Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

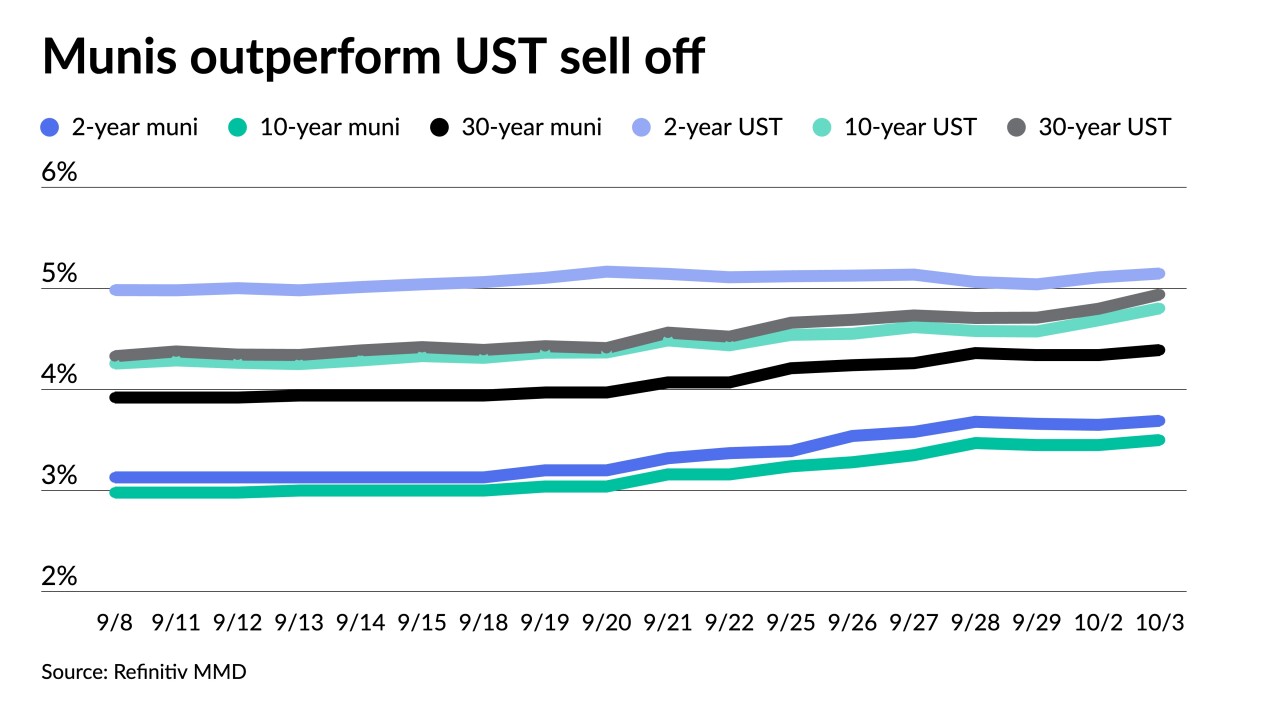

However, "a long-lasting bond market rally seems unlikely given major structural shifts of higher bond supply and on uncertainty with demand," said Edward Moya, senior market analyst at OANDA.

October 10 -

The firm will continue to do business in the competitive market.

October 10 -

RBC Capital Markets and Caine Mitter & Associates moved into the top 10, while CSG Advisors and Kaufman Hall & Associates were bumped to the top 15.

October 10 -

BofA Securities remained in the top spot despite accounting for less par and a smaller market share than in 2022.

October 10 -

California headlined the top 10 issuers in the first three quarters of 2023.

October 10 -

While the market broadly is still in the early stages of using artificial intelligence, more firms are starting to implement it, panelists said at MuniTech NYC, an event hosted by Munichain and Spline Data that brought together a gathering of technology-focused market participants.

October 6 -

All eyes will be on Friday's report, though "it seems most leading indicators suggest job growth will remain healthy, which should keep the bond market selloff going strong," said OANDA's Edward Moya.

October 5 -

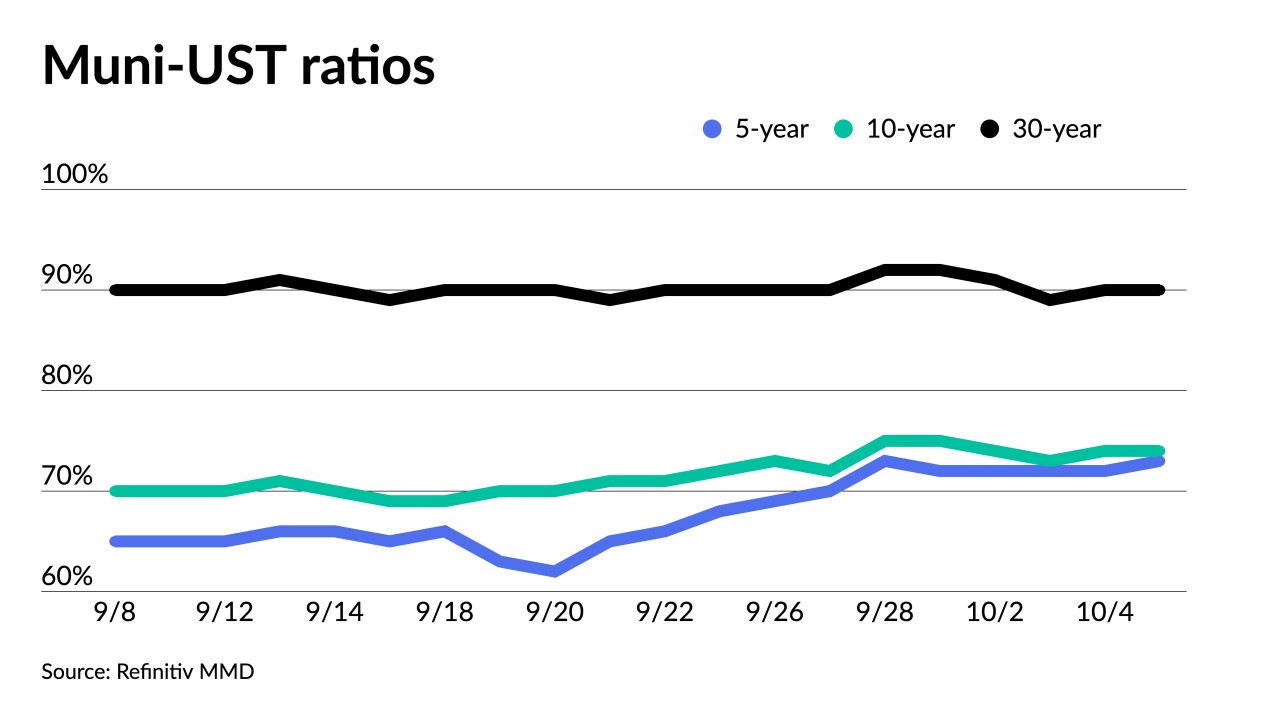

Municipal yields fell up to three basis points, depending on the scale, but underperform a better UST market.

October 4 -

UST rates are driving all things in the muni market, said Jon Mondillo, head of North American Fixed Income at abrdn.

October 3 -

This comes as the firm shores up its presence in Texas.

October 3