Lynne Funk is Senior Director, Strategy and Content, Live Media - Municipal Finance. She leads and shapes The Bond Buyer's six major events, serving as host, moderator, thought leader and brand ambassador. Lynne also is charged with creating innovative live media formats, including new conferences, virtual summits and podcasts to help serve our municipal finance community. Lynne has nearly two decades of experience in the public finance industry. She was most recently Executive Editor of The Bond Buyer. Previously, she was a director at Municipal Market Analytics, Inc., and in the Policy and Public Advocacy for the Municipal Securities Division at the Securities Industry and Financial Markets Association.

-

It is most certainly an issuers' market as rates are low, credit spreads continue to tighten, money pours into municipal bond mutual funds at record levels and a net negative supply of more than $11 billion.

By Lynne FunkJanuary 29 -

Issuance dropped 26.7% in January, tax-exempt issuance fell 32.6% while refundings and taxables saw smaller declines. Part of the drops were due to the typical nature of lighter January issuance but also issuer anticipation of potential federal aid to combat the pandemic.

By Lynne FunkJanuary 29 -

Chicago Board of Education bonds were repriced to lower yields by as much as 37 basis points, showing just how far investors will go for any incremental yield.

By Lynne FunkJanuary 28 -

Climate change should be the focus for investors and issuers in 2021 as the need for addressing the problems it causes is more pressing than ever. Sean Kidney, CEO of Climate Bonds Initiative, lays out the case. Lynne Funk hosts. (35 minutes).

By Lynne FunkJanuary 28 -

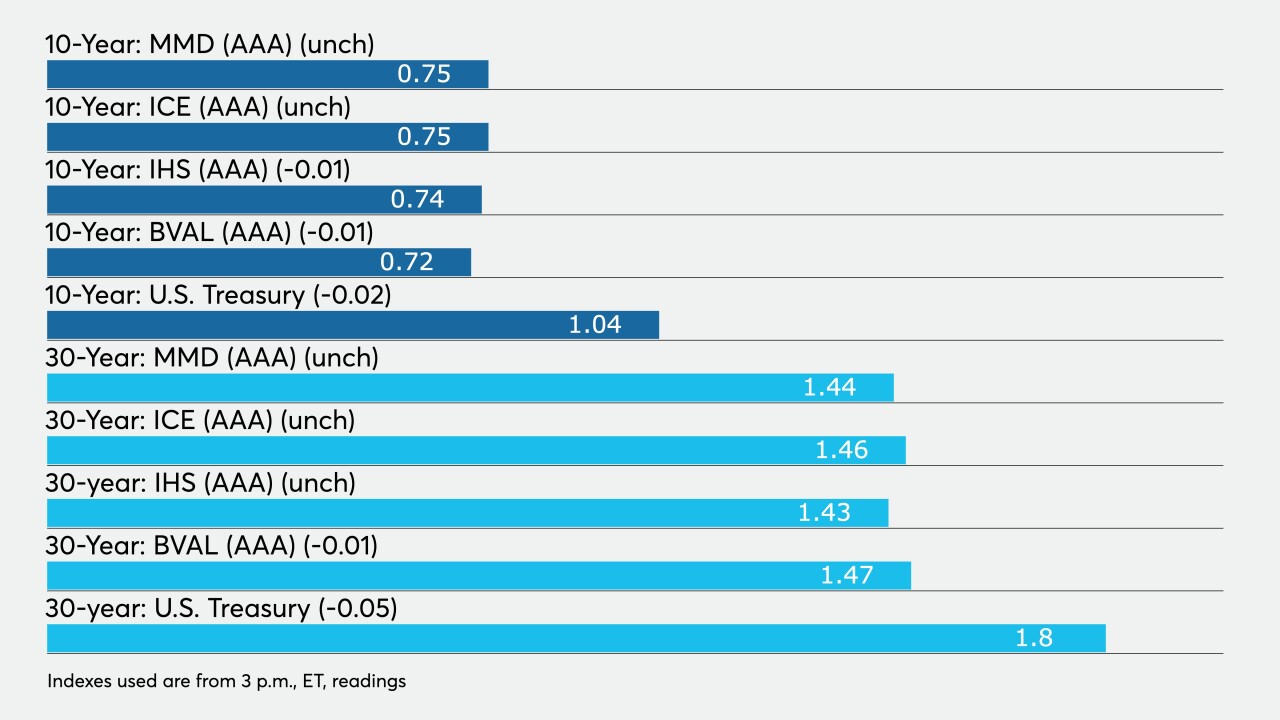

Fed chair says it's unlikely there will be "troubling inflation" any time soon, and rates will stay low and asset purchases will continue at current levels. ICI reports another $3.24 billion of inflows as munis follow UST to lower yields.

By Gary SiegelJanuary 27 -

Returns of all the investment grade options "pale in comparison to those for municipal high-yield," which should bolster Texas gas and Chicago public schools deals.

By Lynne FunkJanuary 25 -

The $187 million deal is the largest yet to be hosted on the Clarity platform, which is approaching the half billion mark of resets every week.

By Lynne FunkJanuary 25 -

Refinitiv Lipper reports another multi-billion week of inflows, the domino effect from such strong flows is that secondary selling doesn’t need to be so active, creating fewer opportunities for new inquiry, analysts say.

By Lynne FunkJanuary 21 -

Muni yields have been in a nine-basis point range since the beginning of the year while UST yields have fluctuated more than 20 basis points. With so little supply, muni credit spreads continue to compress.

January 20 -

Powell, speaking on a livestreamed event, said interest rates will be raised "no time soon" and there will be plenty of notice "well in advance of active consideration."

By Lynne FunkJanuary 14