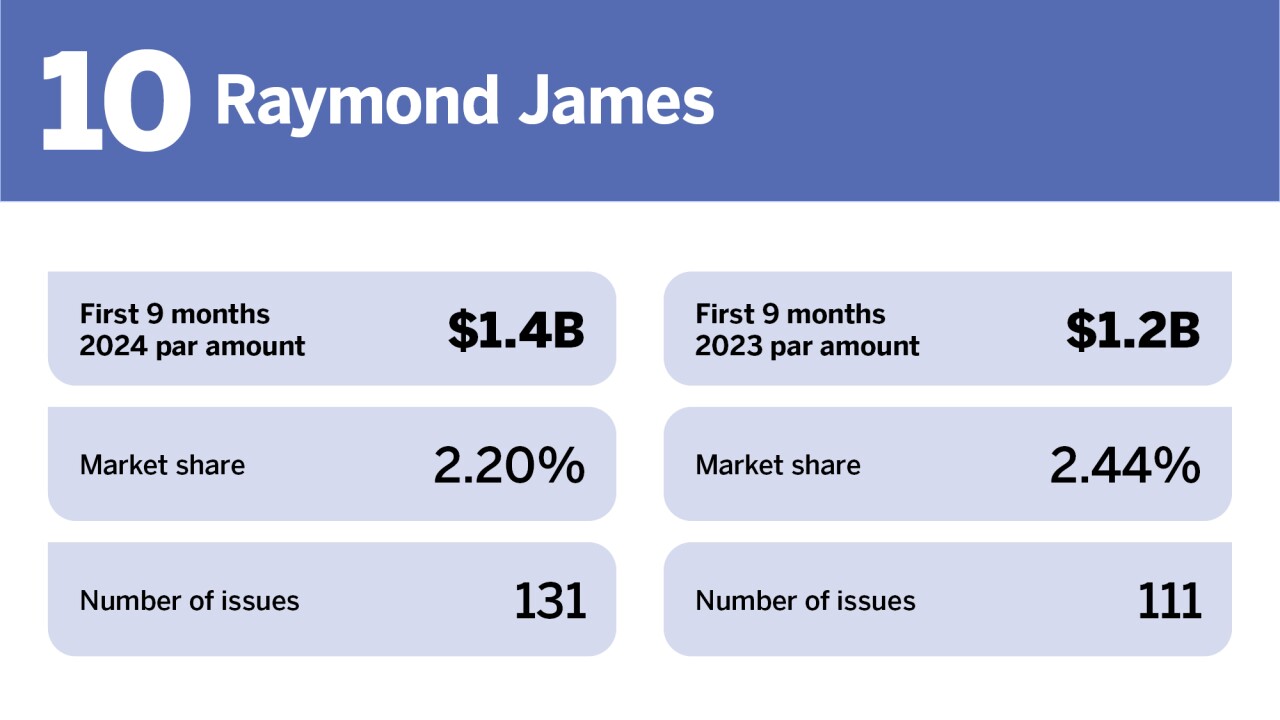

As the underwriter landscape changes, so does the competitive market.

October 15 -

Municipal triple-A yield curves played catch up to USTs Friday to close out a week of more mixed economic data that has economists constantly reevaluating their Federal Reserve policy expectations with little consensus.

October 11 -

Municipal bond insurers wrapped $28.921 billion in the first three quarters 2024, a 26.8% increase from the $22.814 billion insured in the first three quarters of 2023, according to LSEG data.

October 11 -

Analysts remain divided about what the stronger-than-expected consumer price index will mean for Federal Reserve policymakers since the Fed appears to be concentrating on the labor market.

October 10 -

Data from the Municipal Securities Rulemaking Board indicates that trade volume may stay high after a consistent third quarter.

October 10 -

With munis establishing "directional footing" in the fourth quarter of this year, the technical backdrop is still the market driver for 2024, said Jeff Lipton, a research analyst and market strategist.

October 9 -

Fitch revised upward its outlook for Marin General Hospital and affirmed its revenue bonds at BBB, and general obligation bonds at AA-minus.

October 9 -

Supply is slightly lower this week at nearly $10 billion but not by much, with the pace of supply suggesting $500 billion of issuance for the year could still happen, said Tripp Kaiser, a managing director at Municipal Market Analytics, Inc.

October 8