Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

Munis should remain well bid until issuance picks up "dramatically," said Nuveen's Anders S. Persson and Daniel J. Close.

February 27 -

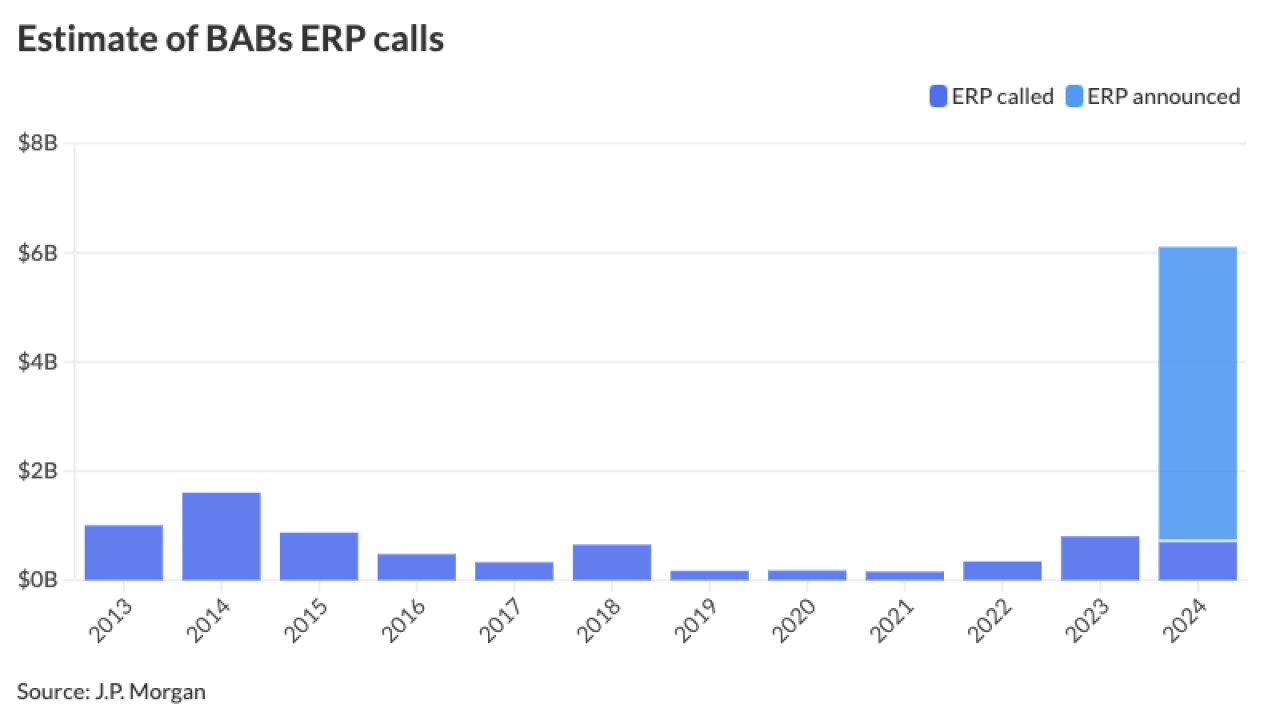

CreditSights said states with the largest payments are Texas at $2 billion, Pennsylvania at $1.5 billion, South Carolina at $1.3 billion and California at $1.2 billion

February 26 -

With a recent court ruling and higher interest rates in their favor, more issuers are likely call back their outstanding BABs using the extraordinary redemption provision.

February 26 -

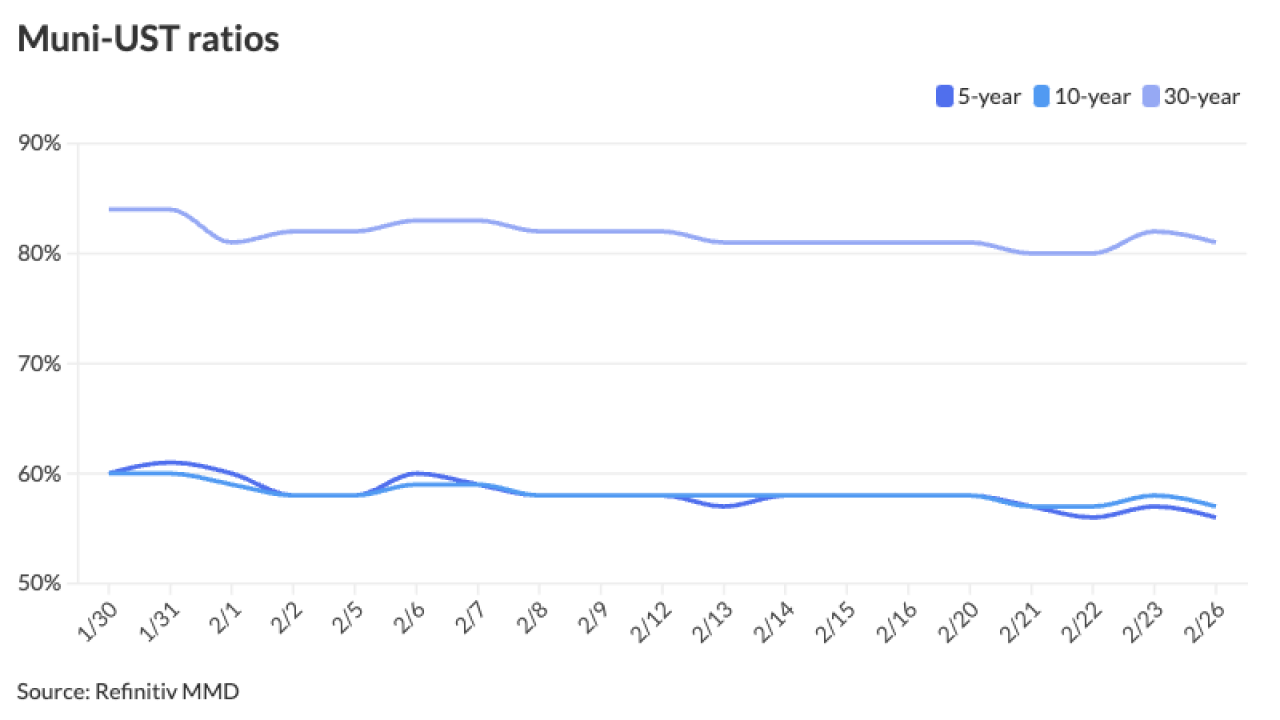

Supply is expected to increase in the coming weeks, and there may be more rate-direction volatility, said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

February 22 -

"We built a modern marketplace that provides an equity-like trading experience back to the brokerages," said Jonathan Birnbaum, OpenYield's founder and CEO.

February 22 -

Policymakers appear to be concerned about the possibility of cutting interest rates too soon, according to minutes of the Federal Open Market Committee's Jan. 30-31 meeting, released Wednesday.

February 21 -

"With the new economic data signaling a delay of the Fed starting rate cuts to further into the year, we should continue to see yields rise until we get near to the Fed's target of a 2% 'neutral' rate for inflation," said Jason Wong, vice president of municipals at AmeriVet Securities.

February 20 -

All municipal bond insurers wrapped $35.381 billion in 2023, a 5.8% increase from the $33.428 billion insured in 2022, according to LSEG data.

February 20 -

Bond volume fell slightly, as volatility, higher interest rates, falling pandemic aid and slower economic growth kept issuers on the sidelines.

February 20 -

Issuance has fluctuated throughout the years since the financial crisis, following interest rate changes — rising when rates rise and falling when rates fall — but the totals have come in well below $15 billion every year since 2012, save for 2017 when $15.234 billion was sold.

February 20