Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

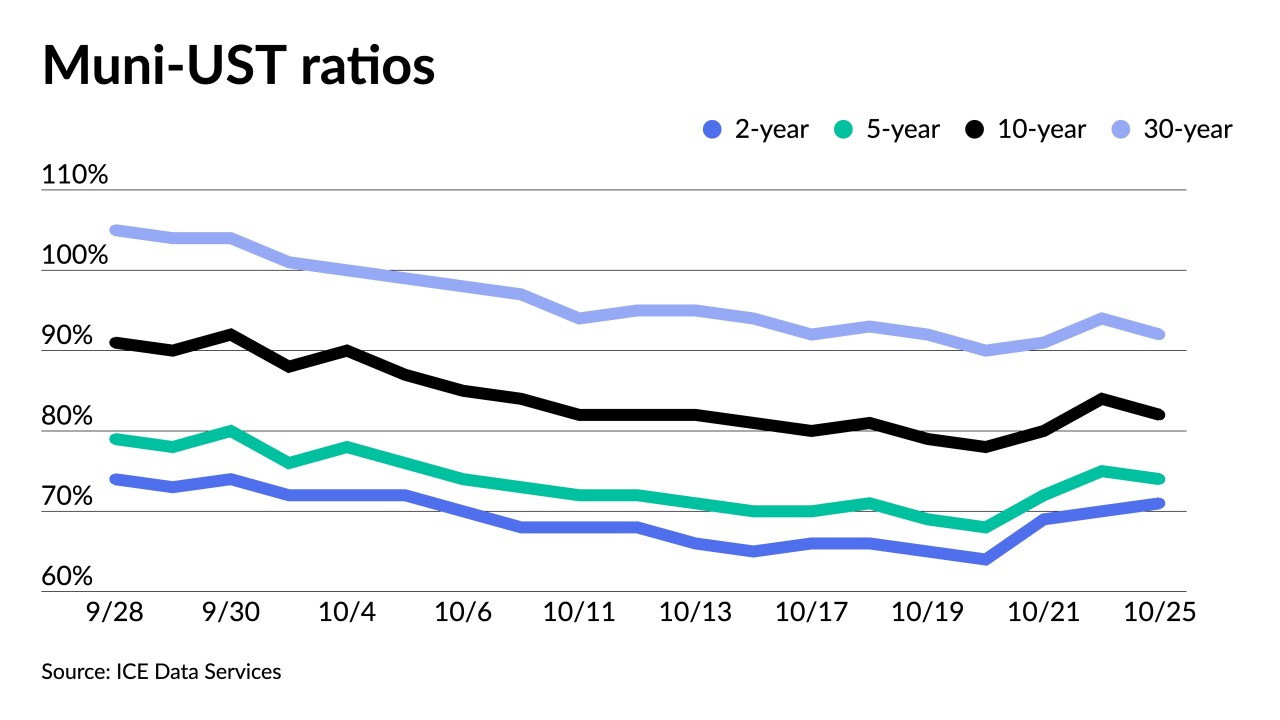

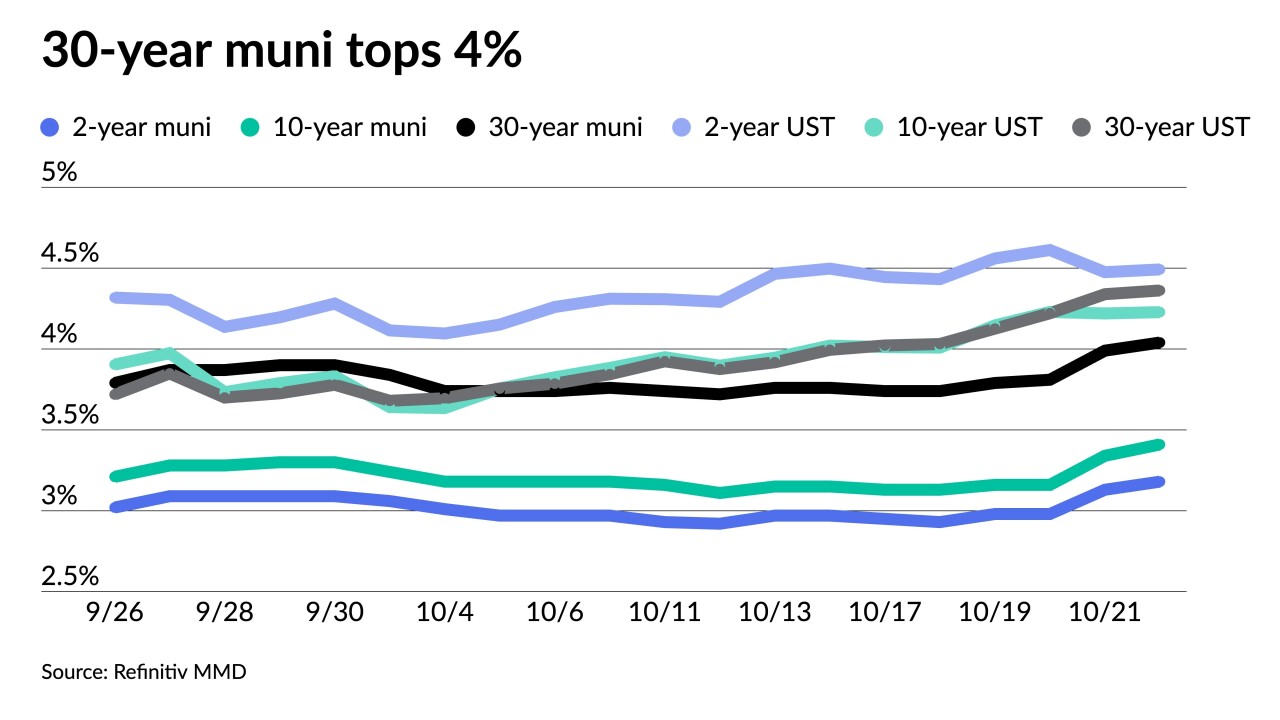

While muni performance has turned negative for October, "the asset class is significantly outperforming UST," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

October 25 -

The top two municipal bond insurers wrapped $22.897 billion in the first three quarters of 2022, a 21.1% decrease from the $29.028 billion of deals done in the first nine months of 2021.

October 25 -

The top bond counsel firms combined for a total of $292.177 billion in 6,406 transactions during the first three quarters of the year, down from the $343,709 billion in 9,139 deals over the same period in 2021.

October 25 -

"Municipal market performance has improved, but the bumpy road continues as investors remain uncertain about the interest rate environment," said Nuveen's Head of Municipals John Miller.

October 24 -

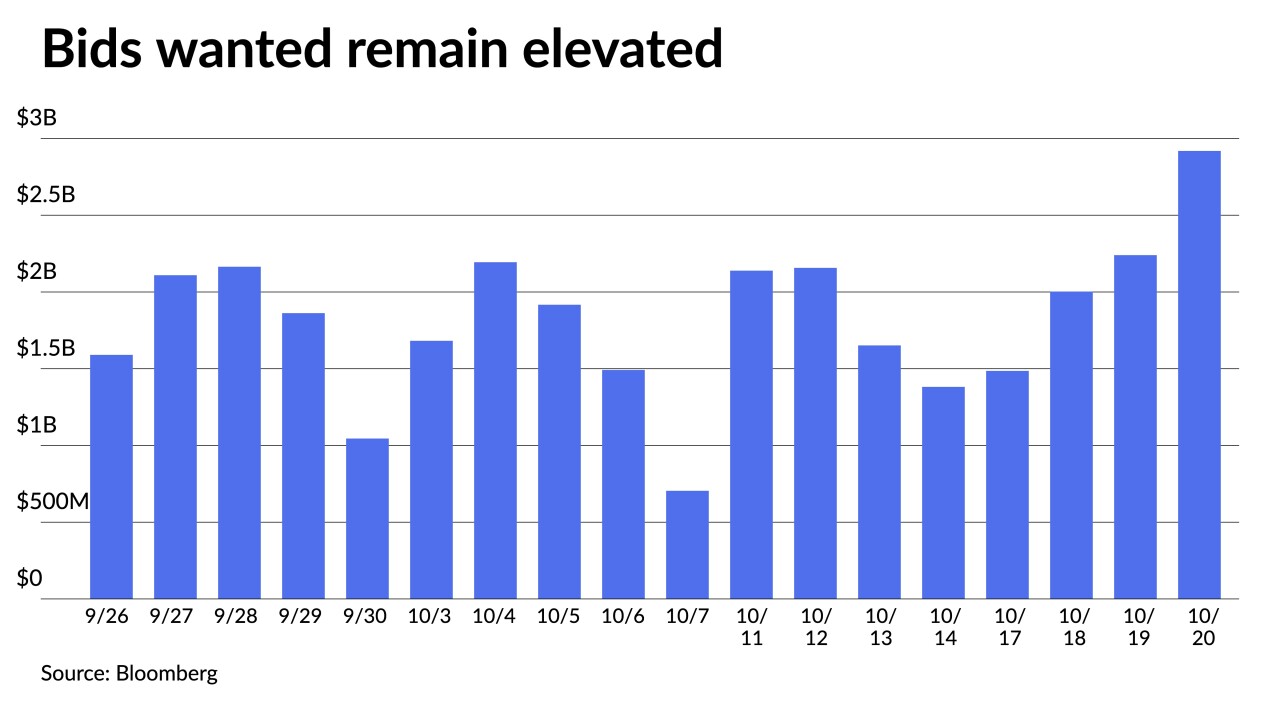

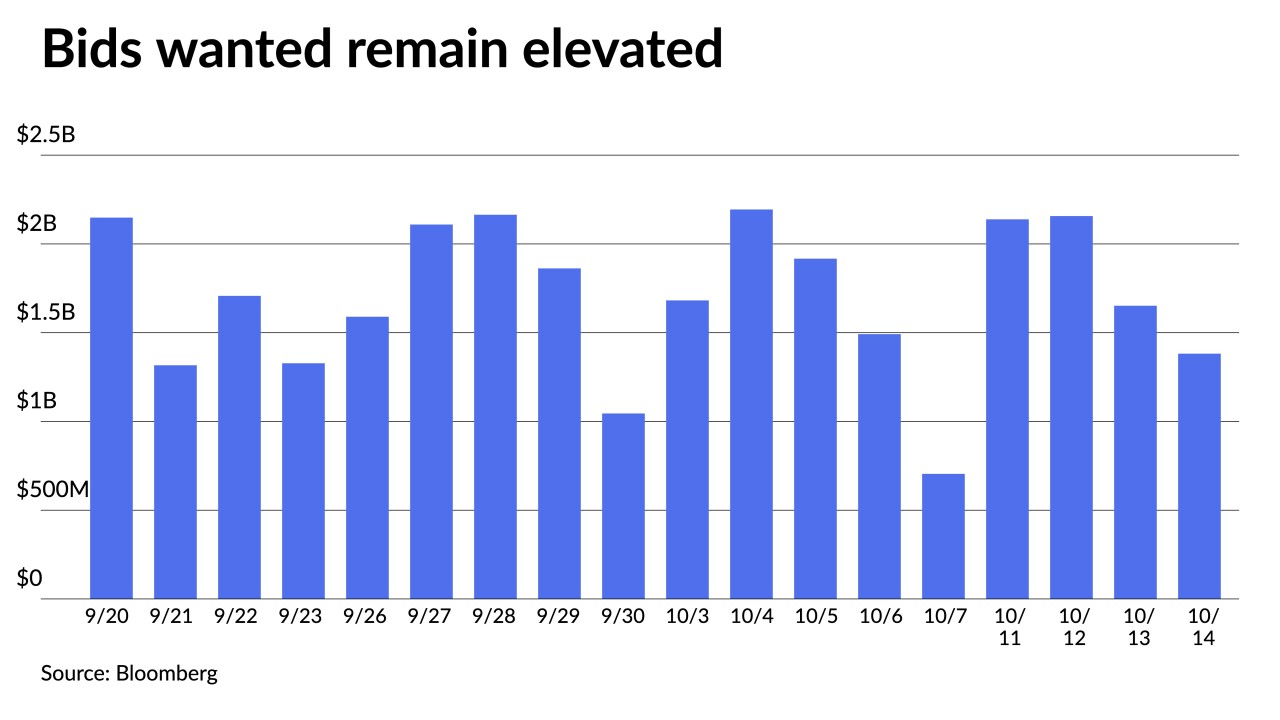

Selling pressure was on the rise again this week. Thursday's $2.919 billion of bonds out for the bid was only surpassed on March 19, 2020, when they hit $4.115 billion. A larger calendar closes out October.

October 21 -

Corporate CUSIPs can reach a different, broader set of investors than even taxable munis and offer more issuing flexibility for well-known universities.

October 21 -

"The curve slope has undergone a massive flattening this year and recent trends suggest demand pockets are developing in specific ranges," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

October 20 -

Outflows continued as investors pulled $4.532 billion from mutual funds in the week ending Oct. 12 after $5.172 billion of outflows the previous week, according to the Investment Company Institute.

October 19 -

Triple-A curves were a touch firmer in spots as secondary trading took a backseat to the larger primary activity with Connecticut and Massachusetts pricing general obligation bonds, a large CommonSpirit healthcare and several competitive issues led by Rhode Island GOs.

October 18 -

Volume rebounds eightfold this week with a new-issue calendar of $8.5 billion, including several billion-dollar deals.

October 17