Gary Siegel is a journalist with more than 35 years of experience. He started his professional career at the Long Island Journal newspapers based in Long Beach, N.Y., working his way up from reporter to Assistant Managing Editor. Siegel also worked for Prentice-Hall in Paramus, N.J., covering human resources issues. Siegel has been at The Bond Buyer since 1989, currently covering economic indicators and the Federal Reserve system.

-

Pending home sales rebounded 4.6% to an index reading of 103.2 in January, after a revised 2.3% decline to 98.7 in December.

By Gary SiegelFebruary 27 -

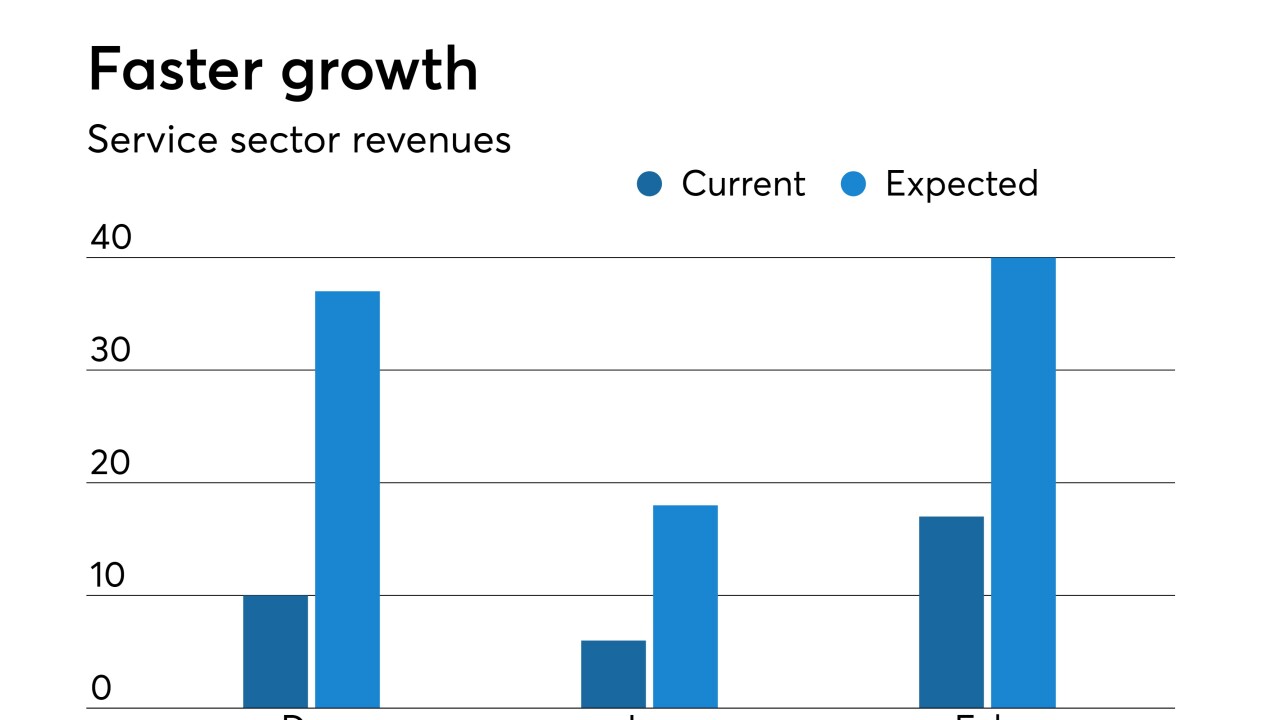

Texas service sector activity “accelerated in February,” according to business executives responding to the Federal Reserve Bank of Dallas' Texas Service Sector Outlook Survey, as the revenue index climbed to 19.2, from 14.9.

By Gary SiegelFebruary 26 -

The service sector improved in February, according to the Federal Reserve Bank of Richmond service-sector activity survey, released Tuesday.

By Gary SiegelFebruary 26 -

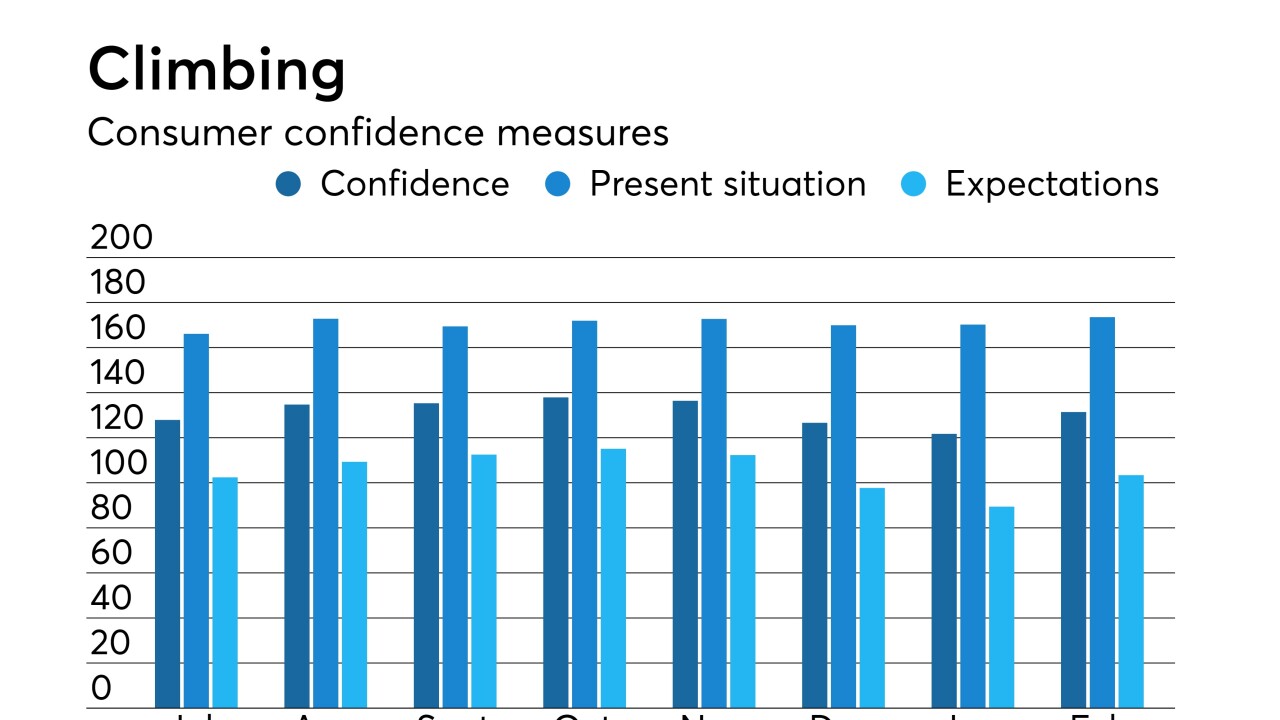

The consumer confidence index increased to 131.4 in February from an upwardly revised 121.7 last month.

By Gary SiegelFebruary 26 -

Manufacturing growth in the central Atlantic region “strengthened in February,” according to the monthly business activity survey conducted by the Federal Reserve Bank of Richmond, as the manufacturing index climbed to positive 16 from negative 2.

By Gary SiegelFebruary 26 -

The region's services sector accelerated, as the general business conditions index rebounded to 10.0 in February from 1.0 in January.

By Gary SiegelFebruary 26 -

Texas factory activity growth, as measured by the production index, “continued to expand in February,” but at a slower pace than in January.

By Gary SiegelFebruary 25 -

The Chicago Fed National Activity Index for January fell to negative 0.43 from a downwardly revised positive 0.05 in December.

By Gary SiegelFebruary 25 -

Existing home sales were down 1.2% to a seasonally adjusted 4.94 million-unit rate in January.

By Gary SiegelFebruary 21 -

The composite of the Leading Economic Index was off 0.1% in January following a revised flat reading in December, the Conference Board said Thursday.

By Gary SiegelFebruary 21 -

The Federal Reserve Bank of Philadelphia Report on Business general business conditions index dropped to negative 4.1 from positive 17.0.

By Gary SiegelFebruary 21 -

Builders’ confidence in the market for new single-family homes grew as the National Association of Home Builders' housing market index climbed to 62 in February from 58 in January.

By Gary SiegelFebruary 19 -

Mark Heppenstall, CIO at Penn Mutual Asset Management, discusses the Fed’s balance sheet normalization and whether its newfound patience can keep the economy growing. Gary Siegel hosts.

By Gary SiegelFebruary 19 -

With monetary policy near the bottom of the range of Federal Open Market Committee estimates of its longer-run neutral rate, communications will need to change, Federal Reserve Bank of Cleveland President Loretta Mester said Tuesday.

By Gary SiegelFebruary 19 -

New York service sector activity “grew at a fairly solid clip” in February, according to the Federal Reserve Bank of New York's Business Leaders Survey, released Tuesday.

By Gary SiegelFebruary 19 -

The federal government ran a $13.5 billion deficit in December, the Treasury Department reported Wednesday.

By Gary SiegelFebruary 13 -

If the economy moves as expected, Federal Reserve Bank of Philadelphia President Patrick Harker expects one rate hike this year and one next year.

By Gary SiegelFebruary 13 -

Labor market “activity declined modestly and momentum remained high in January,” as the Federal Reserve Bank of Kansas City Labor Market Conditions Indicators (LMCI) slid to 0.97 from 1.06 in December, the Bank said Wednesday.

By Gary SiegelFebruary 13 -

With inflation expectations eclipsing economic slack in driving inflation, policymakers will need to keep expectations in line to avoid “large swings in inflation,” according to researchers at the Federal Reserve Bank of San Francisco.

By Gary SiegelFebruary 11 -

Consumers’ inflation expectations held, while respondents showed more pessimism about the economy.

By Gary SiegelFebruary 11