-

The top five bond financings came in above $7 billion.

October 22 -

-

-

-

As the underwriter landscape changes, so does the competitive market.

October 15 -

The top five bond financings came in above $8 billion.

September 23 -

Pent-up demand, dwindling federal aid and lower interest rates led to a 32% increase in municipal issuance in the first half of 2024.

August 19 -

The top five bond financings came in above $1 billion.

August 15 -

The newcomers, Greenberg Traurig, Bryant Rabbino and Ballard Spahr, knocked Bracewell, Nixon Peabody and Gilmore & Bell, out of the top 10.

July 30 -

Municipal bond insurance grew 24.4% in the first half, compared to the same period last year.

July 25 -

The top 5 competitive underwriters remained in the same ranking positions as 1H 2023, while there was some shuffling with the remaining in the Top 10.

July 25 -

Kaufman Hall & Associates, Caine Mitter & Associates, KNN Public Finance entered the Top 10, while CSG Advisors, Estrada Hinojosa and Columbia Capital Management were bumped.

July 24 -

Half of the top 10 issuers are from New York, California issuers hold two spots on the list.

July 24 -

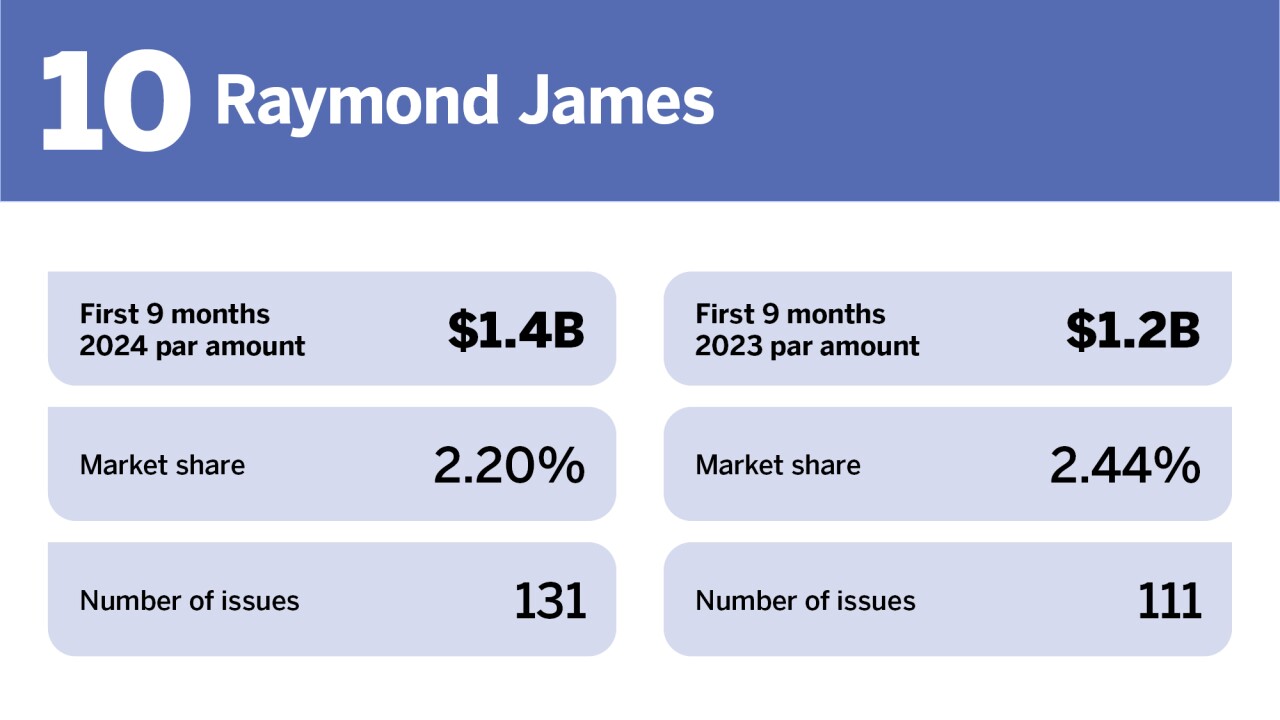

Raymond James was the sole new entrant in the Top 10, knocking out Citi — which formally exited the muni market by the end of Q1 2024.

July 24 -

The top five bond financings have an average dollar volume of more than $1.9 billion.

June 12 -

The top five bond financings have an average dollar volume of more than $1.2 billion.

June 11 -

-

BofA Securities led the underwriting of healthcare issuance in 2023, with $3.3549 billion in total.

June 3 -

Healthcare issuance in 2023 was lower than usual, as many issuers were still using COVID-related federal aid. The largest issuances came from the Massachusetts Development Finance Agency.

June 3 -

Orrick, Herrington & Sutcliffe take the top spot with a 10.29% market share.

May 29