Lynne Funk is Senior Director, Strategy and Content, Live Media - Municipal Finance. She leads and shapes The Bond Buyer's six major events, serving as host, moderator, thought leader and brand ambassador. Lynne also is charged with creating innovative live media formats, including new conferences, virtual summits and podcasts to help serve our municipal finance community. Lynne has nearly two decades of experience in the public finance industry. She was most recently Executive Editor of The Bond Buyer. Previously, she was a director at Municipal Market Analytics, Inc., and in the Policy and Public Advocacy for the Municipal Securities Division at the Securities Industry and Financial Markets Association.

-

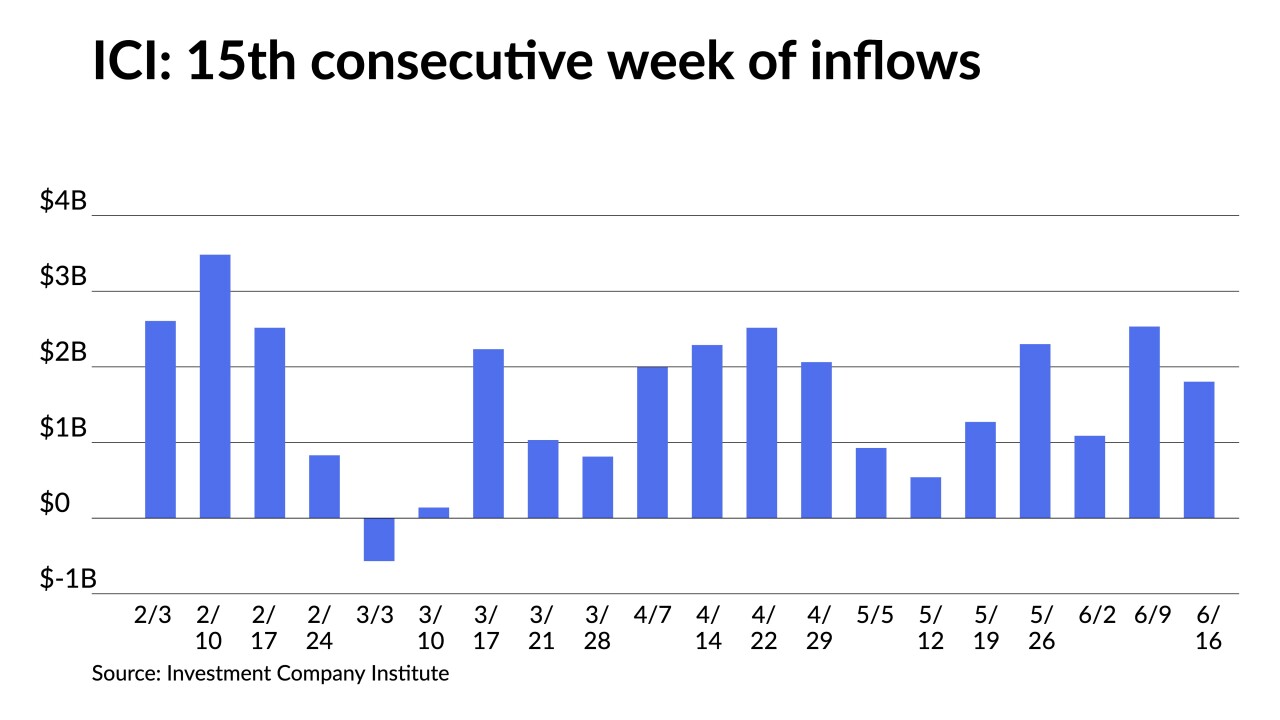

Triple-A benchmark yields moved higher by as much as five basis points while ICI reported another $1.8 billion of inflows and ETFs increase their share by $841 million.

By Lynne FunkJune 23 -

As infrastructure talks unfold in Washington, the likelihood of higher taxes may be waning, at least in the short run.

By Kyle GlazierJune 23 -

A volatile U.S. Treasury market and month-end positioning are pressuring municipal yield curves.

By Lynne FunkJune 22 -

The Federal Reserve must be prepared to move if inflation continues to surprise to the upside, according to one Fed president, while another again stated a desire for the Fed to pull back on its accommodation.

By Lynne FunkJune 21 -

The short end of the yield curve faced pressure from a cheaper UST five-year. As the flattening trend in UST takes hold, demand for duration will also spill over into the tax-exempt space, with long-dated munis continuing to outperform, analysts say.

By Lynne FunkJune 18 -

Refinitiv Lipper's $1.85 billion of inflows say investors aren't going anywhere.

By Lynne FunkJune 17 -

The Investment Company Institute on Wednesday reported $2.533 billion of inflows into municipal bond mutual funds, the highest since February.

By Lynne FunkJune 16 -

Tuesday’s data may not be indicative of where the economy is going and will likely be written off by the Federal Open Market Committee at its meeting, analysts say.

By Lynne FunkJune 15 -

Most analysts expect the Federal Open Market Committee will alter its Summary of Economic Projections and perhaps begin to talk about tapering, without offering clues when they'll begin cutting back on asset purchases.

By Lynne FunkJune 14 -

Now the fifth largest bank in the U.S., PNC will expand its banking and capital markets activities across the Southwest and Western regions.

By Lynne FunkJune 14 -

The Investment Company Institute reported $1.089 billion of inflows into municipal bond mutual funds, marking the 13th consecutive week.

By Lynne FunkJune 9 -

The U.S. Treasury 10-year dipped to its lowest yield since March while municipal investors poured money into new deals and secondary trading helped push benchmarks even lower.

By Lynne FunkJune 8 -

The market idled Monday while investors prepare for a $12 billion new-issue onslaught that brings diversity of credits that will help direct benchmark yields. Continued fund flows are needed to sustain current yields.

By Lynne FunkJune 7 -

ICI's report marks the 12th consecutive week of inflows bringing the total for 2021 to more than $40 billion. Lower- and non-rated deals saw 20 to 30 basis point bumps in repricings as any paper with yield is massively oversubscribed.

By Lynne FunkJune 2 -

The revenue sector winners in May included healthcare with +0.53% gains, transportation with +0.42%, each benefiting from "the reach for yield and improving metrics," analysts said.

By Lynne FunkJune 1 -

Municipal yields will likely stay in a narrow range with trading activity subdued unless larger interest rate volatility unexpectedly sets in, analysts say.

By Lynne FunkMay 28 -

The fundamentals of the muni market have investors stuck in a low-rate environment without much of an alternative. Refinitiv Lipper reported $1.466 billion of inflows into municipal bond mutual funds with $813.8 million into high-yield.

By Lynne FunkMay 27 -

A reported preliminary 25.8% drop in May issuance shows how strong fund inflows, improving credit and the reopening of governments are keeping the muni market issuer friendly.

By Lynne FunkMay 26 -

Triple-A municipal benchmark yield curves were bumped one to two basis points, lagging a four basis point rally in U.S. Treasuries after weaker consumer sentiment and dovish comments from Fed officials moved equities lower.

By Lynne FunkMay 25 -

Strong technicals have been the theme, and with federal aid and better-than-expected tax receipts coming in, issuers are not tapping the market as much as investors would hope.

By Lynne FunkMay 21