Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

May volume "surprised on the high end and it has been one of the fastest starts to the year historically," said James Pruskowski, chief investment officer at 16Rock Asset Management.

May 31 -

Despite losses, munis are "being set up nicely" as the summer season approaches, said Jeff Lipton, a research analyst and market strategist.

May 30 -

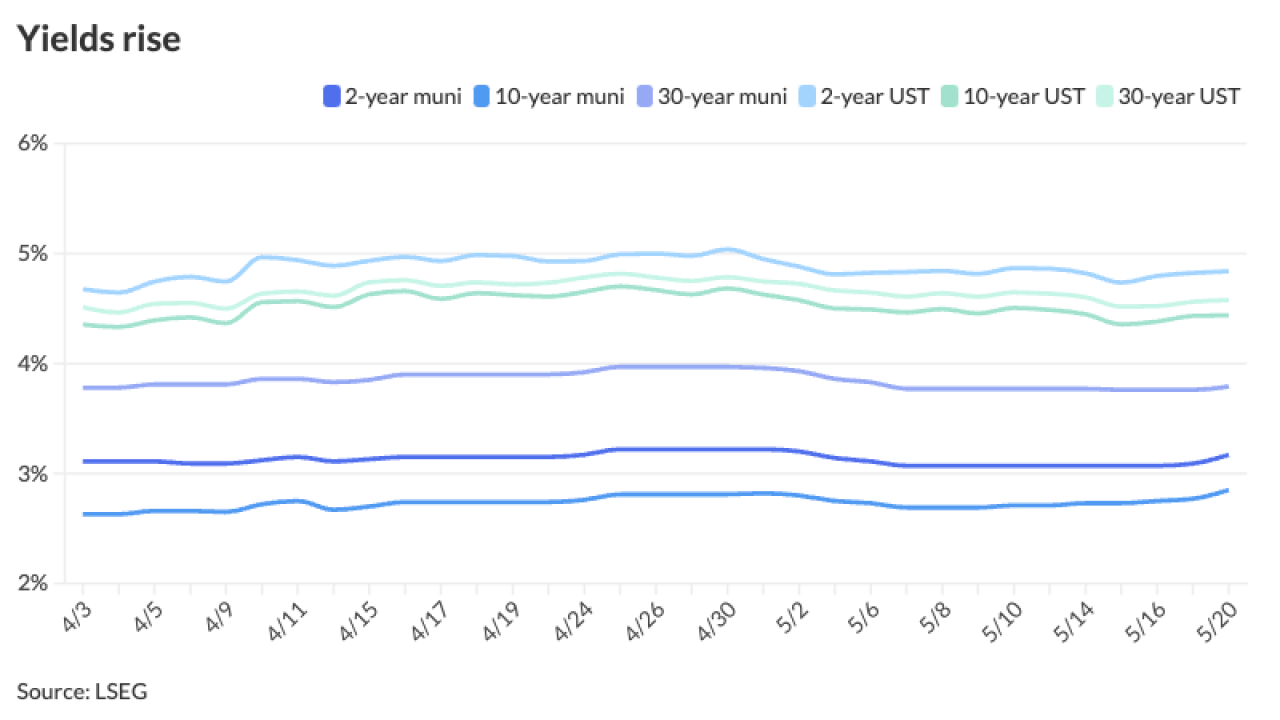

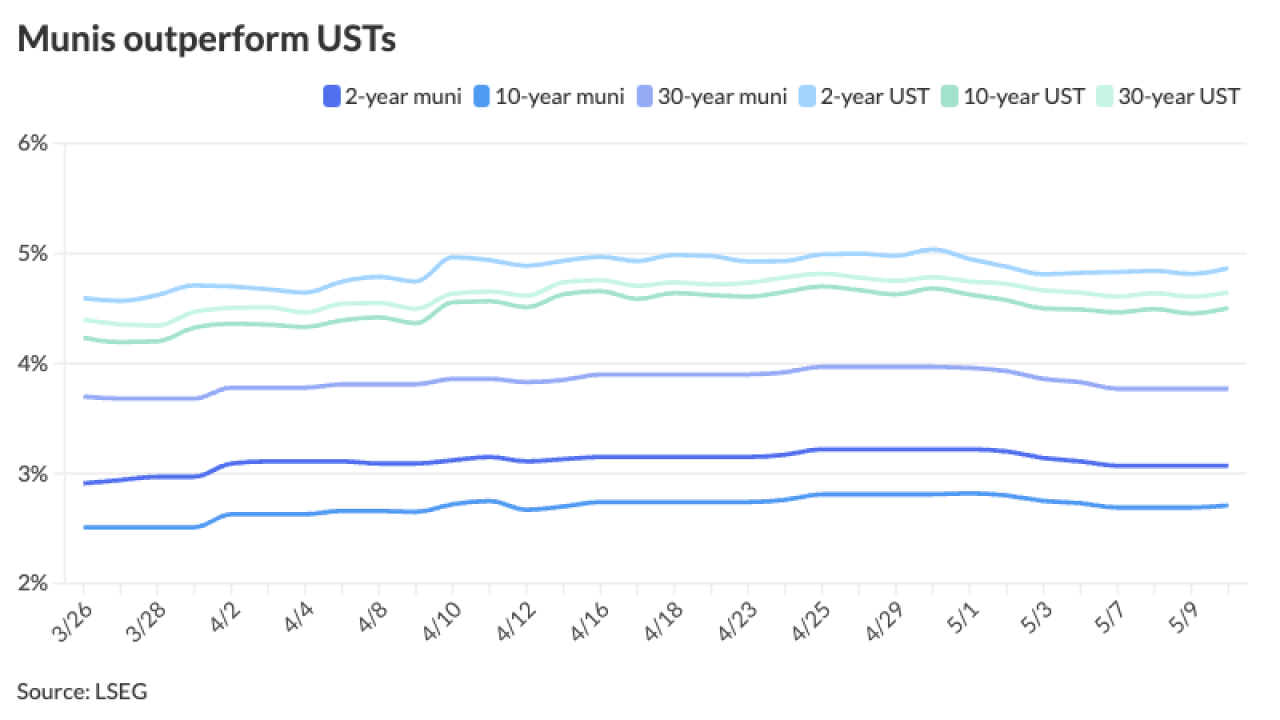

Muni yields rose up to 13 basis points Wednesday, depending on the curve, coming on the tailwind of a market correction, said Brad Libby, a fixed-income portfolio manager and credit analyst at Hartford Funds.

May 29 -

SMA growth has been "pretty staggering to see," said Matthew Schrager, managing director and co-head of TD Securities Automated Trading, noting the "interplay between SMA and electronic trading is a very symbiotic relationship."

May 29 -

Munis sold off last week "as the anticipated market correction may have finally started ahead of the summer reinvestment period," said Jason Wong, vice president of municipals at AmeriVet Securities.

May 28 -

Municipal bond mutual funds saw the second week of outflows as investors pulled $217.6 million from the funds after $546.2 million of outflows the week prior, according to LSEG Lipper. High-yield saw inflows again.

May 23 -

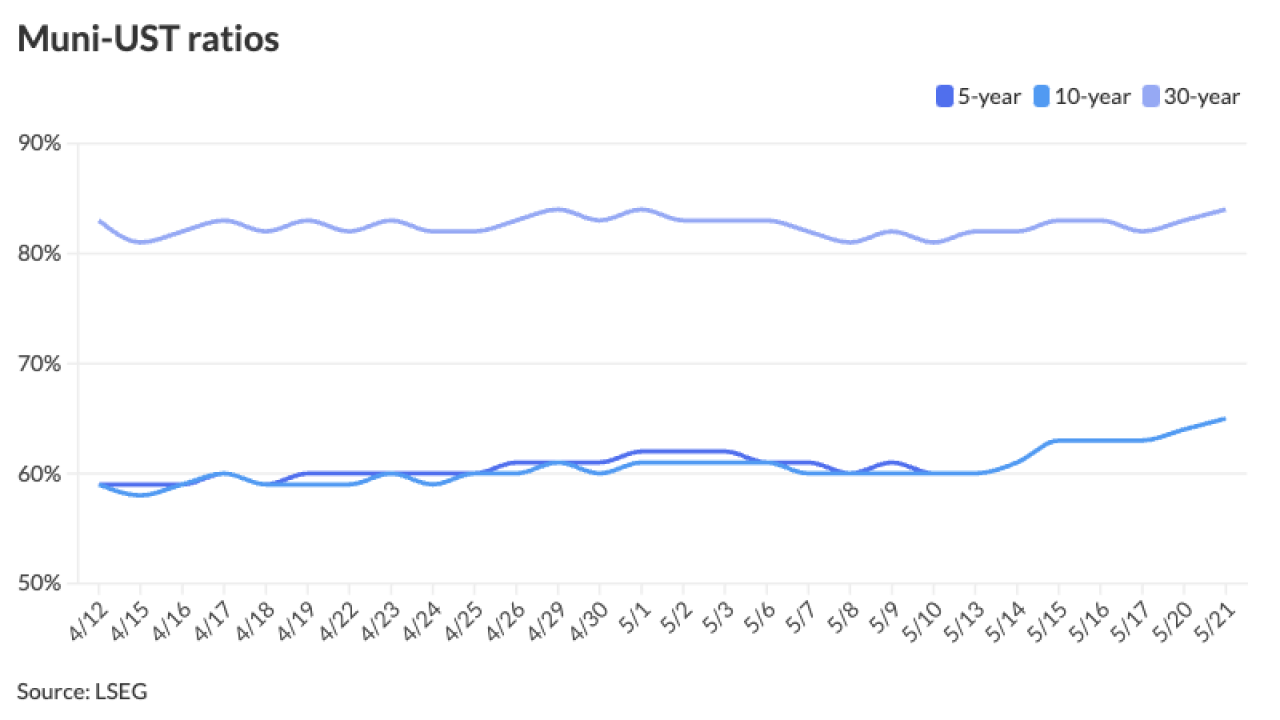

The ongoing influx of new-issue supply has pushed muni-UST ratios to at or near year-to-date highs, J.P. Morgan strategists said.

May 22 -

Dan Tomson, Citi's former co-head of Municipal Banking and Public Finance, and David Stephan, a former J.P. Morgan executive director, have joined the firm.

May 22 -

Several weeks of elevated supply should theoretically be "weighing more on performance, but the market is now just ahead of its largest reinvestment season, which so far in 2024 has become even more pronounced, with an additional $19.5 billion scheduled for call/redemption between [June 1 and August 30]," said Matt Fabian, a partner at Municipal Market Analytics.

May 21 -

"While we acknowledge that the market tone is weaker [Monday], we are generally constructive regarding valuations and expect this week's supply to be absorbed fairly well after last week's giveback of the richening witnessed over prior weeks," said Vikram Rai, head of municipal markets strategy at Wells Fargo.

May 20 -

"The industry is built on relationships, and it's powered by technology," said Josh Rosenblum, head of algorithmic trading at Brownstone.

May 20 -

There are nearly 30 new-issues over $100 million on tap across the credit spectrum, led by the week's largest negotiated deal from Harris County, Texas, with $950 million of toll road first lien revenue and refunding bonds. The competitive calendar ticks up with several high-grade names.

May 17 -

Muni exchange-traded funds are "dominated" by retail and are "momentum driven," said David Litvack, a tax-exempt strategist and chief investment officer at BofA.

May 16 -

The CPI print keeps the possibility of the Fed cutting rates at least once this year, potentially at least two rate cuts if the data continues to point to a trend of inflation falling further, said Jeff Lipton, a research analyst and market strategist.

May 15 -

This week's issuance is above the 2024's year-to-date weekly average of $7.6 billion, said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

May 14 -

Creedon has "tremendous capacity" as a banker, with experience in sectors outside of Janney's current business, such as tobacco securitization, and in geographical areas where the firm is seeking to grow, said Vivian Altman, Janney's head of public finance.

May 14 -

With the market "hungry" for high-yield bonds, declining cigarette sales have not had as much of an impact "as maybe it should or could in the future," said John Miller, head and chief investment officer of First Eagle's High Yield Municipal Credit team.

May 14 -

The muni market improvement has the asset class seeing gains of 1.08% so far in May, as year-to-date returns inch closer to "positive territory," said Jason Wong, vice president of municipals at AmeriVet Securities.

May 13 -

The New York City Transitional Finance Authority leads the new-issue calendar with a total of $1.8 billion of future tax-secured subordinate bonds in the negotiated and competitive markets.

May 10 -

Municipal bond mutual funds saw another week of inflows as investors added $1.053 billion in the week ending Wednesday, the second-largest figure this year.

May 9