Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

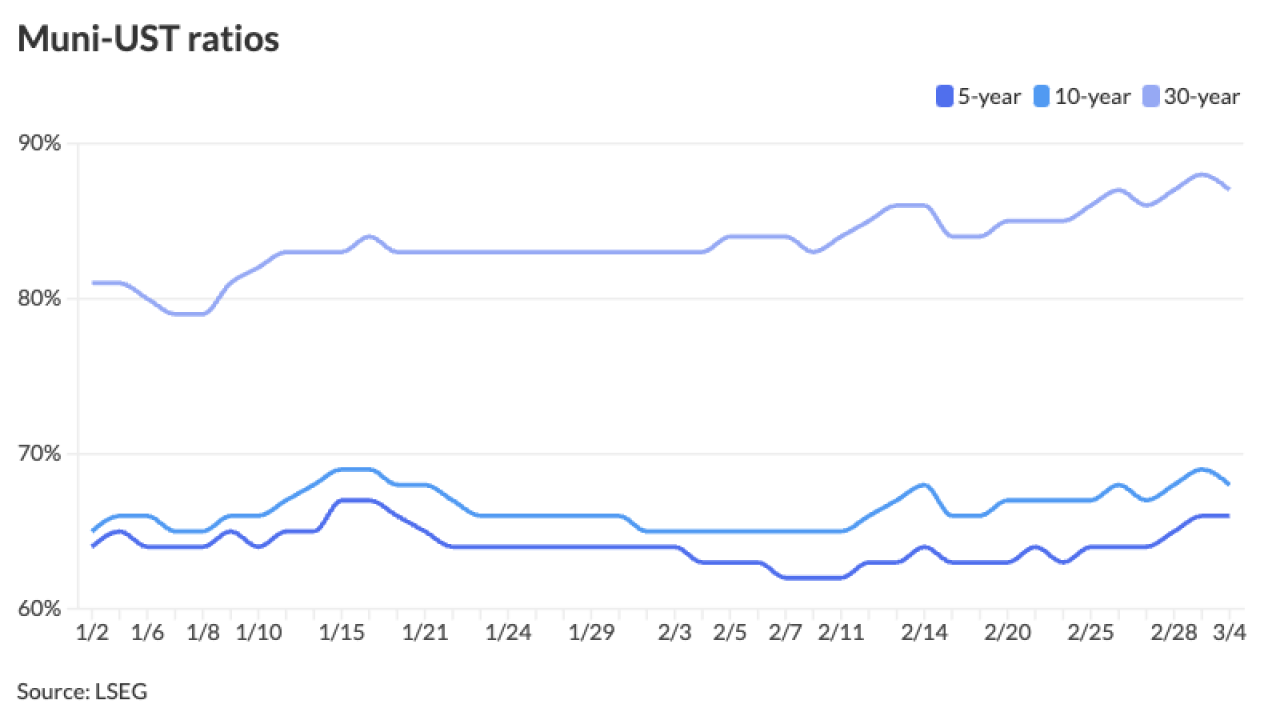

Short-end U.S. Treasuries rallied mid-morning, while UST yields were little changed out long, but ended the day weaker across most of the curve with the greatest losses out long. Munis were steady throughout the day.

March 4 -

"Apathy and caution" were the theme of the past week, said Birch Creek strategists.

March 3 -

New York City leads the negotiated calendar with $1.4 billion of GOs, followed by the Regents of the University of California with $1.2 billion of general revenue bonds.

February 28 -

February's volume was at $33.725 billion in 622 issues, up 1.6% from $33.191 billion in 614 issues in February 2024, according to LSEG data.

February 28 -

While UST yields rose up to five basis points out long Thursday, the current rally "that has taken the 30-year UST closer to where the 10-year yield traded a week ago has not impacted the same range in munis," said Kim Olsan, senior fixed income portfolio manager at NewSquare.

February 27 -

It has been a bit of a "heavy start" to the year for issuance, said Jeff Devine, a municipal research analyst at GW&K.

February 26 -

Muni prices continue to "show relative resilience" despite a nearly record pace of issuance, said Matt Fabian, a partner at Municipal Market Analytics.

February 25 -

The public finance industry is addressing cyber threats, which became clearer with last year's hack of White Lake Township's bond closing.

February 25 -

Last week, "there was no meaningful economic data to digest and yields were slightly lower," said Daryl Clements, a portfolio manager at AllianceBernstein.

February 24 -

The muni market produced $512.7 billion of debt issuance in 2024, up 33.1% from $385.1 billion in 2023, according to LSEG data. This surpasses the previous record of $484.6 billion in 2020 by almost $30 billion.

February 24