Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

The state's new law requires companies like investment banks to provide written verification of their positions, part of a trend among similar bills aimed at preventing Wall Street banks from lying about their positions, said a firearms industry lobbyist.

June 20 -

Issuance this year is "well on its way" to $450 billion, mostly from the tax-exempt supply of new money projects, said Matt Fabian, a partner at Municipal Market Analytics.

June 18 -

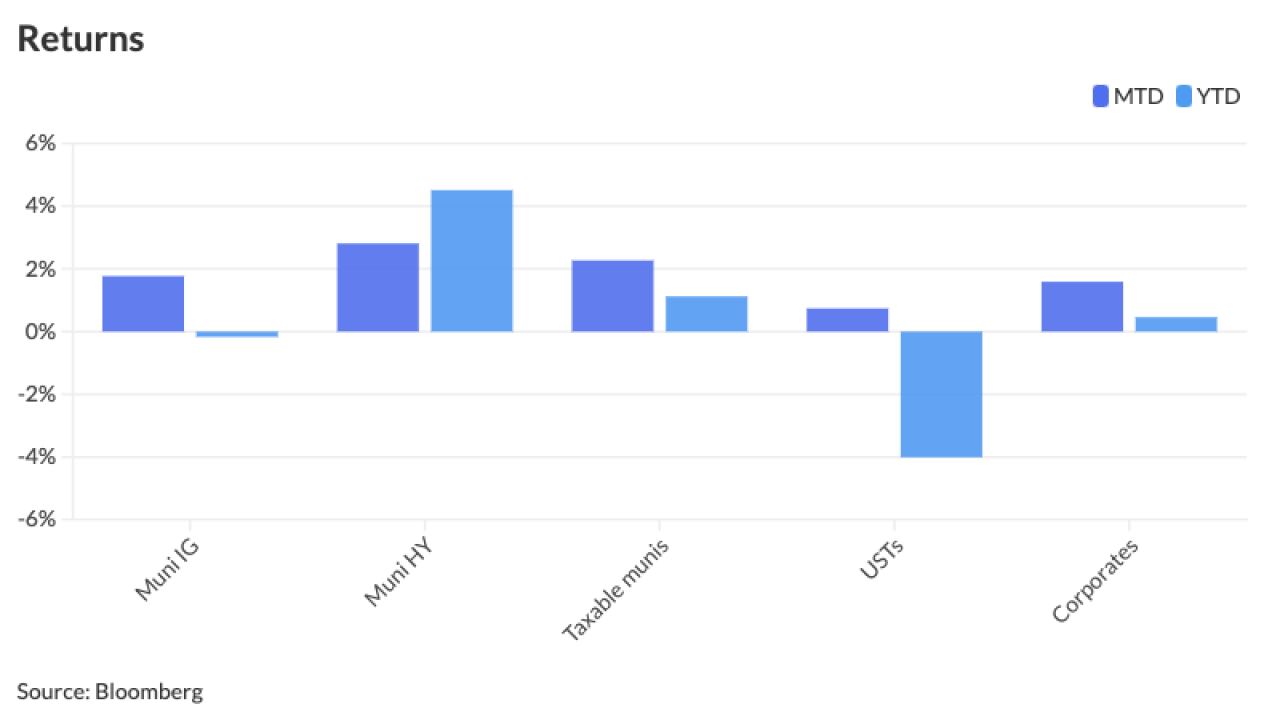

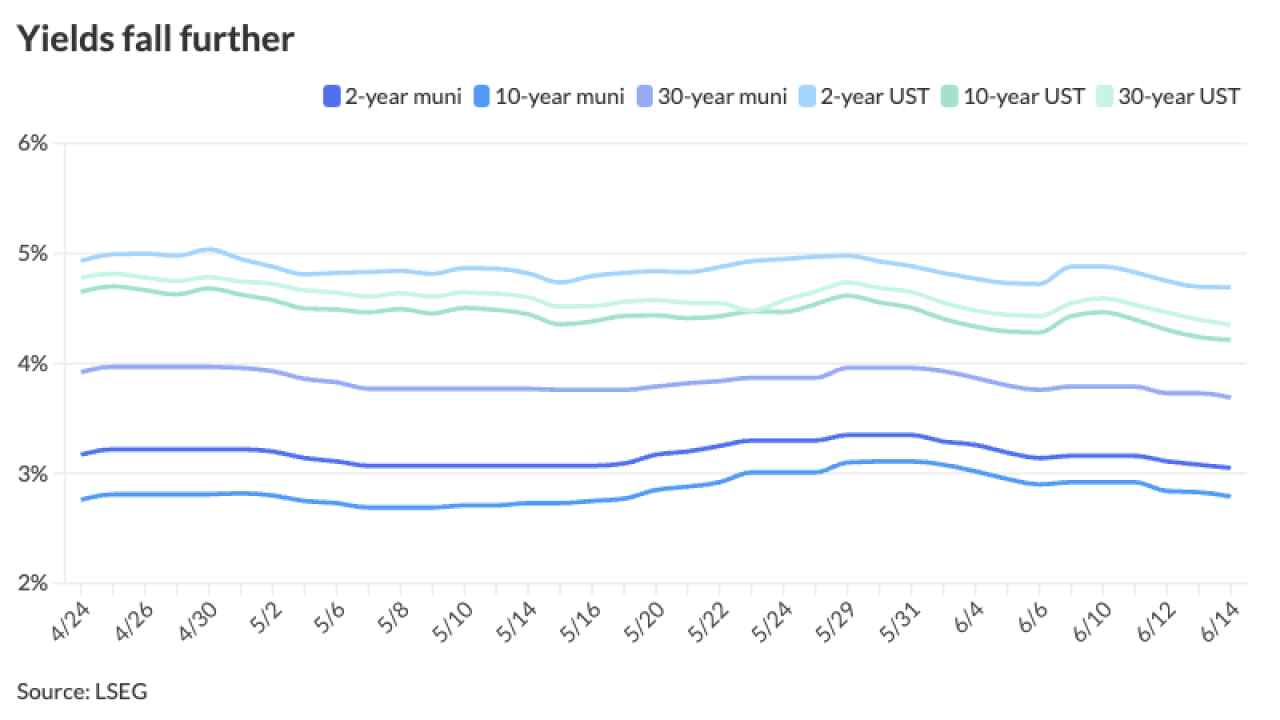

Despite some slight weakness Monday, munis continued an "impressive start to June," with yields falling 10 to 13 basis points last week, Birch Creek strategists said.

June 17 -

The new-issue calendar is led by the New York Transportation Development Corp. with $1.5 billion of green AMT special facilities revenue bonds for the John F. Kennedy International Airport New Terminal One project,

June 14 -

"Even after this week's rally, absolute yields look attractive in the context of the trading range over the past three years, May's underperformance versus taxable fixed-income, and our longer-term projections for lower rates this year," J.P. Morgan strategists said.

June 13 -

Household ownership of munis — which includes direct ownership of individual bonds in brokerage accounts, fee-based advisory accounts and SMAs — rose to $1.779 trillion, up 0.3% from Q4 2023 and from 5.6% in Q1 2023.

June 13 -

Driven by ongoing capital expenditure funding and current refunding opportunities, airport issuance is estimated at $21 billion in 2024, with a slew of from June through September and more planned in December, according to Ramirez.

June 12 -

"We will remain cautious until CPI and the FOMC are in the rear-view mirror and as long as these don't catalyze a sell-off (since that would trigger outflows) or catalyze a sharp rally (as municipals lag rates during a sharp rally and ratios can increase optically) ... " said Vikram Rai, head of municipal markets strategy at Wells Fargo.

June 11 -

Munis should see better performance this week as issuance falls to $5.2 billion this week and cash still needs to be reinvested, said Jason Wong, vice president of Municipals at AmeriVet Securities.

June 10 -

Municipal bond mutual funds saw inflows as investors added $549.2 million after $94.9 million of outflows the week prior, according to LSEG Lipper.

June 6