Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

Friday's payrolls "surprised to the upside, with nonfarm payrolls increasing 517,000 last month after an upwardly revised 260,000 gain in December," Barclays strategists said.

February 3 -

Nearly two-thirds of market participants in a Bond Buyer live market survey believe 2023 issuance will remain around last year's levels.

February 3 -

The top two municipal bond insurers wrapped $28.224 billion in 2022, a 30.1% decrease from the $37.486 billion of deals done in 2021, according to Refinitiv data.

February 3 -

A few developments in recent sessions "may have staying power should the new outlook on upcoming FOMC actions gain traction," said Kim Olsan, a senior vice president of municipal bond trading at FHN Financial.

February 2 -

"Investors are acknowledging that the Fed is nearing the end of its rate tightening cycle which is supporting a relief rally in stocks and lower bond yields, said Bryce Doty, senior vice president at Sit Investment Associates.

February 1 -

Total volume for the month was $21.931 billion in 417 issues versus $26.292 billion in 770 issues a year earlier, according to Refinitiv data.

January 31 -

"January issuance is at a multi-year low, with large declines in both taxable and tax-exempt issuance," said Matt Fabian, a partner at Municipal Market Analytics.

January 31 -

Investors will likely sit on the sidelines until after this week's Federal Reserve Board rate announcement.

January 30 -

Investors will be greeted Monday with a new-issue calendar estimated at $847 million.

January 27 -

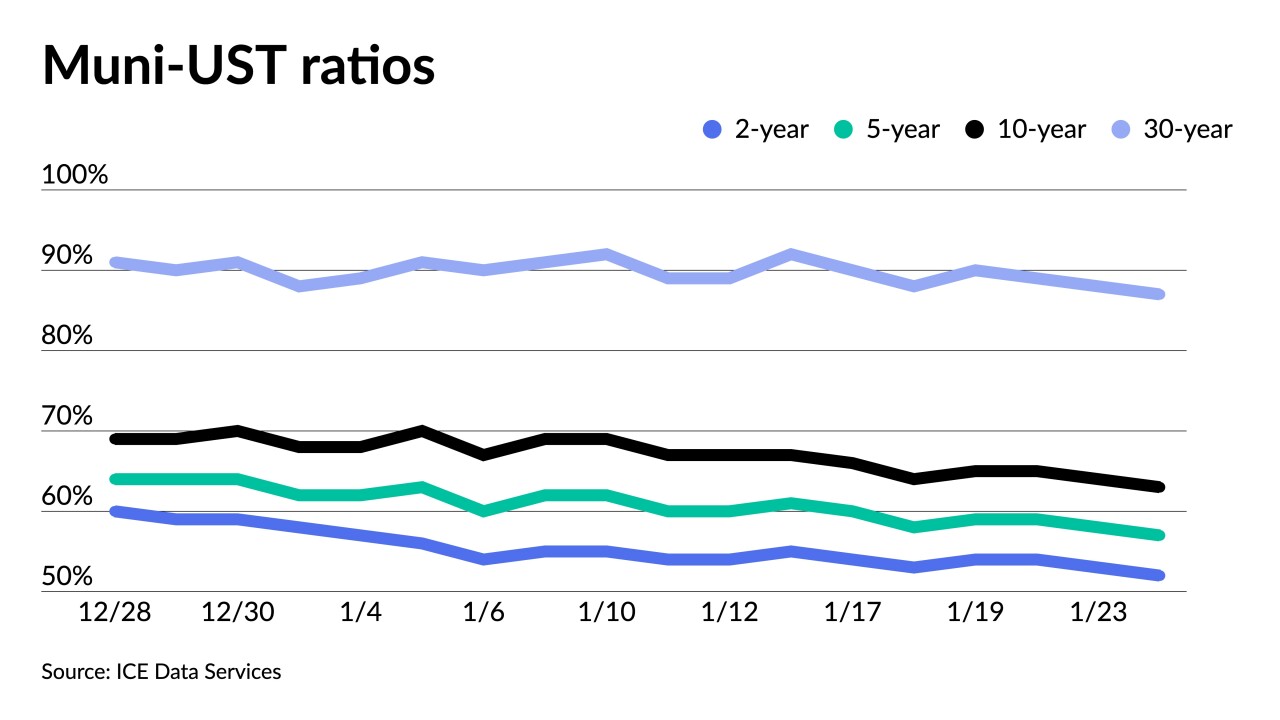

On the buy side, lower interest rates and an extreme imbalance between supply and demand is supporting the municipal market's positive tone, according to JB Golden, executive director and portfolio manager at Advisors Asset Management.

January 26 -

The top bond counsel firms combined for a total of $359.123 billion in 7,878 transactions during 2022, down from the $456.136 billion in 11,819 deals in 2021.

January 26 -

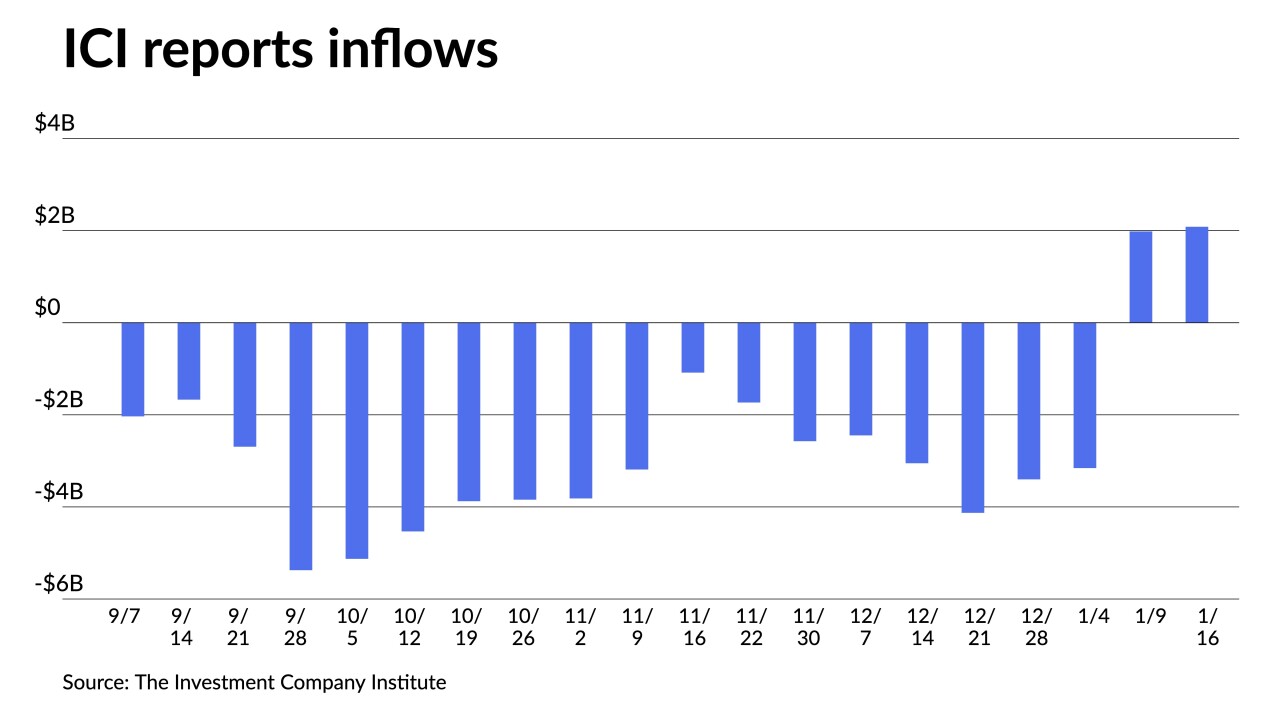

Inflows continued with the Investment Company Institute reporting investors added $2.083 billion to mutual funds in the week ending Jan. 18, after $1.982 billion of inflows the previous week.

January 25 -

The 2023 "January effect" seems to be "displaying typical behavior given relatively thin issuance this month and demand patterns that have been buoyed by four of six reinvestment needs," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

January 24 -

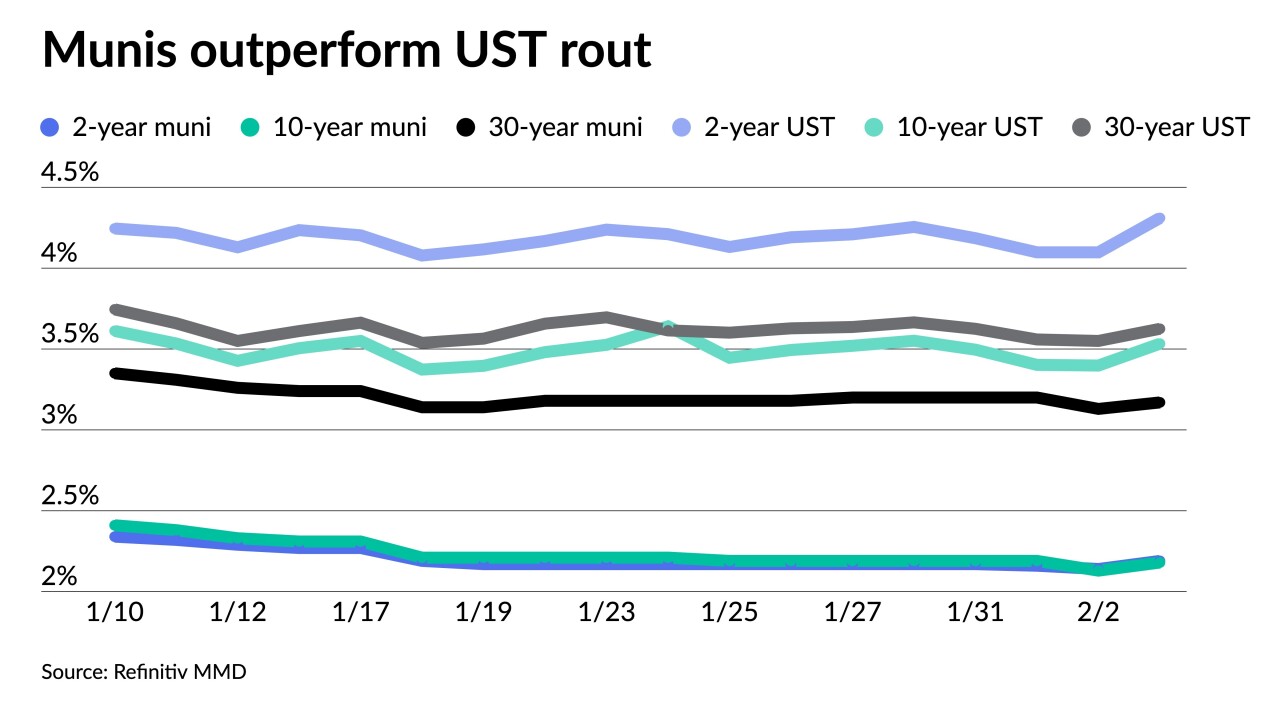

For the first time in several weeks, munis last week outperformed "by a wide margin and across the entirety of the yield curve," said Eric Kazatsky, head of municipal strategy at Bloomberg Intelligence.

January 23 -

Investors will be greeted Monday with a new-issue calendar estimated at $5.520 billion.

January 20 -

The primary "pumped new life into an already-firm market with a lower yield range being established," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

January 19 -

Inflows returned, with the Investment Company Institute reporting investors added $1.982 billion to mutual funds in the week ending Jan. 11, after $3.157 billion of outflows the previous week.

January 18 -

Demand for muni bonds has slowly started make a comeback, with Jason Wong, vice president of municipals at AmeriVet Securities, saying, "this demand is a welcome sign to the tax-exempt sector as rising yields pushed investors to the sidelines."

January 17 -

Municipal financial advisors saw $304.569 billion of business in 5,935 transactions in 2022, down from the $377.886 billion in 8,611 deals in 2021.

January 13 -

Inflows returned as Refinitiv Lipper reported $1.981 billion was added to municipal bond mutual funds in the week ending Wednesday after $2.477 billion of outflows the week prior.

January 12