Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

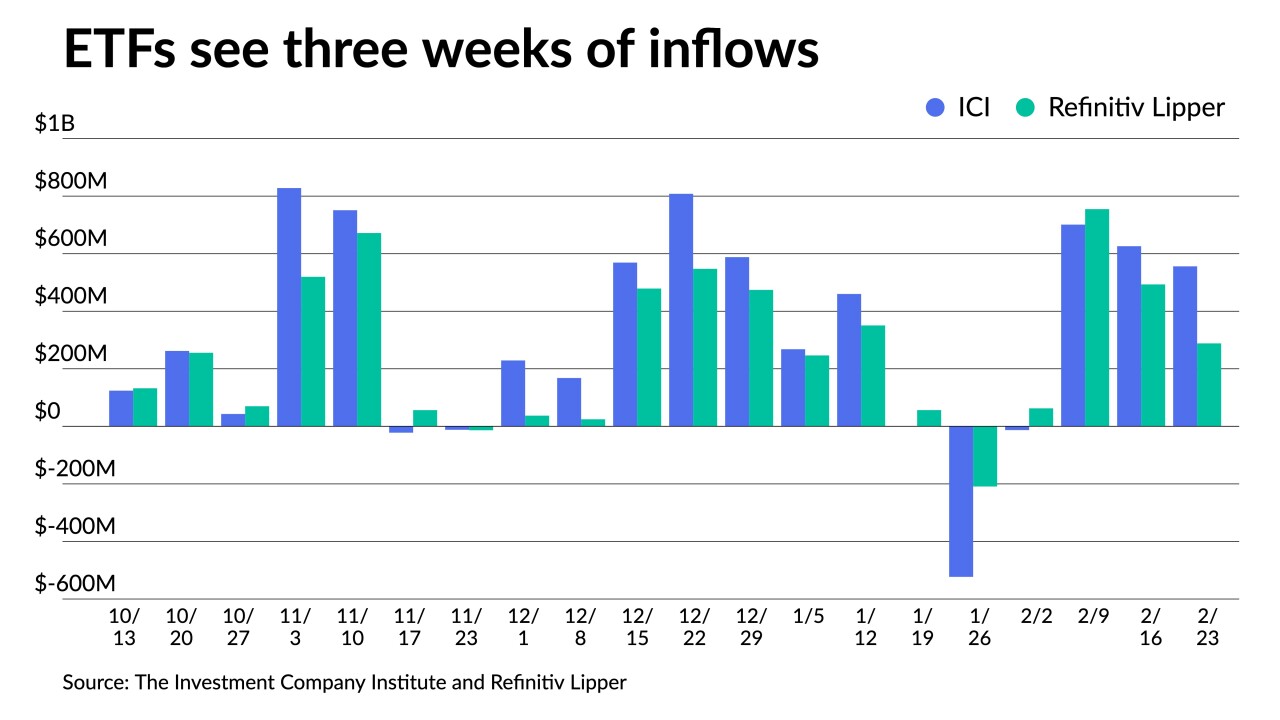

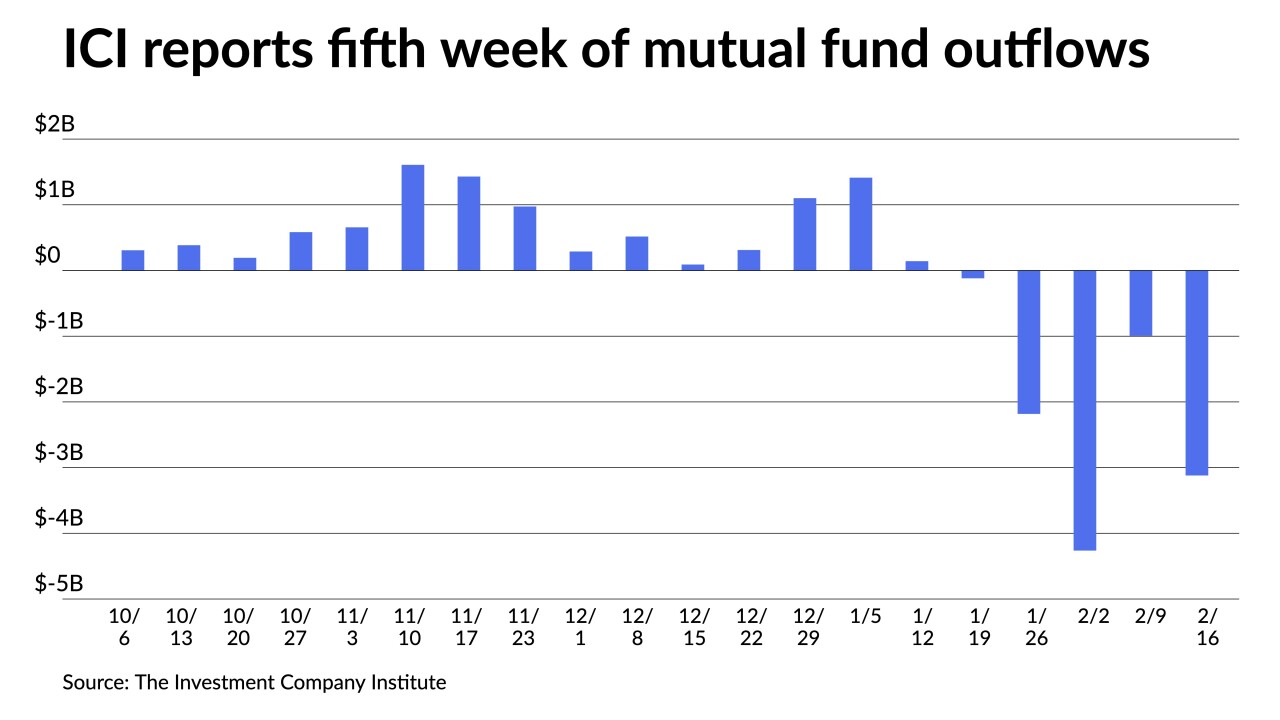

ETFs pulled in just more than $2 billion in February while muni mutual funds saw $8.5 billion of outflows.

March 4 -

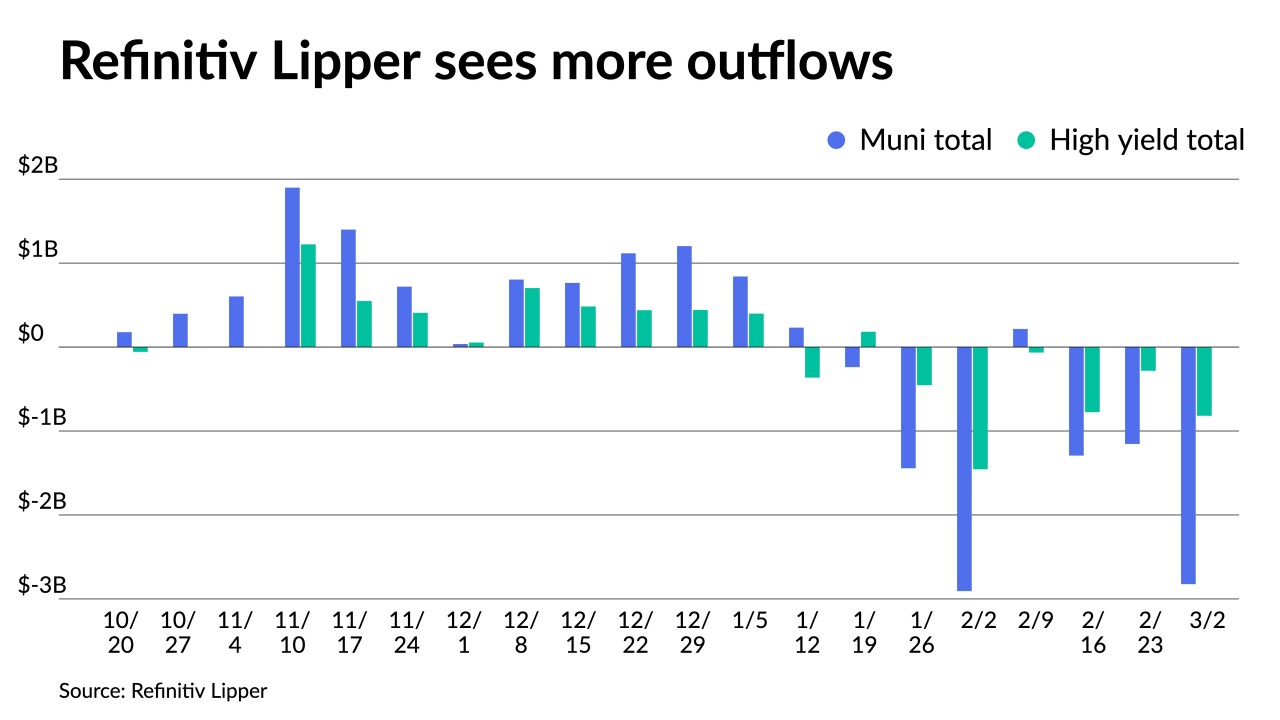

Ongoing turmoil in the Ukraine is roiling markets, municipals included. Refinitiv Lipper reported more outflows, with high-yield seeing $818.218 million pulled out in the latest week.

March 3 -

In a Bond Buyer survey, 57% of participants believe issuance will be less than $475 billion. Additionally, 47% said ESG would have the greatest impact on the public finance industry in 2022.

March 2 -

The Russian invasion of Ukraine could slow interest rate hikes and has led the market to pull back on the chances of a 50-basis-point liftoff.

March 1 -

All markets, but particularly municipals, are in uncharted territory once again, with volatility amplified by the crisis in Ukraine and a still somewhat uncertain path for the Federal Reserve and inflation.

By Gary SiegelFebruary 28 -

February volume was $26.481 billion in 594 deals versus $37.052 billion in 981 issues a year earlier, bringing total volume for the first two months of the year to $51.426 billion, or 20% less than 2021.

February 28 -

The new-issue calendar is $5.45 billion while 30-day visible supply sits at $11.14 billion. The largest deal of the week comes from the New York City Municipal Water Finance Authority with $793.83 million.

February 25 -

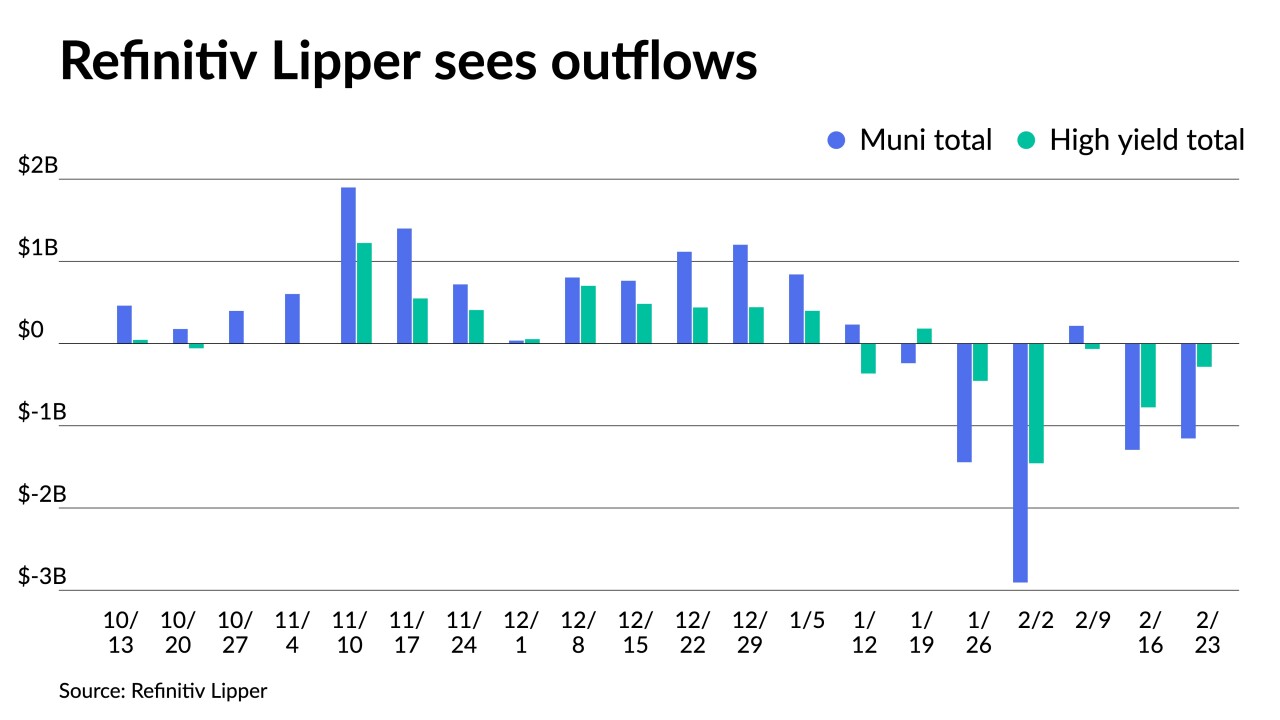

Investors yanked $1.154 billion out of municipal bond mutual funds in the latest week, Refinitiv Lipper reported.

February 24 -

The Investment Company Institute on Wednesday reported $3.120 billion of outflows in the week ending Feb. 16, up from $993 million of outflows in the previous week.

February 23 -

Between the long holiday weekend and investors trying to absorb the Russia-Ukraine developments, it was a slow start to the week in the municipal market.

February 22