Municipals rallied by one to four basis points Tuesday following strong bids for competitive Georgia and Wisconsin exempt general obligation bonds and various negotiated deals repriced to lower yields while the 10-year U.S. Treasury dipped to 1.53%, a low not hit since March.

The move in Treasuries helped, but after weeks of limited tax-exempt supply and pent-up demand, municipals were in their own lane and investors put cash to work and pushed municipal yields even lower.

Gilt-edged Georgia saw its levels come through triple-A benchmarks. Wisconsin sold short-call GOs saving at least 15 basis points in 10-years with its 5% coupon 10-year with a seven-year par call yielding 0.80% while 5s of 2036 at were bought at 0.97%.

After the long-end has been seeing most of the gains lately, trading Tuesday showed how low investors were willing to go on the short end with California 5s of 2022 trading at 0.05% versus 0.13%-0.08% Monday. Mecklenburg County, North Carolina 5s of 2022 at 0.06%, a basis point lower from Monday. Georgia 5s of 2022 were competitively bought at 0.07%. North Carolina 4s of 2023 traded at 0.13%-0.11%. A long Los Angeles Department of Water and Power bond traded at 1.45% (around triple-A benchmarks) and various trades in the belly of the curve pushed yields down by two to three basis points. New York credits continued to trade tighter with city GOs in 12 years at 1.22%, about 22 basis points above triple-As.

Investors seeking more than 1% on high-grade debt need to go out beyond 12 years while the municipal 10-year creeps closer to sub-0.90%.

Triple-A benchmark yields fell as much as four basis points while ratios hovered around recent percentages, dipping lower on the long bond. The 10-year closed at 61% and at 65% in 30-years, according to Refinitiv MMD. ICE Data Services saw ratios on the 10-year at 61% and the 30-year at 67%.

In the competitive arena,

The first, $412.47 million of Series 2021A Bidding Group 1 tax-exempt GOs, went to Wells Fargo Securities. Bonds in 2022 with a 5% coupon yield 0.07%, 5s of 2026 at 0.45%, 5s of 2031 at 0.94% and 5s of 2033 at 1.01%. The second, $366.47 million of Series 2021A Bidding Group 2 tax-exempts, went to Citigroup Global Markets Inc., with 4s of 2034 at 1.14%, 4s of 2036 at 1.22% and 3s of 2041 at 1.59%.

Morgan Stanley & Co. won the two taxable tranches. $174.57 million of Series 2021B Bidding Group 1 taxable GOs, saw 2s of 2022 yield 0.12%, bonds in 2026 priced at par at 0.82% and at par in 2031 at 1.73%. The $153.53 million of Bidding Group 2 taxables saw 2s of 2032 yield 1.75%, bonds in 2036 at par at 2.11% and 2.35s of 2041 yield 2.32%.

Wisconsin (Aa1//AA+) sold $227.3 million of general obligation bonds to UBS Financial Services. Bonds in 2022 with a 5% coupon yield 0.06%, 5s of 2026 at 0.43%, 5s of 2031 (c28) at 0.80%, 5s of 2036 at 0.97% (c28) and 4s of 2041 at 1.25% (c28).

In the negotiated space, BofA Securities repriced with bumps of one to 10 basis points $623.7 million of first and second lien wastewater refunding revenue bonds, $443.6 million first lien (Aa3/AA//) and $180.1 million (A1/AA-//) for the Indiana Finance Authority. The first series, saw 5s of 2021 yield 0.07% (-2), 5s of 2022 at 0.10%, 5s of 2026 at 0.52% (-5), 5s of 2031 at 1.10% (-7), 4s of 2036 at 1.40% (-10) and 3s of 2041 at 1.82% (-5). The second series saw 5s of 2021 at 0.15% (-1), 5s of 2022 at 0.175, 5s of 2026 at 0.59% (-5), 5s of 2031 at 1.19% (-5), 4s of 2036 at 1.49% (-8) and 5s of 2041 at 1.53% (-6).

BofA Securities repriced for the University of North Carolina Chapel Hill (Aaa/AAA/AAA/) $140 million of tax-exempt and taxable general revenue refunding bonds with bumps of two to five basis points. The $104 million of exempts, callable in 12/1/2031, saw 5s of 2028 at 0.76% (-2), 5s of 2031 at 1.02% (-3), 5s of 2036 at 1.17% (-5) and 5s of 2040 at 1.30% (-5).

Citigroup Global Markets Inc. priced $125.7 million of airport system junior subordinate lien revenue notes (AMT) for Clark County, Nevada, (A1//A+/A+). Bonds in 2022 with a 5% coupon yield 0.18%, 5s of 2026 at 0.72% and 5s of 2027 at 0.88%.

Morgan Stanley & Co. priced $72.4 million of exempt airport system junior subordinate lien revenue notes with 5s of 2033 at 1.23% and 5s of 2036 at 1.32%.

Raymond James repriced by four to 10 basis points $82.4 million of general obligation bonds for Maine (Aa2/AA//). Bonds in 2024 with a 1% coupon yield 0.18% (-7), 4s of 2024 at 0.18% (-7), 5s of 2026 at 0.45% (-4) and 5s of 2031 at 0.96% (-10).

Secondary trading and scales

Trading showed large blocks of high-grades clearing at lower yields.

California 5s of 2022 traded at 0.05%. Mecklenburg County, North Carolina 5s of 2022 at 0.06% versus 0.07% Monday. Wisconsin 5s of 2022 at 0.06% after being sold at the same yield Tuesday.

Montgomery County, Maryland 4s of 2023 traded at 0.09%, last trading in blocks on 5/27 at 0.17%. Delaware 5s of 2023 traded at 0.10%-0.07%. North Carolina 5s of 2026 at 0.43%.

Yale 5s of 2029 traded at 0.80% versus 0.83% Monday. New York City 5s of 2033 traded at 1.23%-1.22% versus 1.25% Monday and 1.28%-1.26% Thursday. Wisconsin 5s of 2033 at 1.02%, sold at 0.88% with the shorter coupon Tuesday. Gilt-edged Maryland 5s of 2033 traded at 1.02%.

Hawaii 5s of 2036 at 1.26%. Ohio 5s of 2038 at 1.25%. Los Angeles Department of Water and Power 5s of 2040 at 1.25% versus 1.28%-1.27% Friday. LA MTA 5s of 2041 at 1.25%. Energy Northwest 5s of 2041 at 1.40%-1.39%. Iowa Finance Authority 5s of 2041 at 1.34%-1.33%. Washington 5s of 2042 at 1.41%.

Washington 5s of 2046 at 1.51%-1.50%. LA DWP 5s of 2049 at 1.46% versus 1.54% original. LA DWP 5s of 2050 at 1.45%. Tampa, Florida 5s of 2054 at 1.58%.

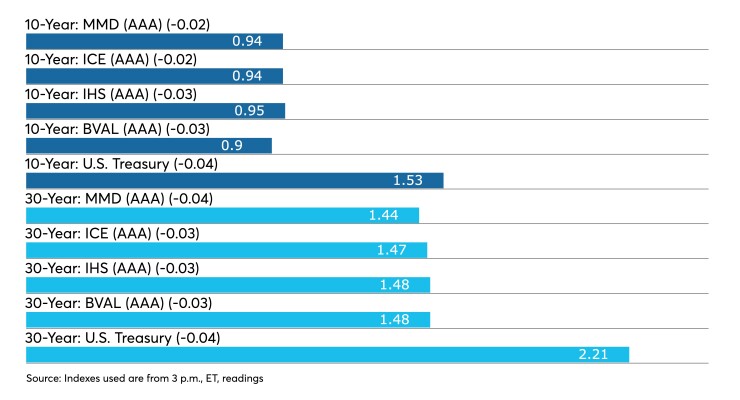

High-grade municipals were better by one to four basis points, according to final readings on Refinitiv MMD's AAA. Short yields fell one basis point in 2021 and 2022 to 0.06% and 0.09%, respectively. The yield on the 10-year fell two to 0.94% while the yield on the 30-year fell four basis points to 1.44%

The ICE AAA municipal yield curve showed short maturities fall one basis point in 2021 to 0.05% and two to 0.09% in 2023. The 10-year maturity dipped two basis points to 0.94% and the 30-year yield fell four to 1.47%.

The IHS Markit municipal analytics AAA curve showed short yields at 0.07% and 0.10% in 2021 and 2022, respectively, with the 10-year down three to 0.92% and the 30-year yield down three to 1.48%.

The BVAL AAA curve showed the yield on the 2021 maturity at 0.06% and the 2022 maturity at 0.08%, both down one, while the 10-year fell three basis points to 0.90% and the 30-year fell three to 1.47%

In late trading, the 10-year Treasury was yielding 1.53% and the 30-year Treasury was yielding 2.21% while equities were up on the day with the Dow rising 15 points, the S&P 500 gaining 0.10% and the Nasdaq gaining 0.37%.

Tuesday’s economic indicators

For the first time this year, America’s trade gap with foreign countries improved as exports increased and imports decreased.

The U.S. trade deficit fell to $68.9 billion in April from a revised $75.0 billion in March, the Commerce Department reported. March’s deficit was originally reported at $74.4 billion.

Economists polled by IFR Markets had expected the deficit to have slipped to $69.0 billion.

The Labor Department reported the number of job openings reached a high of 9.3 million in April.

Hires were little changed at 6.1 million while separations increased to 5.8 million. Within separations, the quits rate reached a new high of 2.7% while the layoffs and discharges rate fell to a new low of 1.0%.

Elsewhere, the NFIB’s small business optimism index dipped 0.2 points in May to 99.6. A record-high 48% of owners reported unfilled job openings.

“The labor shortage is holding back growth for small businesses across the country,” said NFIB Chief Economist Bill Dunkelberg. “If small business owners could hire more workers to take care of customers, sales would be higher and getting closer to pre-COVID levels. In addition, inflation on Main Street is rampant and small business owners are uncertain about future business conditions.”

Primary to come

In the short-term sector, Los Angeles County is coming to market with a $1 billion note deal. UBS Financial Services is set to price the Series 2021-2022 tax and revenue anticipation notes on Thursday.

Massachusetts (Aa1/AA+//AAA) is set to price $720 million of transportation fund revenue rail enhancement bonds. The first series, $168 million of sustainability bonds, are serials 2050-2051. The second, $232 million, are serials 2023-2046. The third, $320 million, are refunding serials 2022, 2029-2030, 2033-2043. BofA Securities is head underwriter.

The Department of Water and Power of the City of Los Angeles (Aa2//AA-/AA) is set to price $439.4 million of power system revenue refunding bonds on Thursday. Serials 2022, 2026-2037, 2039-2041; terms 2046, 2051. RBC Capital Markets will run the books.

The West Virginia Parkways Authority (/AA-/AA-/) is set to price on Wednesday $333.6 million of senior lien turnpike toll revenue bonds, serials 2022-2051. Wells Fargo Securities is head underwriter.

Houston (A1///AA-) is set to price $293.1 million of AMT subordinate lien revenue refunding bonds. Goldman Sachs is lead underwriter.

The Maryland Economic Development Corp. (////) is set to price $263.7 million of taxable SSA Baltimore Project federal lease revenue bonds, term 2034. Oppenheimer & Co. will run the books.

The Cass County Joint Water Resource District, North Dakota, (Aa3///) is set to price on Wednesday $180 million refunding bonds. Colliers Securities is head underwriter.

The Wayne County Airport Authority, Michigan, (A1//A/AA-) is set to price on Wednesday $163.1 million of Detroit Metropolitan Wayne County Airport revenue bonds consisting of $131.2 million of Series 2021A (non-AMT) serials 2023-2041, term 2046, and $31.9 million Series 2021B (AMT), serials 2023-2041, term 2046. Siebert Williams Shank & Co. is lead underwriter.

The New Memphis Arena Public Building Authority of Memphis and Shelby County, Tennessee, (Aa2/AA//) is set to price on Thursday $161.1 million of local government public improvement capital appreciation bonds and convertible capital appreciation social bonds. BofA Securities is head underwriter.

The San Mateo County Joint Powers Financing Authority, California, (Aa1/AA+//) is set to price on Thursday $144.45 million of Cordilleras Mental Health Center Replacement Project lease revenue bonds, serials 2027-2055. Citigroup Global Markets is head underwriter.

The Anaheim Public Financing Authority, California, (A2/AA//AA+) is set to price on Thursday $140.5 million of taxable working capital financing lease revenue bonds, insured by Assured Guaranty Municipal Corp. Goldman Sachs is head underwriter.

The Illinois Housing Development Authority (Aaa///) is set to price $125 million of social revenue refunding bonds. Jefferies is lead underwriter.

The Greater Texas Cultural Education Facilities Finance Corp. (Aa3//AA-) is set to price on Wednesday $101.2 million of Epicenter Multipurpose Facilities Project taxable lease revenue bonds. Piper Sandler is head underwriter.

The Mission Economic Corp. in Texas is set to price $100 million of senior lien revenue bonds (Panda High Plains Hemp Gin LLC project) on Tuesday, serials 2024-2041. Citigroup Global Markets will run the books.

Chip Barnett contributed to this report.