Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

FOMC meeting minutes "clearly show why they didn't cut rates," said Northlight Asset Management Chief Investment Officer Chris Zaccarelli.

August 20 -

The muni bond market remains strong, supported by Treasury market strength, said Anders S. Persson, Nuveen's chief investment officer for global fixed income, and Daniel J. Close, Nuveen's head of municipals.

August 19 -

"If unfavorable economic numbers ... are released next month, we should expect a hold on any rate cuts and a possible rate hike to follow, putting a damper on any positive returns for the rest of the year," said Jason Wong, vice president of municipals at AmeriVet Securities.

August 18 -

Municipal bond insurance volume grew 12.6% in the first half of 2025 year-over-year, according to LSEG data.

August 18 -

Rising underwriting spreads are a "flashing neon sign that the muni market is still nursing the hangover from higher rates and choppy flows," said James Pruskowski, an investor and market strategist.

August 18 -

The market saw elevated issuance, with an average of $10 billion to $12 billion of supply per week.

August 18 -

Issuance for the week of Aug. 18 remains elevated at an estimated at $6.166 billion, with $5.065 billion of negotiated deals and $1.101 billion of competitive deals on tap, according to LSEG.

August 15 -

The latest inflation report — the producer price index — threw a monkey wrench into expectations for a big rate cut next month, according to some economists, may put into question any easing in September.

August 14 -

Muni performance is likely to recover during the second half of the year, said Cooper Howard, a fixed income strategist at Charles Schwab.

August 13 -

"The combination of stronger core and softer headline readings has left some traders struggling for direction," said Daniela Sabin Hathorn, senior market analyst at Capital.com. "There is a reason to be both bullish and bearish depending on which CPI reading you wish to focus on."

August 12 -

Returns for the month currently stand at 0.64%, which have "pushed muni returns back into the green with year-to-date returns of 0.09%," said Jason Wong, vice president of municipals at AmeriVet Securities.

August 11 -

Issuance for the week of Aug. 11 remains elevated at an estimated at $10.713 billion, with $8.857 billion of negotiated deals and $1.857 billion of competitive deals on tap, according to LSEG.

By Alex WaltersAugust 8 -

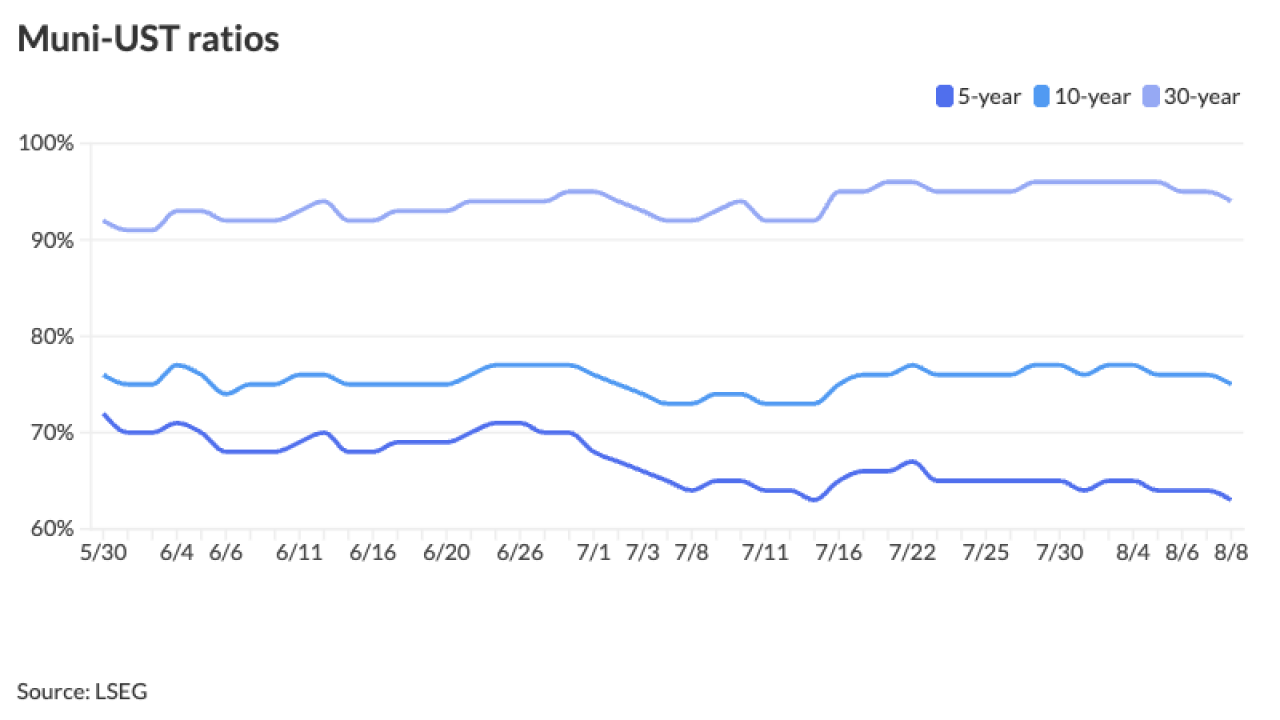

While UST yields "consolidate" following Friday's massive rally after the July jobs report, muni yields remain resilient, according to Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

August 7 -

The municipal bond market is "doing pretty good for the moment," said Jeff Timlin, a managing partner at Sage Advisory.

August 6 -

The risk Brightline Florida poses to the rest of the high-yield market may manifest in fund flows, investors said.

August 6 -

Over the past three trading sessions, MMD yields have been bumped nine to 12 basis points, while UST yields have fallen over 20 basis points on the front of the curve.

August 5 -

"If the narrative takes hold that the Fed is behind the eight ball and will need to cut rates several times in the coming months to catch up to the realities of a weaker economy, we expect muni yields will drift lower alongside treasuries," Birch Creek strategists said.

August 4 -

Municipal yields fell four to seven basis points, depending on the curve, while UST yields rallied nine to 30 basis points, with the largest gains on the front end.

August 1 -

This is the fourth consecutive month where issuance has topped $50 billion.

August 1 -

Tax-exempt munis have underperformed year-to-date, said David Hammer, a managing director and portfolio manager at PIMCO.

July 31