Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

Issuance remains robust Wednesday with an estimated $5.9 billion, said J.P. Morgan strategists led by Peter DeGroot.

June 5 -

New-issue volume has topped $50 billion over the past few weeks, said AllianceBernstein in a weekly report.

June 4 -

Falling occupancy figures, staffing shortages, and rising labor costs have elevated the sector's risk, with Greenwich Investment Management's bankruptcy yet another example of how the sector requires thorough credit analysis.

June 4 -

This week's surge in issuance, which tops $14 billion, is "likely going to keep a lid on any enthusiasm," Birch Creek strategists said in a weekly report.

June 3 -

May volume "surprised on the high end and it has been one of the fastest starts to the year historically," said James Pruskowski, chief investment officer at 16Rock Asset Management.

May 31 -

Despite losses, munis are "being set up nicely" as the summer season approaches, said Jeff Lipton, a research analyst and market strategist.

May 30 -

Muni yields rose up to 13 basis points Wednesday, depending on the curve, coming on the tailwind of a market correction, said Brad Libby, a fixed-income portfolio manager and credit analyst at Hartford Funds.

May 29 -

SMA growth has been "pretty staggering to see," said Matthew Schrager, managing director and co-head of TD Securities Automated Trading, noting the "interplay between SMA and electronic trading is a very symbiotic relationship."

May 29 -

Munis sold off last week "as the anticipated market correction may have finally started ahead of the summer reinvestment period," said Jason Wong, vice president of municipals at AmeriVet Securities.

May 28 -

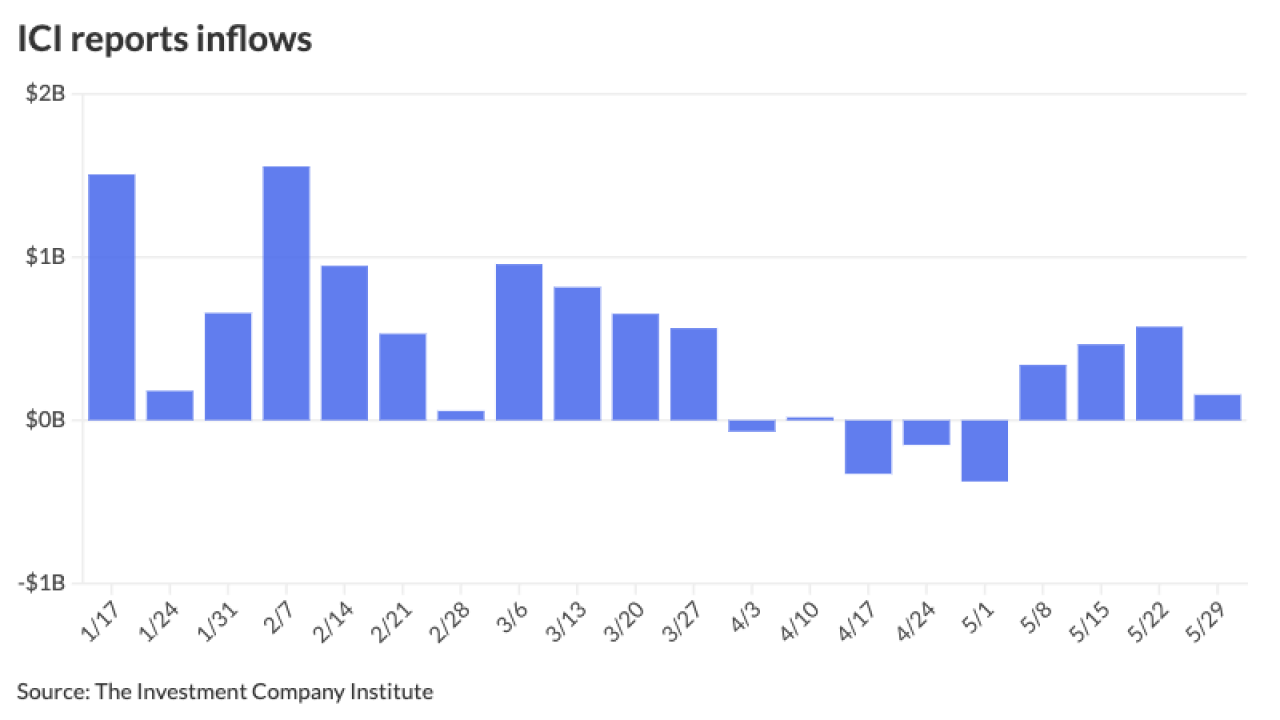

Municipal bond mutual funds saw the second week of outflows as investors pulled $217.6 million from the funds after $546.2 million of outflows the week prior, according to LSEG Lipper. High-yield saw inflows again.

May 23