Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

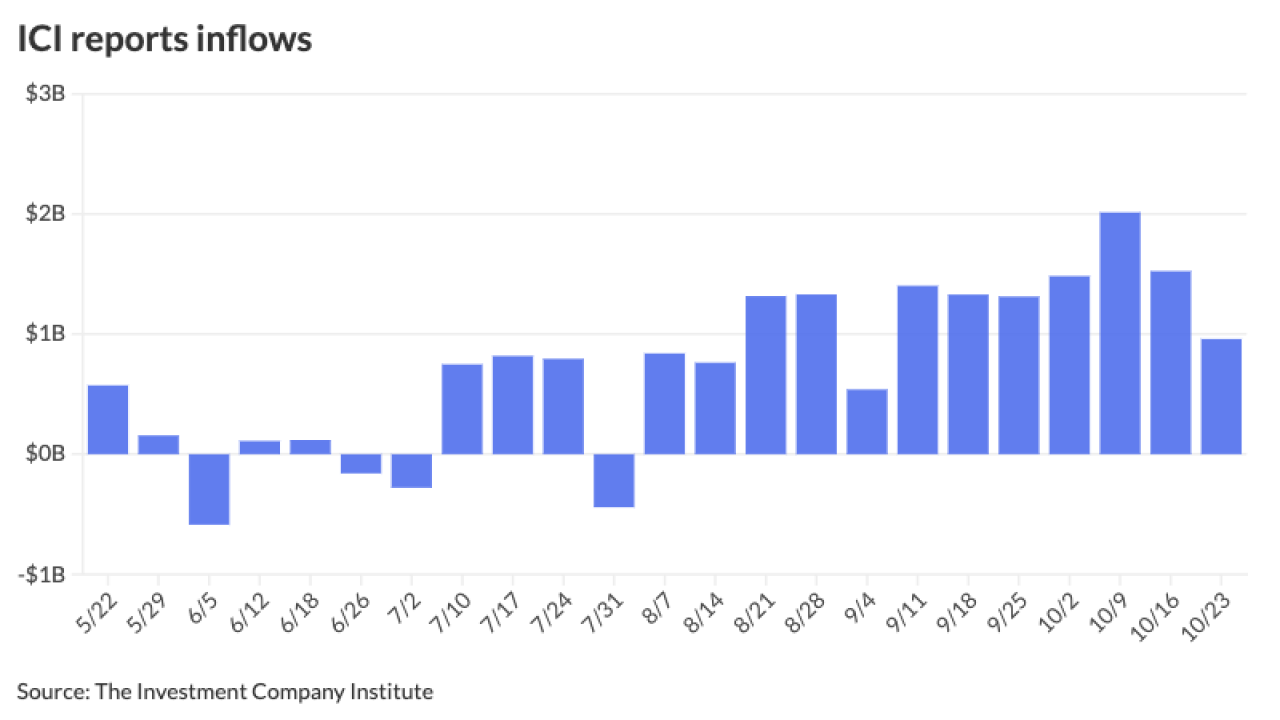

Despite the post-election selloff, inflows continued this week as LSEG Lipper reported investors added $1.263 billion to municipal bond mutual funds for the week ending Wednesday, compared to $658.5 million of inflows the prior week. High-yield inflows returned.

November 7 -

The red wave that took the presidency and the Senate — along with increased odds of a Republican victory in the House — was hanging heavily over fixed income markets Wednesday, with munis and UST yields rising up to 17 basis points, with the largest losses out long.

November 6 -

"If the GOP wins the House, the specter of risk to the municipal bond tax-exemption will increase," said Edwin Oswald, a tax partner at Orrick Herrington & Sutcliffe in Washington D.C.

November 6 -

Voters were asked to consider at least $148.912 billion of bonds this year in 908 ballot referendums, according to data compiled by Bond Buyer.

By Gary SiegelNovember 6 -

"A victory for former President Trump is likely to be viewed as ushering in a more inflationary environment, whereas a win for Vice President Harris will probably be seen as closer to the status quo," said Erik Weisman, chief economist and portfolio manager at MFS Investment Management."

November 5 -

Investors should "brace themselves" for further volatility, as uncertainty is likely to remain, said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

November 4 -

Issuance will "not completely disappear, but will adjust to its seasonal norm from the record-breaking pace of the past several months," said Barclays' Mikhail Foux.

November 1 -

The month's total is above the 10-year average of $40.288 billion. The market needs to see about $45 billion of issuance in November and December to hit an all-time record year.

October 31 -

Municipals largely stayed in their own lane Wednesday, digesting the large slate of new issues as supply dwindles heading into election week, with Bond Buyer 30-day visible supply falling to $5.56 billion.

October 30 -

Nearly $1 billion of outstanding BABs may still be called back before yearend.

October 30 -

California sold tax-exempt and taxable GOs, the University of Miami priced a refunding deal while the Harris County-Houston Sports Authority came with a refunding and tender offer.

October 29 -

While the asset class is still in the red for October, it has pared back earlier losses. The Bloomberg Municipal Index is at negative 1.42% in October and positive 0.84% year to date.

October 28 -

Vales is currently a director for fixed-income focused broker-dealer InspereX and an independent trustee for the Axonic Funds, having previously served as the CEO of electronic trading platform TMC Bonds, which ICE acquired in 2019.

October 25 -

While fundamentals remain strong — with credit upgrades outpacing downgrades by 3.5 times so far in 2024 — technical factors have been "less supportive," Principal Asset Management strategists said in a report.

October 24 -

"Coming off rich muni-Treasury ratios, the market has swiftly repriced," said 16Rock Asset Management's James Pruskowski. "With now cheaper benchmark yields and wider credit spreads, fresh capital is flowing in, and a strong bottoming opportunity looks to be emerging."

October 23 -

"The identity of the marginal buyer may be shifting, and with that the market's valuation of structure and liquidity," said Matt Fabian, a partner at Municipal Market Analytics.

October 22 -

As technology options grow, firms are looking for ways to streamline and scale workflows.

October 22 -

Demand for munis remains "insatiable," said Daryl Clements, a municipal portfolio manager at AllianceBernstein.

October 21 -

Mulry's career in public finance spanned nearly 40 years. He is remembered as a dedicated and generous colleague and friend.

October 17 -

"Buyer interest comes as forward supply is projected around $20 billion (the high water mark over the last year) while offsetting calls and maturities sit about $2 billion lower, creating a net supply surplus," said Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital.

October 17