Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

Returns for the month currently stand at 0.64%, which have "pushed muni returns back into the green with year-to-date returns of 0.09%," said Jason Wong, vice president of municipals at AmeriVet Securities.

August 11 -

Issuance for the week of Aug. 11 remains elevated at an estimated at $10.713 billion, with $8.857 billion of negotiated deals and $1.857 billion of competitive deals on tap, according to LSEG.

By Alex WaltersAugust 8 -

While UST yields "consolidate" following Friday's massive rally after the July jobs report, muni yields remain resilient, according to Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

August 7 -

The municipal bond market is "doing pretty good for the moment," said Jeff Timlin, a managing partner at Sage Advisory.

August 6 -

The risk Brightline Florida poses to the rest of the high-yield market may manifest in fund flows, investors said.

August 6 -

Over the past three trading sessions, MMD yields have been bumped nine to 12 basis points, while UST yields have fallen over 20 basis points on the front of the curve.

August 5 -

"If the narrative takes hold that the Fed is behind the eight ball and will need to cut rates several times in the coming months to catch up to the realities of a weaker economy, we expect muni yields will drift lower alongside treasuries," Birch Creek strategists said.

August 4 -

Municipal yields fell four to seven basis points, depending on the curve, while UST yields rallied nine to 30 basis points, with the largest gains on the front end.

August 1 -

This is the fourth consecutive month where issuance has topped $50 billion.

August 1 -

Tax-exempt munis have underperformed year-to-date, said David Hammer, a managing director and portfolio manager at PIMCO.

July 31 -

The top two municipal bond insurers wrapped $22.121 billion in 1H 2025, up from $19.4 billion in 1H 2024, the data shows.

July 31 -

The FOMC held rates steady at the conclusion of its meeting Wednesday and offered no hints regarding a September move.

July 30 -

The muni market has "cheapened and steepened," which is a great opportunity for people still on the sidelines to get into the market again, said Jennifer Johnston, director of municipal bonds research at Franklin Templeton.

July 29 -

The asset class got a "much-needed boost" from inflows into muni mutual funds last week, said Birch Creek strategists.

July 28 -

Issuance for the week of July 28 is estimated at $11.035 billion, with $9.018 billion of negotiated deals and $2.017 billion of competitive deals on tap, according to LSEG.

July 25 -

Investors added $571.5 million from municipal bond mutual funds in the week ended Wednesday, following $224.6 million of outflows the prior week, according to LSEG Lipper data.

July 24 -

The fund's sell-off in June shows the challenges of accurate pricing in the high-yield muni market.

July 24 -

Year-to-date volume stands at $310.166 billion, up 17.4% from $264.151 billion at the same time last year, prompting several firms to revisit their supply projections for the year.

July 24 -

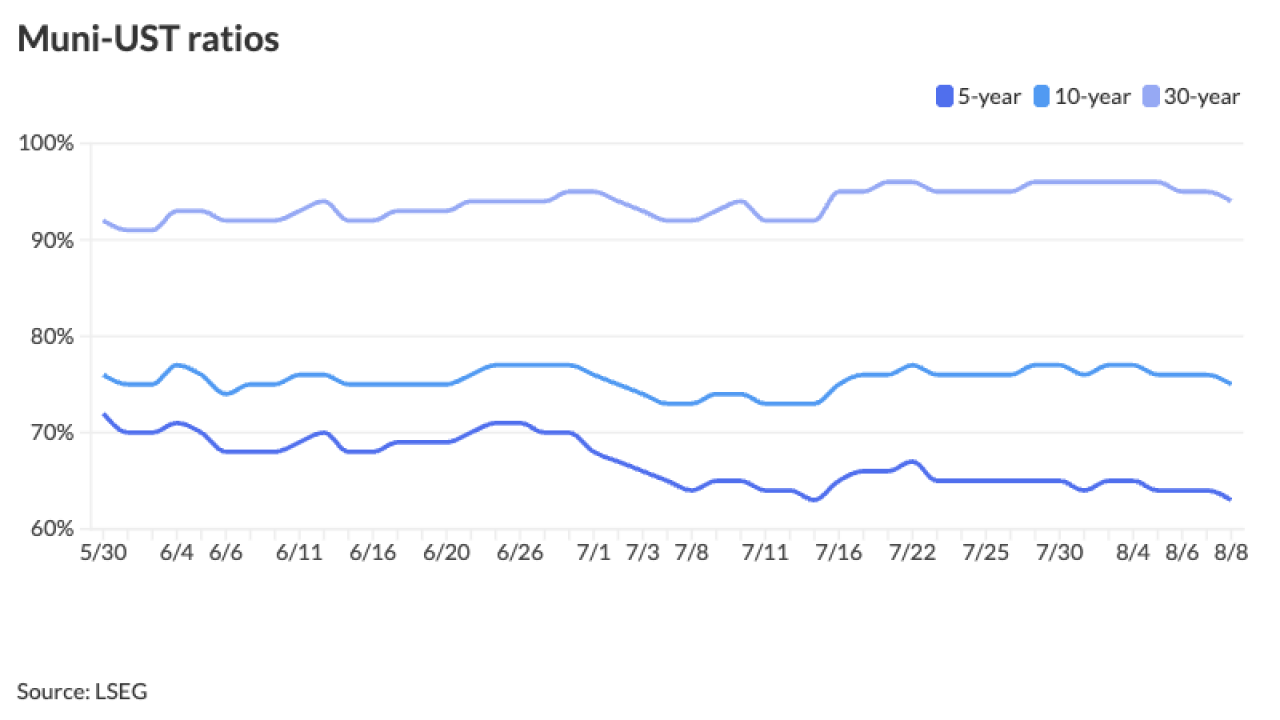

Longer-term munis have become more attractive, said Cooper Howard, a fixed income strategist at Charles Schwab.

July 23 -

There is a buyer base that is a little bit "skeptical" of longer maturities, but it's more of a retail response, said Adam Congdon, a director at Payden & Rygel.

July 22