-

Republican Ken Paxton said his first-of-its-kind legal opinion aims to dismantle diversity, equity, and inclusion practices in the Lone Star State.

January 20 -

Fitch's three-notch senior bond downgrade reflects "substantial credit risk."

January 20 -

The new-issue calendar is an estimated $10.836 billion, with $6.979 billion of negotiated deals on tap and $3.857 billion of competitives.

January 16 -

Foothill-Eastern Transportation Corridor Agency, one of two toll systems operated by The Transportation Corridor Agencies, received a ratings boost to A3.

January 16 -

The Florida train is struggling to generate enough revenue to pay its debt.

January 16 -

Federal Reserve Vice Chair for Supervision Michelle Bowman warned that labor market conditions could weaken further and said the central bank should avoid signaling a pause in monetary policy.

January 16 -

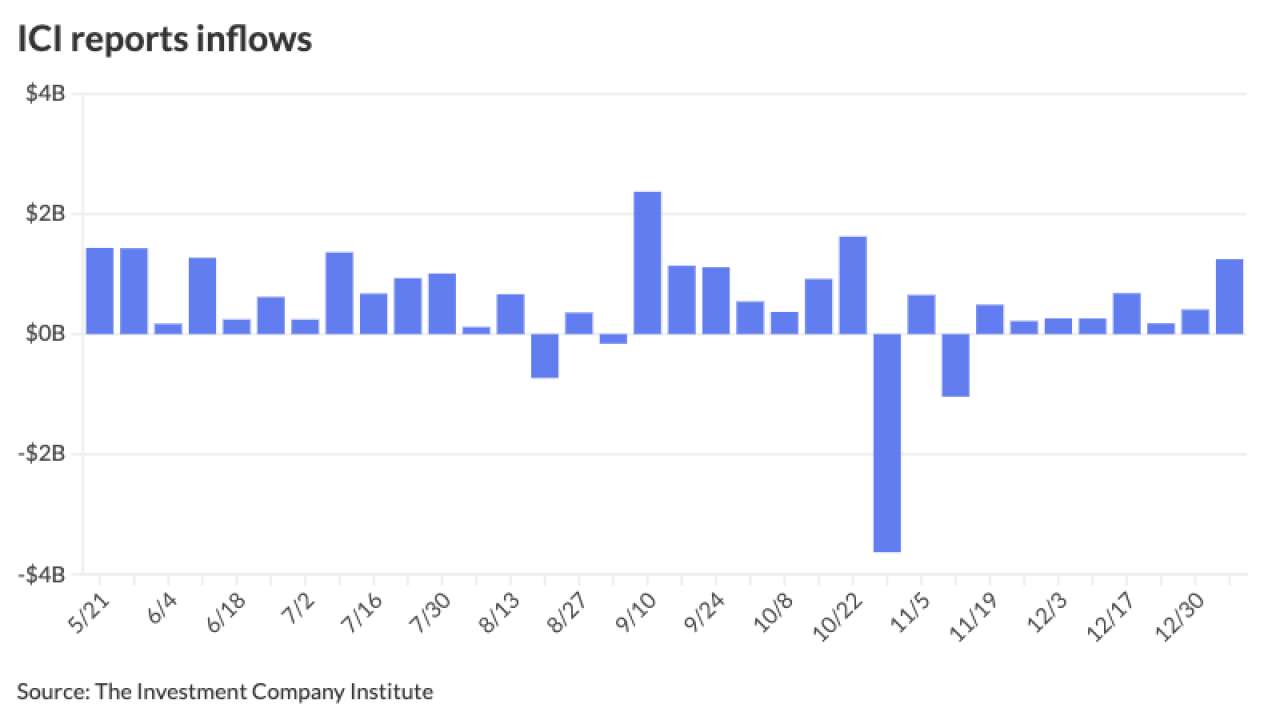

"We're starting off from a really high tax equivalent yield and that really starts the market from a position of strength," said Matt Norton, CIO for municipal bonds at AllianceBernstein.

January 15 -

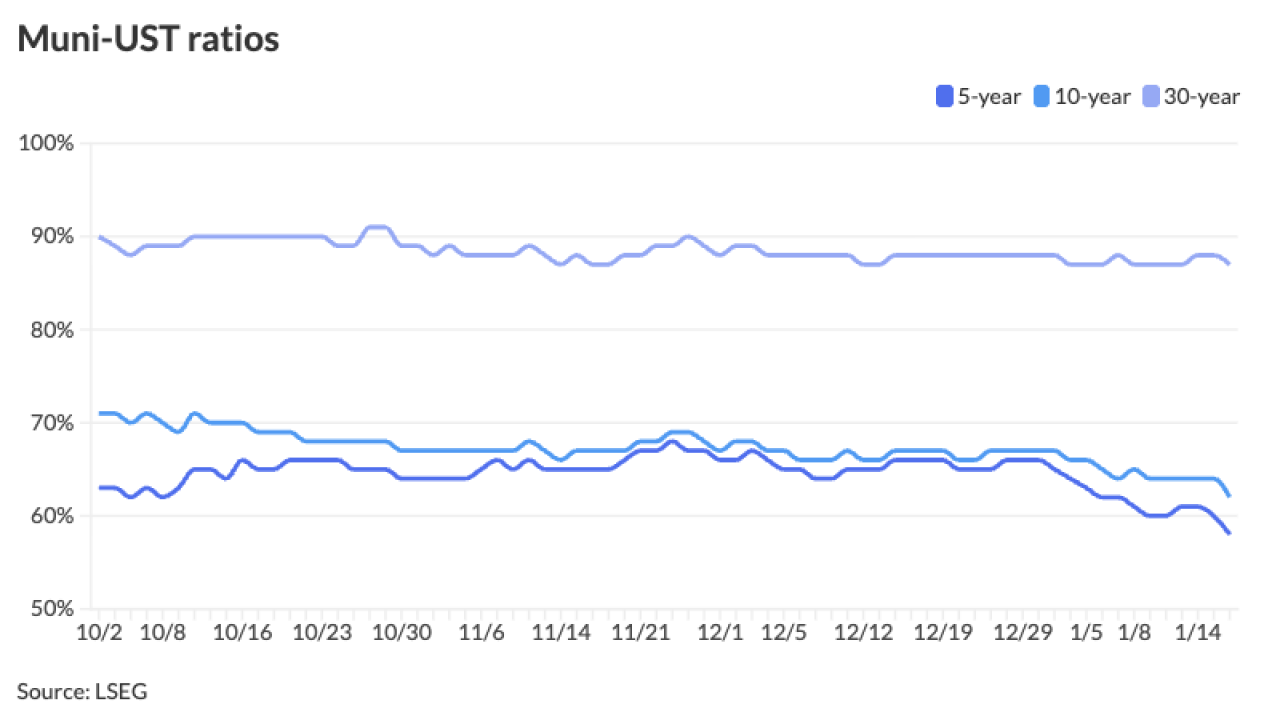

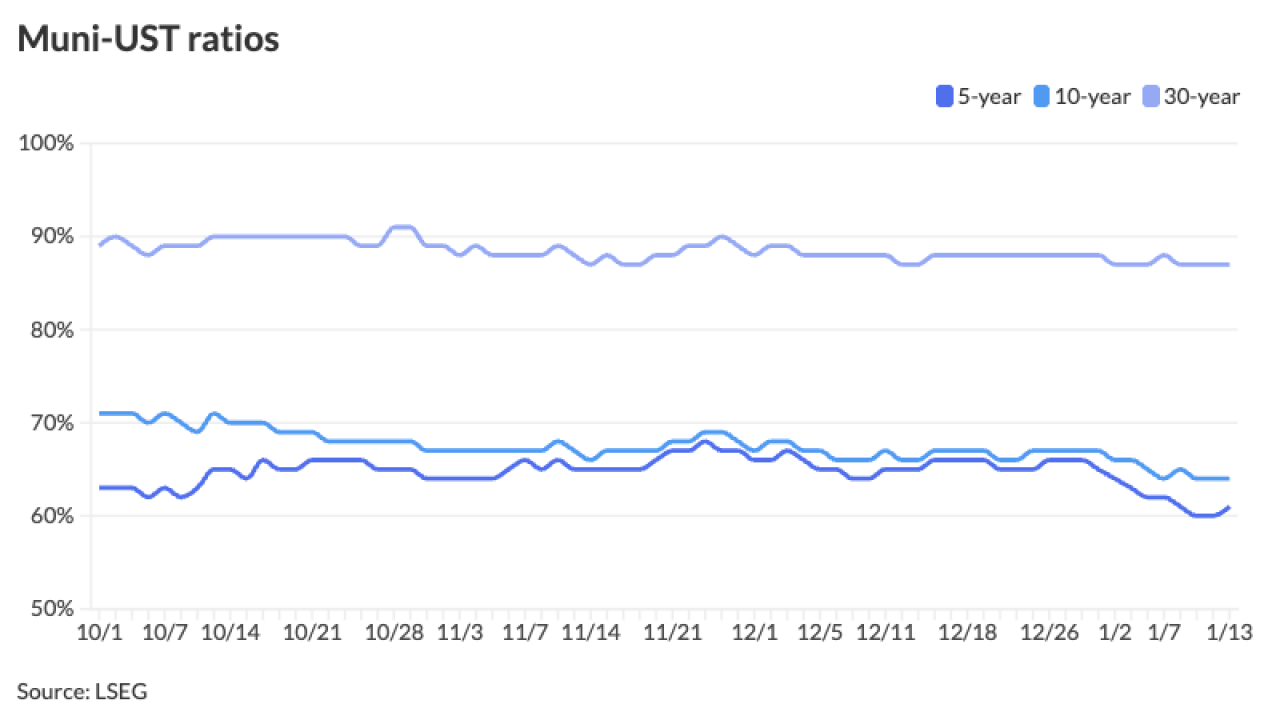

January got off to a good start, with muni yields rallying through Jan. 7. Since then, yields have been steady to slightly richer in spots, with muni yields seeing some strength in the front end and belly of the curve.

January 14 -

Eurostar veteran Nicolas Petrovic will oversee the Florida system while Mike Reininger will focus exclusively on Brightline West.

January 14 -

Moody's Ratings downgraded Fridley Independent School District three notches, to Ba3 from Baa3, and placed its bond ratings under review for downgrade.

January 14 -

"The bond market breathed a sigh of relief this morning as the CPI inflation numbers came in a tad weaker than expected," said John Kerschner, global head of securitised products and portfolio manager at Janus Henderson Investors.

January 13 -

The rating agency lifted the state's general obligation and other ratings by a notch, citing well-established and prudent governance practices.

January 13 -

Maryland is currently battling federal job losses and string of financial challenges but is starting the new year with a new triple-A rating on its general obligation bonds complete with a stable outlook.

January 13 -

Despite the quiet start to the week for munis, all financial markets may feel a "heightened level of risk for rate volatility over the next few days," said Tim Iltz, a fixed income credit and market analyst at HJ Sims.

January 12 -

"With decent job growth in December and a downtick in the federal funds rate, the Federal Reserve will likely hold the federal funds rate steady at [its] next decision in late January," said Comerica Bank Chief Economist Bill Adams.

January 9 -

Munichain says its product will simplify and vastly improve the ordering process.

January 9 -

Average trade size continued to decline in 2025, "consistent with a market that is becoming increasingly more electronic," the MSRB said.

January 9 -

Los Angeles plans to price $86 million in bonds off its Proposition HHH bond measure, closing out the $1.2 billion GO authorization from 2016.

January 9 -

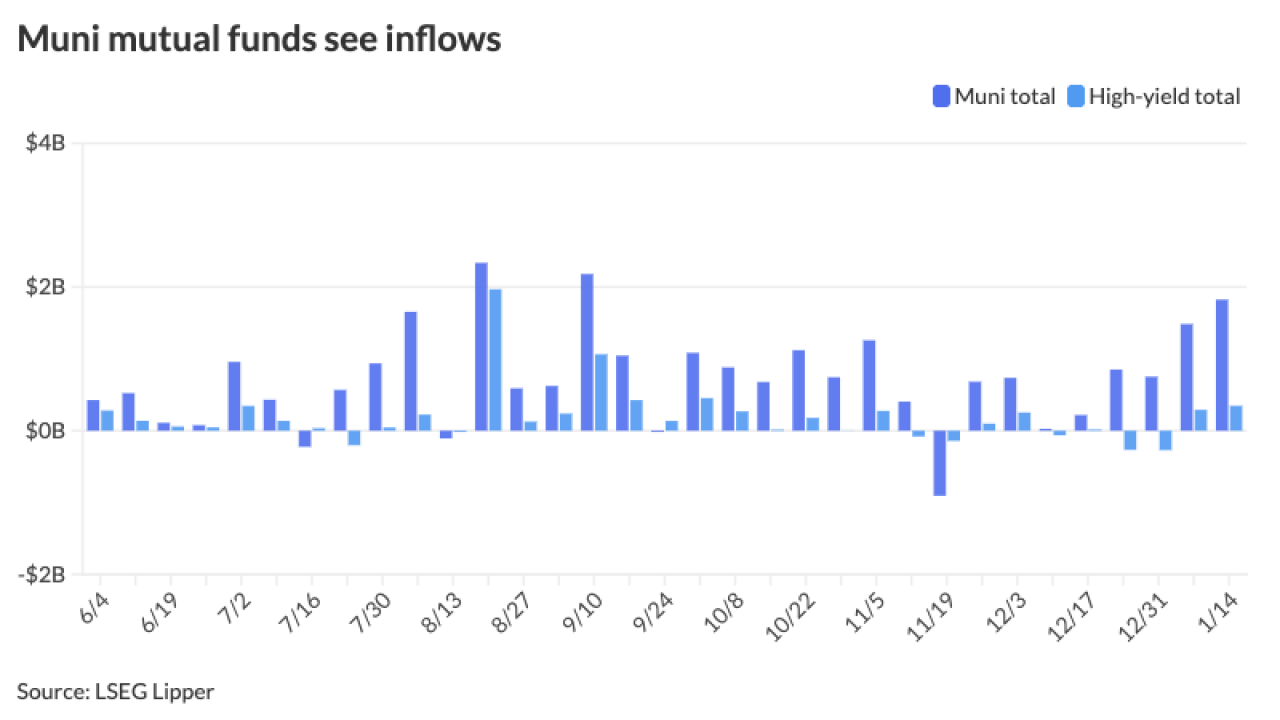

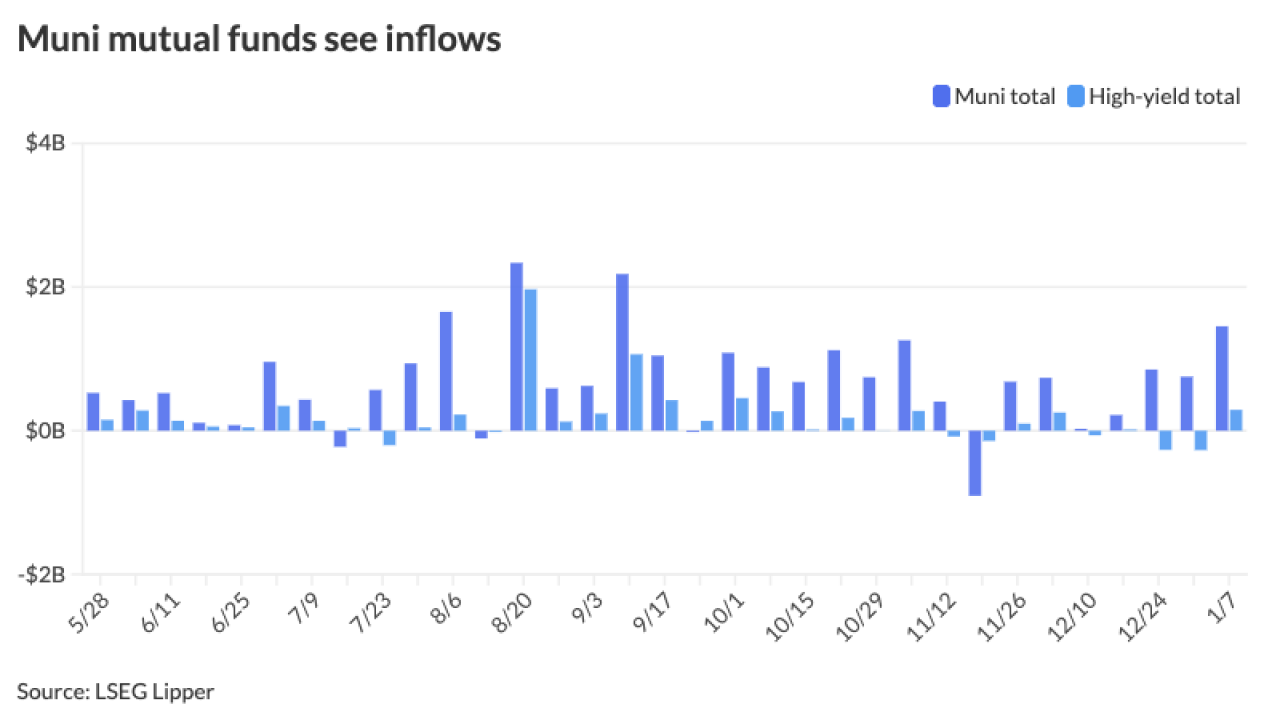

Munis are off to a "hot start" this year, said Jeremy Holtz, a portfolio manager at Income Research + Management.

January 8 -

In this third of a three-part 2026 municipal bond outlook series, Market Intelligence analyst Jeff Lipton explains how another year of heavy supply, surging ETF and SMA assets, climate and cyber risk, and growing use of bond insurance will drive muni market structure and strategy for both sell-side and buy-side stakeholders.

January 8 The Bond Buyer

The Bond Buyer