Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

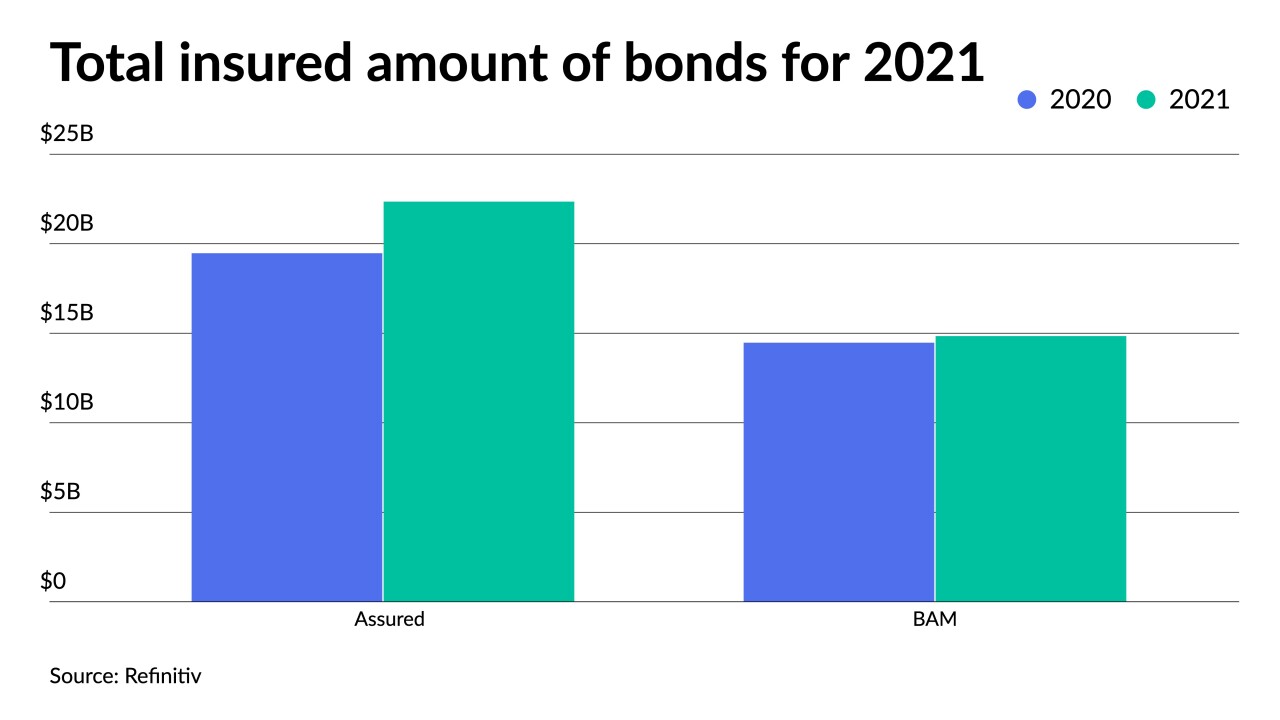

As issuance hit $480.03 billion in 2021, the insurance industry wrapped 7.8%, up slightly from 7.1% in 2020. Deals with insurance totaled $37.522 billion, more than the $34.428 billion in 2020, according to Refinitiv data.

February 22 -

2021 comes in just shy of the all-time record in 2020, as the muni industry showed its resilience in the second year of the pandemic.

February 22 -

The new-issue calendar for the holiday-shortened week is $4.98 billion, with $3.633 billion of negotiated deals and $1.347 billion of competitive loans.

February 18 -

Refinitiv Lipper reported outflows after inflows of $216 million the previous week.

February 17 -

Rates could go up faster than they did in 2015 if predictions for the economy hold, minutes from the FOMC said, but the release offered no hints as to whether a 50 basis point liftoff would be considered.

February 16 -

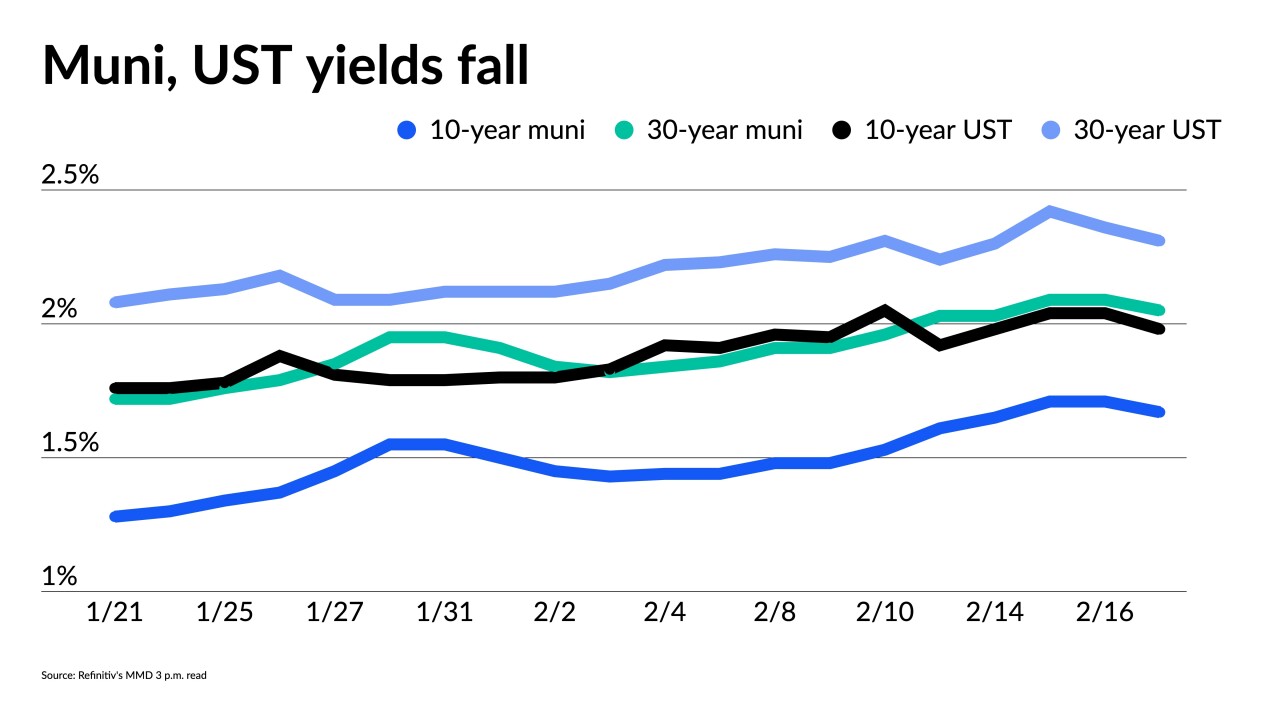

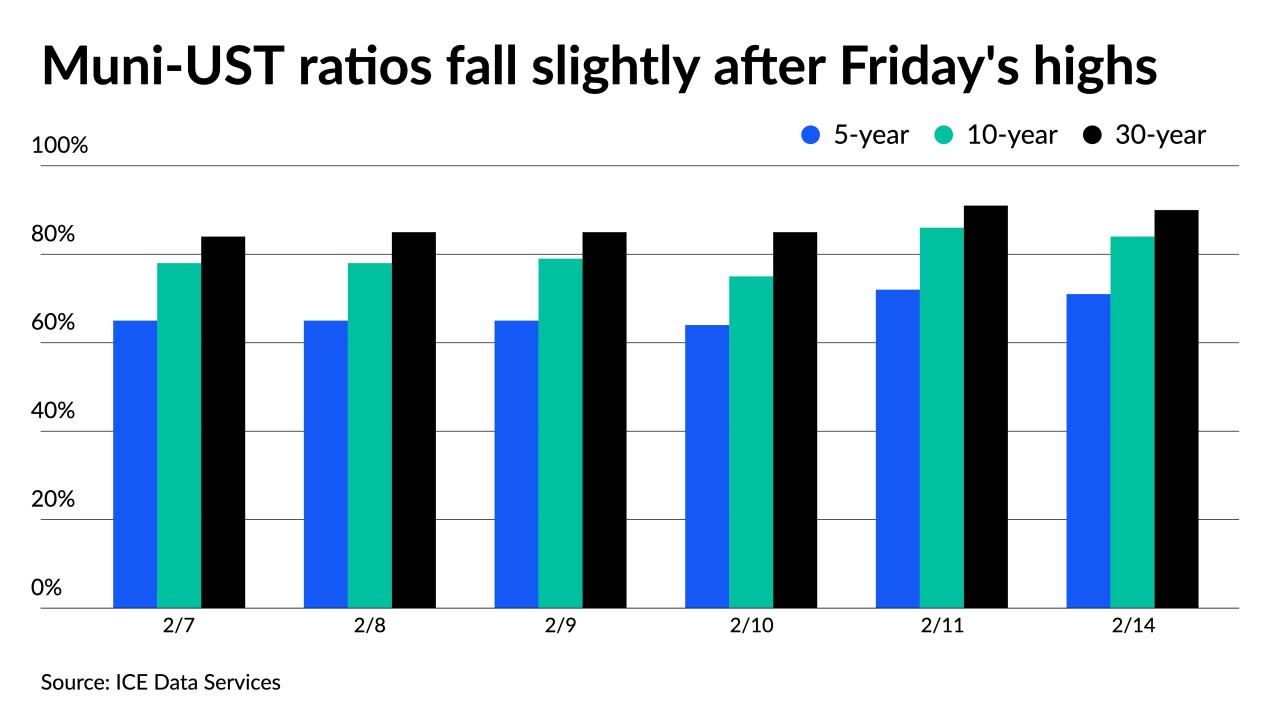

Municipal bonds' relative value has increased dramatically as rates have risen and credit fundamentals have improved, with municipal-to-Treasury ratios now on par with their five-year averages.

February 15 -

Inflation remains under market scrutiny, with Monday’s data suggesting consumers expect price pressures to cool later this year.

February 14 -

Municipal yields rose up to 10 basis points on the short end, playing catch up to the volatility of Treasuries' moves on Thursday. Rising UST rates will inevitably be more significant for munis until they settle into more stable levels.

February 11 -

Refinitiv Lipper reported the first inflows into municipal bond mutual funds at $216 million after three weeks of large outflows while high-yield saw small outflows. Exchange-traded funds reported $755 million of inflows.

By Lynne FunkFebruary 10 -

Markets were somewhat comforted by Federal Reserve Bank of Atlanta President Raphael Bostic’s comments suggesting the Fed will not be as aggressive as the markets suspect.

February 9