Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

"Volatility creates all kinds of opportunities in the municipal space, not just for tax-loss harvesting, but for positioning and parts of the yield curve that might be undervalued or certain sectors or states that are poised to perform well going into yearend," said Tim McGregor, a managing partner at Riverbend Capital Advisors.

November 21 -

JoAnne Carter, managing director and president of PFM, will succeed Hartman as CEO.

November 20 -

"This year, with the tax-exemption clearly threatened, primary calendars should (although, of course, might not) be larger, putting a $500 billion full-year supply total in range, with $451 billion already in the books through 46 weeks," said MMA's Matt Fabian.

November 19 -

Houston is set to price Tuesday $1 billion of United Airlines Terminal Improvement Projects AMT revenue bonds while the Public Finance Authority will bring $125 million of non-rated Million Air Three General Aviation Facilities Project revenue bonds.

November 18 -

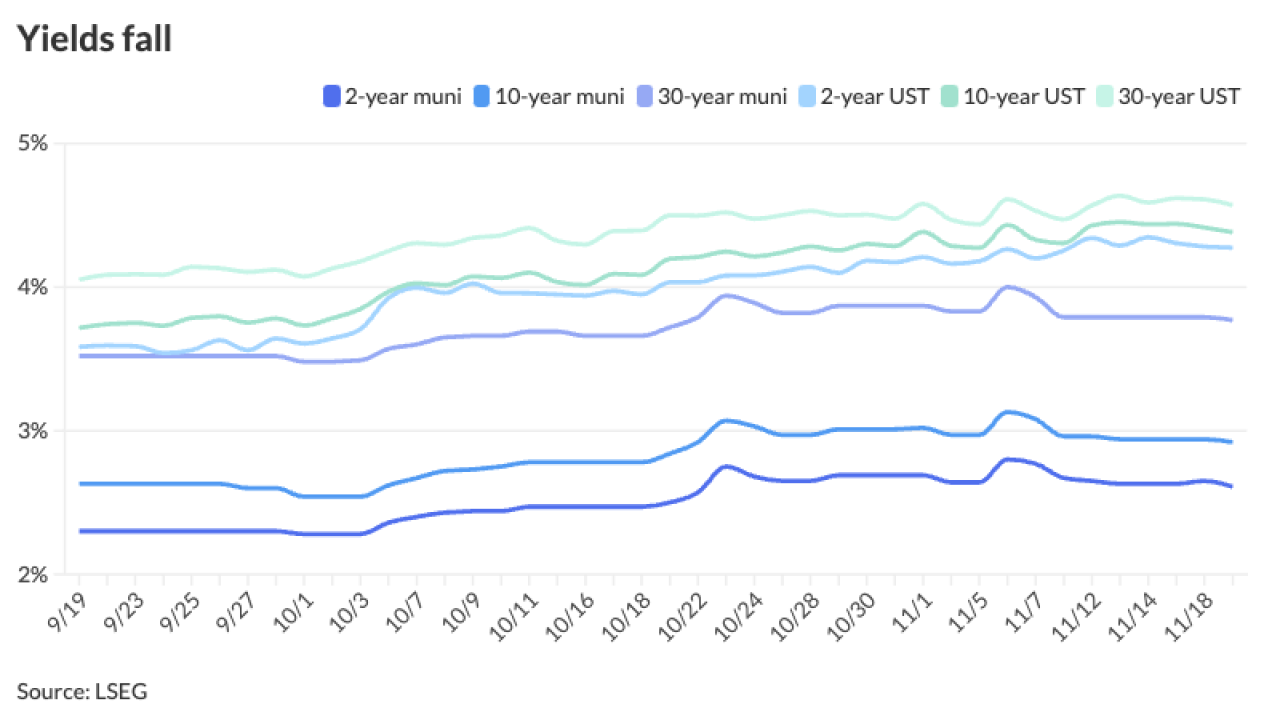

This month is experiencing similar volatility as 2016 when generic yields traded higher by 50 to 70 basis points during November of that year, said Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital.

November 14 -

The number of active ETFs launched has skyrocketed this year, with 20 new funds launched year-to-date. This compares with the four passive ETFs created so far in 2024, according to Morningstar Direct data.

November 14 -

Market reaction to inflation numbers was "tempered," said Richard Flax, chief investment officer at Moneyfarm. But should inflationary pressures hold in 2025, "markets may anticipate that further rate cuts could be limited in scope, suggesting a more cautious investment outlook."

November 13 -

Municipals ignored USTs losses, leading to lower muni to UST ratios and adding to the better performance across the curve and credit spectrum.

November 12 -

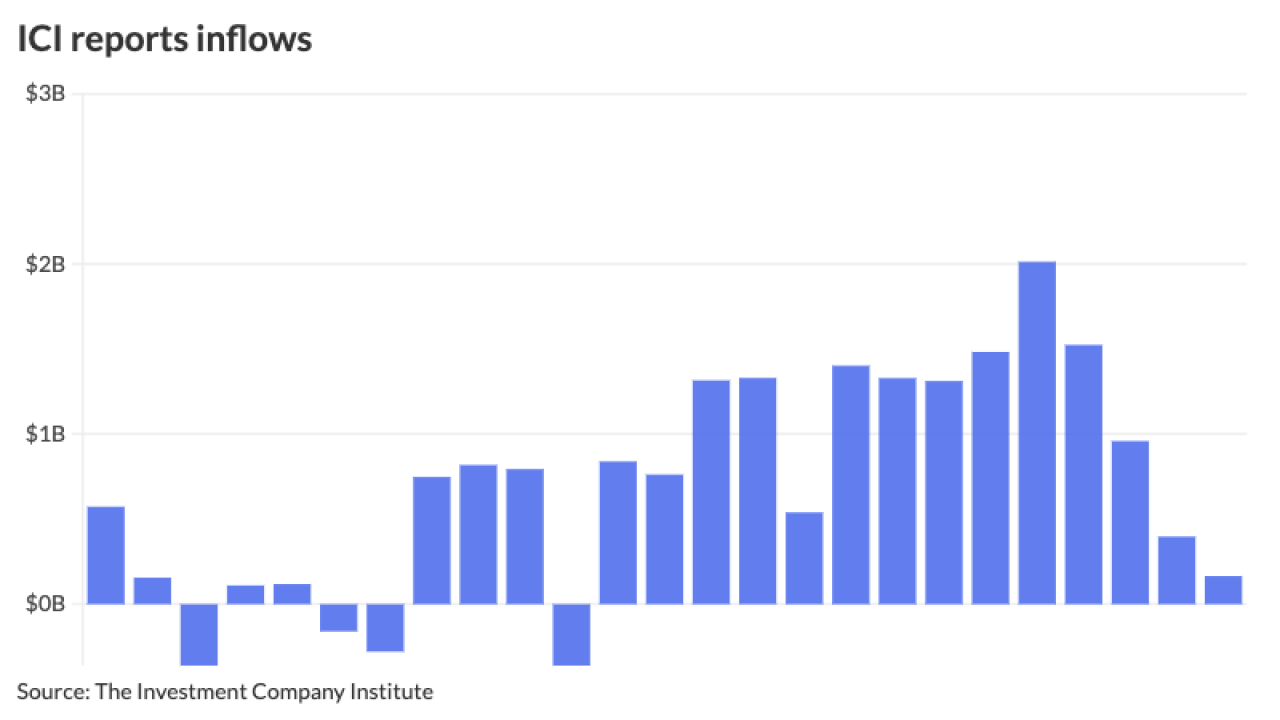

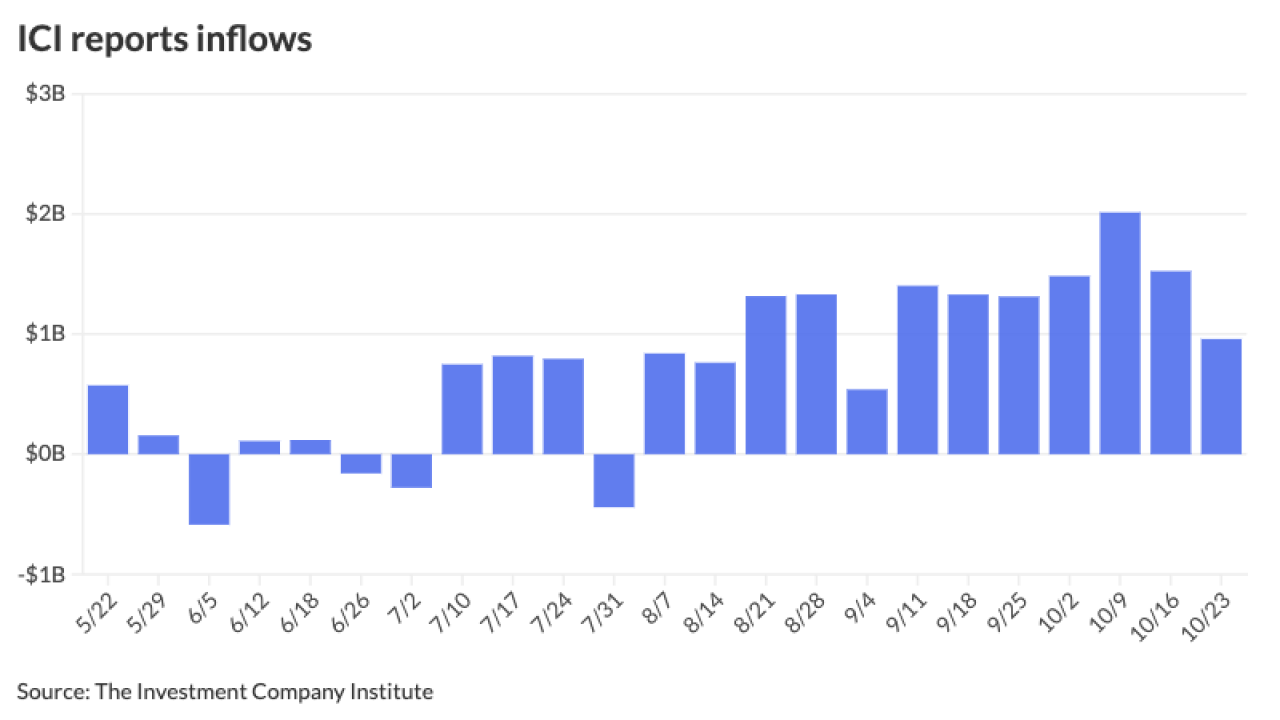

Tax-exempt money market funds reached a 2024 high of assets under management at $136.84 billion for the week ending Wednesday, according to the Investment Company Institute.

November 11 -

"A sharply lower new-issuance calendar, peak yields, large redemption money and mutual funds inflows are all positive performance factors for the market," BofA strategists said.

November 8 -

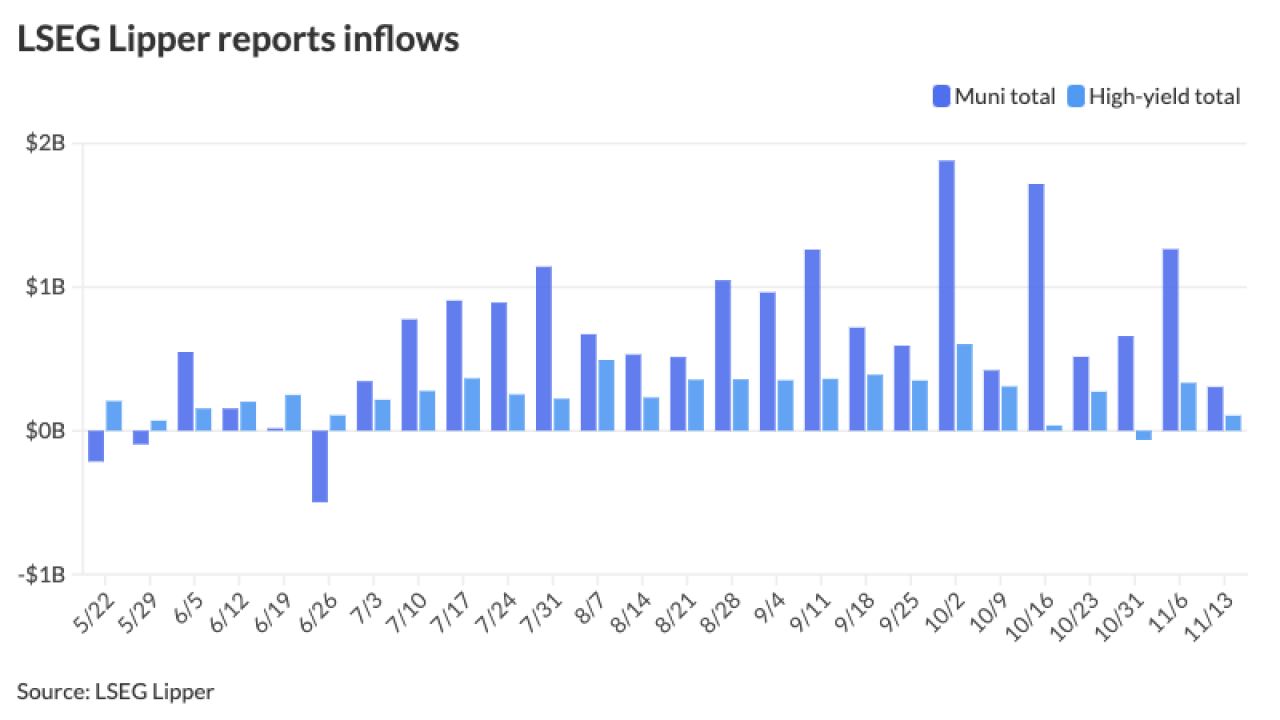

Despite the post-election selloff, inflows continued this week as LSEG Lipper reported investors added $1.263 billion to municipal bond mutual funds for the week ending Wednesday, compared to $658.5 million of inflows the prior week. High-yield inflows returned.

November 7 -

The red wave that took the presidency and the Senate — along with increased odds of a Republican victory in the House — was hanging heavily over fixed income markets Wednesday, with munis and UST yields rising up to 17 basis points, with the largest losses out long.

November 6 -

"If the GOP wins the House, the specter of risk to the municipal bond tax-exemption will increase," said Edwin Oswald, a tax partner at Orrick Herrington & Sutcliffe in Washington D.C.

November 6 -

Voters were asked to consider at least $148.912 billion of bonds this year in 908 ballot referendums, according to data compiled by Bond Buyer.

By Gary SiegelNovember 6 -

"A victory for former President Trump is likely to be viewed as ushering in a more inflationary environment, whereas a win for Vice President Harris will probably be seen as closer to the status quo," said Erik Weisman, chief economist and portfolio manager at MFS Investment Management."

November 5 -

Investors should "brace themselves" for further volatility, as uncertainty is likely to remain, said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

November 4 -

Issuance will "not completely disappear, but will adjust to its seasonal norm from the record-breaking pace of the past several months," said Barclays' Mikhail Foux.

November 1 -

The month's total is above the 10-year average of $40.288 billion. The market needs to see about $45 billion of issuance in November and December to hit an all-time record year.

October 31 -

Municipals largely stayed in their own lane Wednesday, digesting the large slate of new issues as supply dwindles heading into election week, with Bond Buyer 30-day visible supply falling to $5.56 billion.

October 30 -

Nearly $1 billion of outstanding BABs may still be called back before yearend.

October 30