Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

"While valuations are still historically tight, the extra demand through the summer should help support the muni market in the coming weeks," Birch Creek strategists said.

July 1 -

In the first half of 2024, winding-down federal aid, a resurgence of Build America Bond refundings and election uncertainty have contributed to the surge in issuance, said James Welch, a portfolio manager at Principal Asset Management.

June 28 -

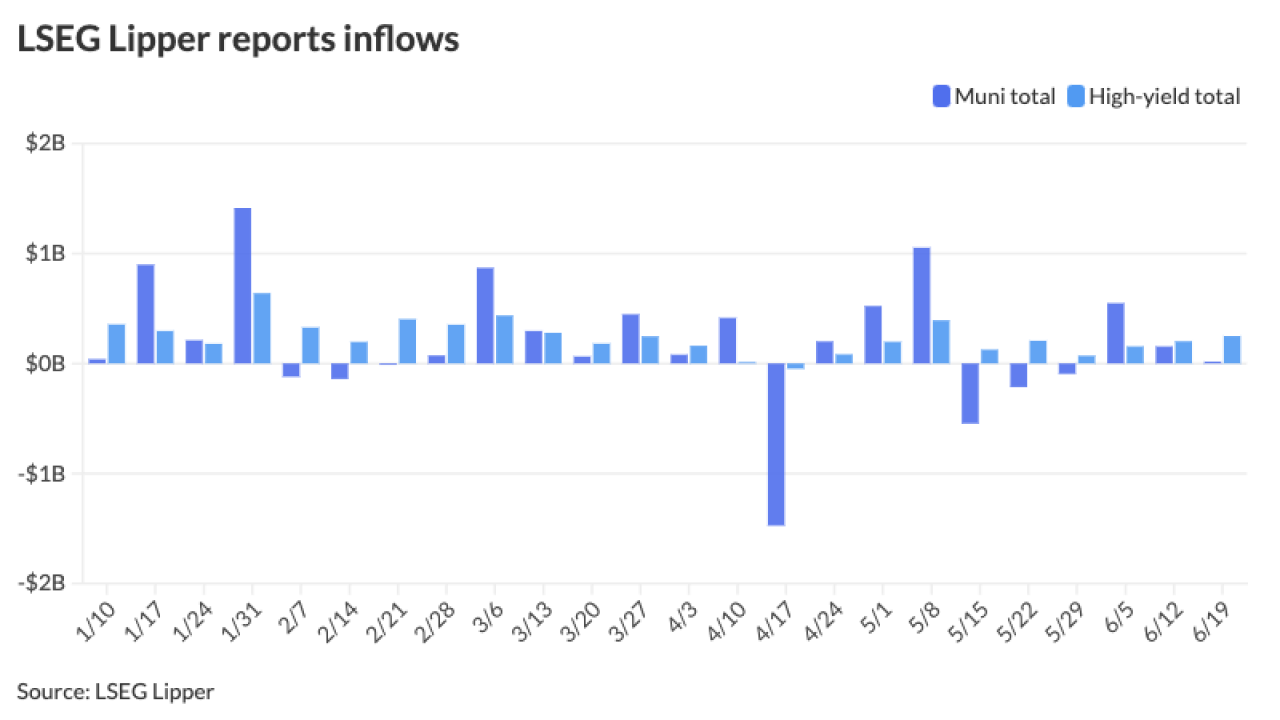

Municipal bond mutual funds saw outflows as investors pulled $498 million from funds after $16 million of inflows the week prior, according to LSEG Lipper. High-yield funds still saw inflows.

June 27 -

June supply appears to be finishing above $45 billion, the third highest monthly total in the last 10 years, said Kim Olsan, vice president of municipal bond trading at FHN Financial.

June 26 -

In 2024, variable rate (short put) issuance is up 6.4% increase year-over-year, LSEG data shows. Few expect issuance to return pre-financial crisis levels.

June 26 -

Demand for the increased supply has been "solid" if nearly largely reliant on income-oriented small lot buyers, noted Municipal Market Analytics, Inc. Partner Matt Fabian. Through last week, buyers continued to be separately managed account/retail in size.

June 25 -

Total volume currently stands at $224.13 billion, up 38.5% from $161.848 billion at this time last year. As the end of the first half approaches, several firms are revisiting their supply projections for the year, given the growth so far this year.

June 25 -

With the "pretty good run" month-to-date, it would not be unexpected to see "the market take a breather, and with a large calendar this coming week, it may again move sideways," said AllianceBernstein strategists in a weekly report.

June 24 -

Broker-dealer Millennium will provide clients with real-time pricing and trade execution capabilities by connecting directly to the Investortools Dealer Network, or IDN.

June 24 -

Municipal bond mutual funds saw small inflows as investors added $16.4 million to the funds after $154.4 million of inflows the week prior, according to LSEG Lipper.

June 20