Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

The two main insurers, Assured Guaranty Municipal Corp. and Build America Mutual, accounted for $28.823 billion of deals in 2022 compared to $37.193 billion of in 2021.

February 13 -

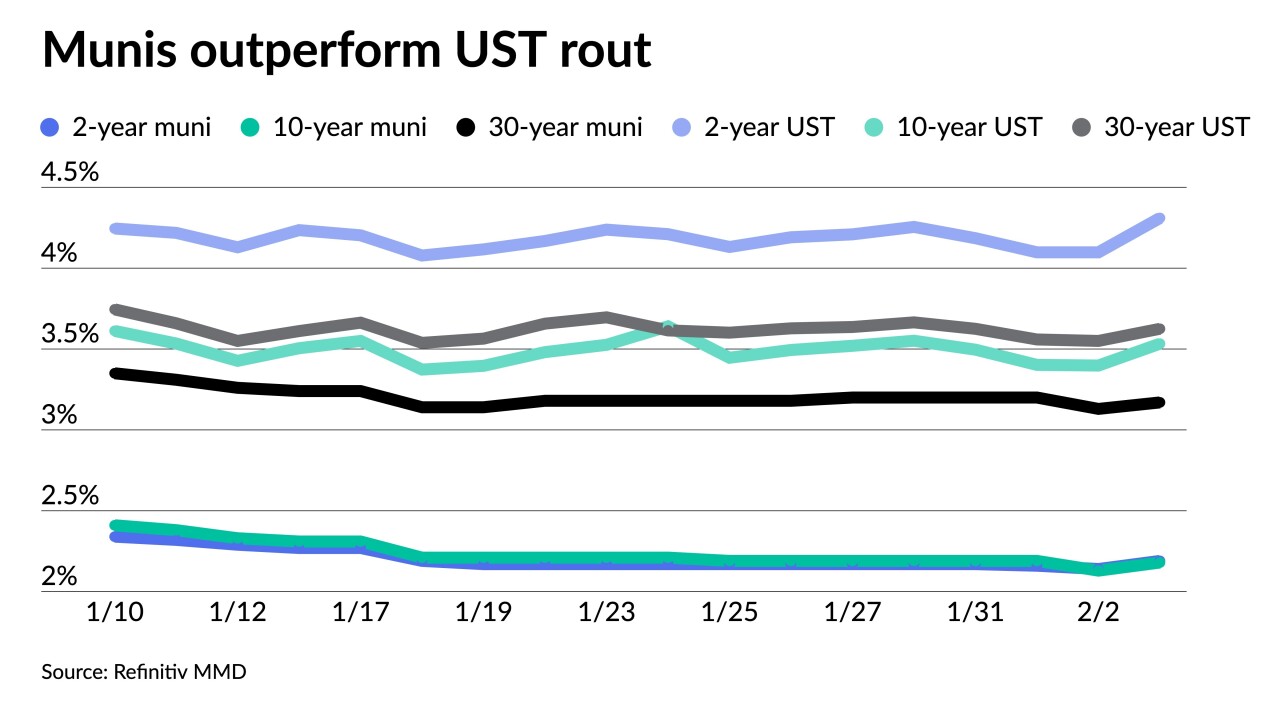

"This peculiar shape of the muni yield curve has created a conundrum for investors, as all high-quality municipal bonds, with the possible exception of the long end, have become quite rich," Barclays strategists said.

February 10 -

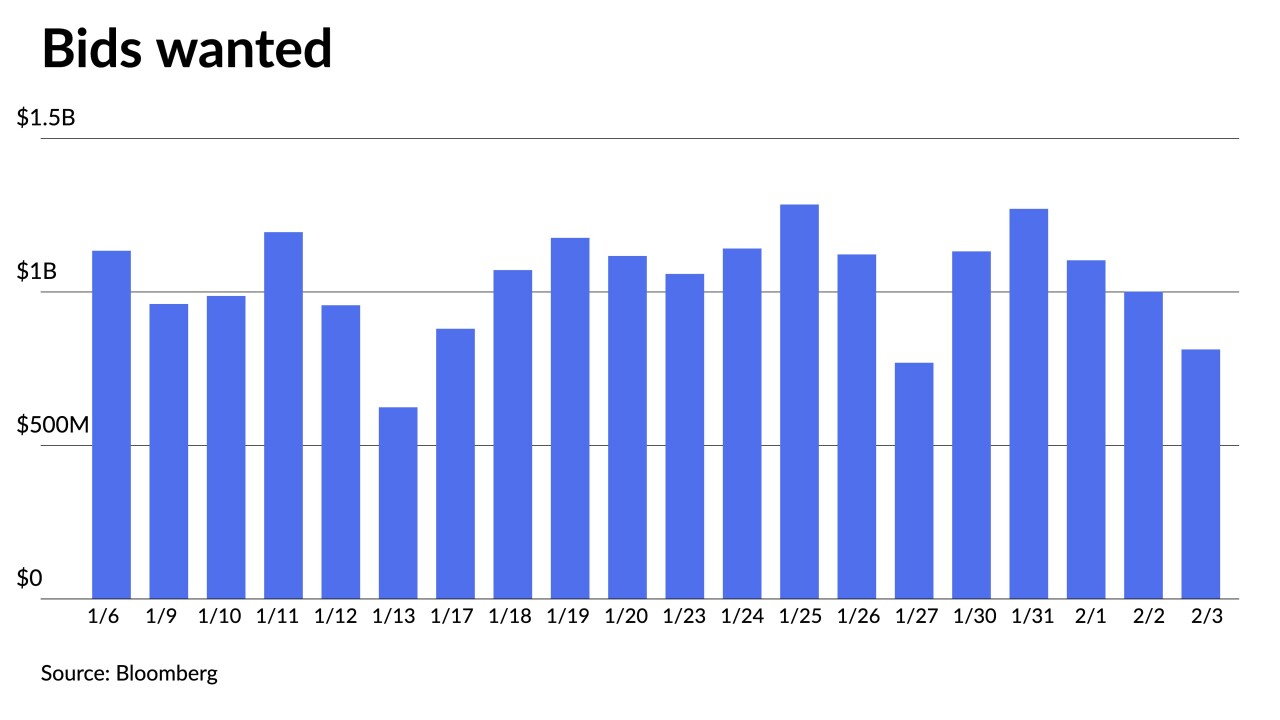

Inflows returned as Lipper reported $775.006 million was added to municipal bond mutual funds in the week ended Wednesday after $361.649 million of outflows the week prior.

February 9 -

Although there is some volatility in the municipal market, the landscape is in good shape, according to Cooper Howard, fixed income strategist at Charles Schwab.

February 8 -

"The market started the year with a reduction of the oppressive pressure caused by last year's heavy net outflows from mutual funds," said CreditSights strategists Pat Luby and Sam Berzok.

February 7 -

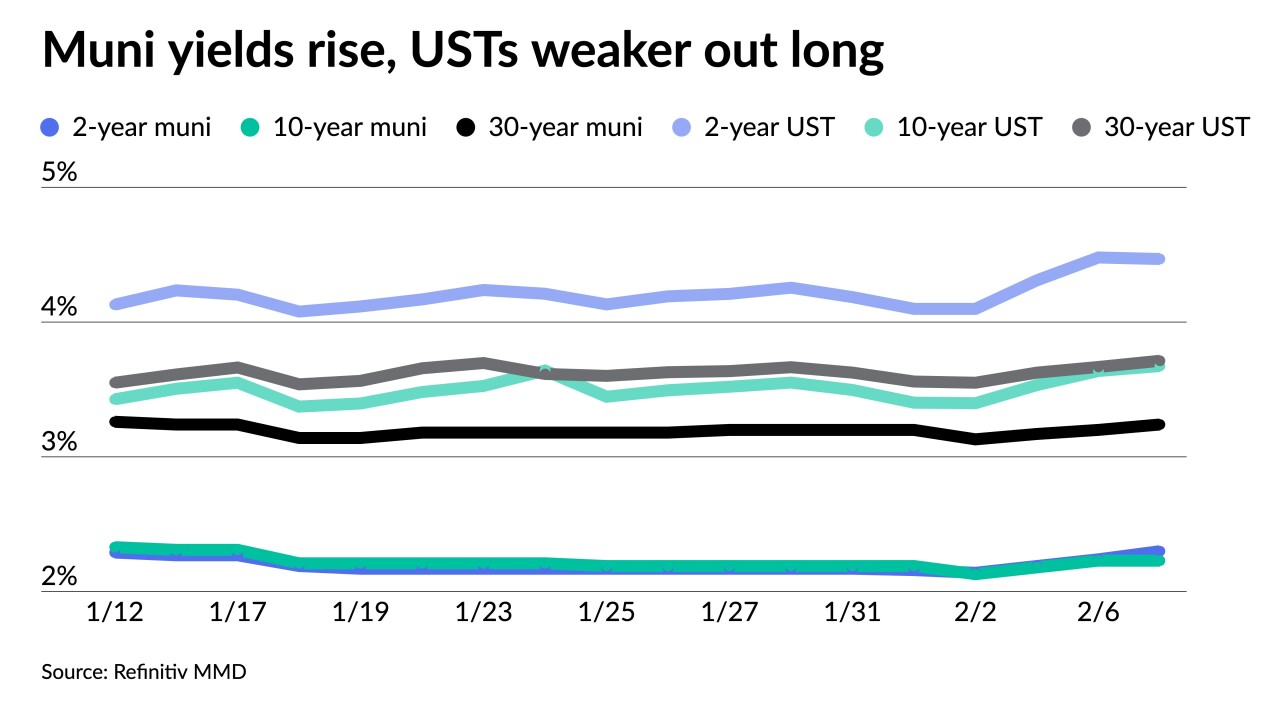

"We did see some bump in the curve as a result of the FOMC hiking rates by 25 basis points on Wednesday," said Jason Wong, vice president of municipals at AmeriVet Securities. "However, with an unexpected high employment number, fixed-income yields rose."

February 6 -

Friday's payrolls "surprised to the upside, with nonfarm payrolls increasing 517,000 last month after an upwardly revised 260,000 gain in December," Barclays strategists said.

February 3 -

Nearly two-thirds of market participants in a Bond Buyer live market survey believe 2023 issuance will remain around last year's levels.

February 3 -

The top two municipal bond insurers wrapped $28.224 billion in 2022, a 30.1% decrease from the $37.486 billion of deals done in 2021, according to Refinitiv data.

February 3 -

A few developments in recent sessions "may have staying power should the new outlook on upcoming FOMC actions gain traction," said Kim Olsan, a senior vice president of municipal bond trading at FHN Financial.

February 2