Gary Siegel is a journalist with more than 35 years of experience. He started his professional career at the Long Island Journal newspapers based in Long Beach, N.Y., working his way up from reporter to Assistant Managing Editor. Siegel also worked for Prentice-Hall in Paramus, N.J., covering human resources issues. Siegel has been at The Bond Buyer since 1989, currently covering economic indicators and the Federal Reserve system.

-

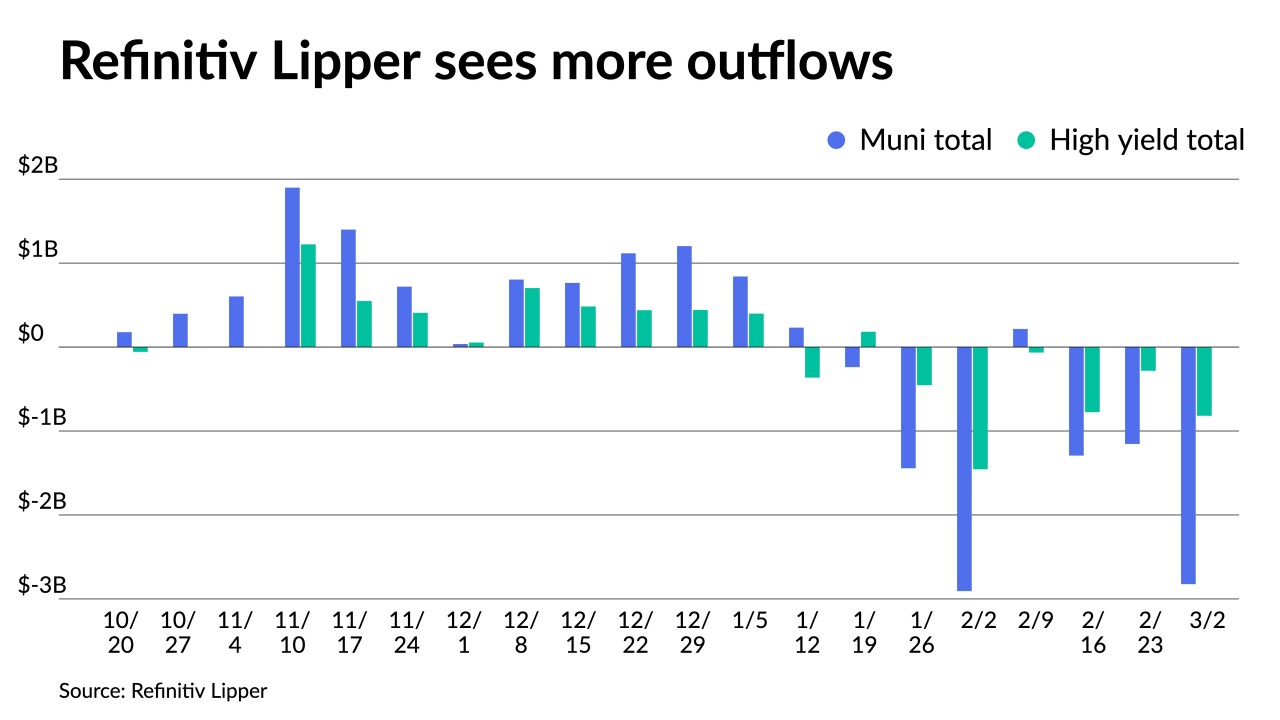

Ongoing turmoil in the Ukraine is roiling markets, municipals included. Refinitiv Lipper reported more outflows, with high-yield seeing $818.218 million pulled out in the latest week.

March 3 -

The Investment Company Institute on Wednesday reported $2.637 billion of outflows in the week ending Feb. 23, down from $3.120 billion of outflows in the previous week.

By Lynne FunkMarch 2 -

The Russian invasion of Ukraine could slow interest rate hikes and has led the market to pull back on the chances of a 50-basis-point liftoff.

March 1 -

All markets, but particularly municipals, are in uncharted territory once again, with volatility amplified by the crisis in Ukraine and a still somewhat uncertain path for the Federal Reserve and inflation.

By Gary SiegelFebruary 28 -

Between the long holiday weekend and investors trying to absorb the Russia-Ukraine developments, it was a slow start to the week in the municipal market.

February 22 -

The new-issue calendar for the holiday-shortened week is $4.98 billion, with $3.633 billion of negotiated deals and $1.347 billion of competitive loans.

February 18 -

Refinitiv Lipper reported outflows after inflows of $216 million the previous week.

February 17 -

Rates could go up faster than they did in 2015 if predictions for the economy hold, minutes from the FOMC said, but the release offered no hints as to whether a 50 basis point liftoff would be considered.

February 16 -

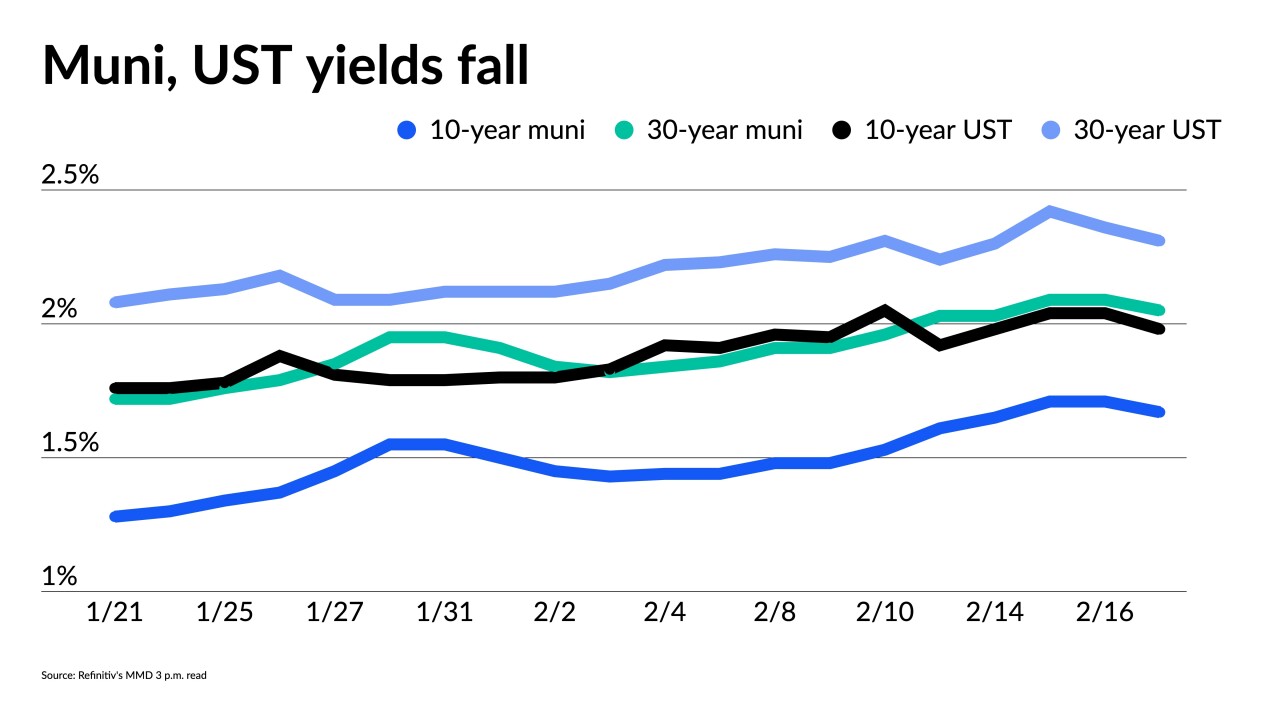

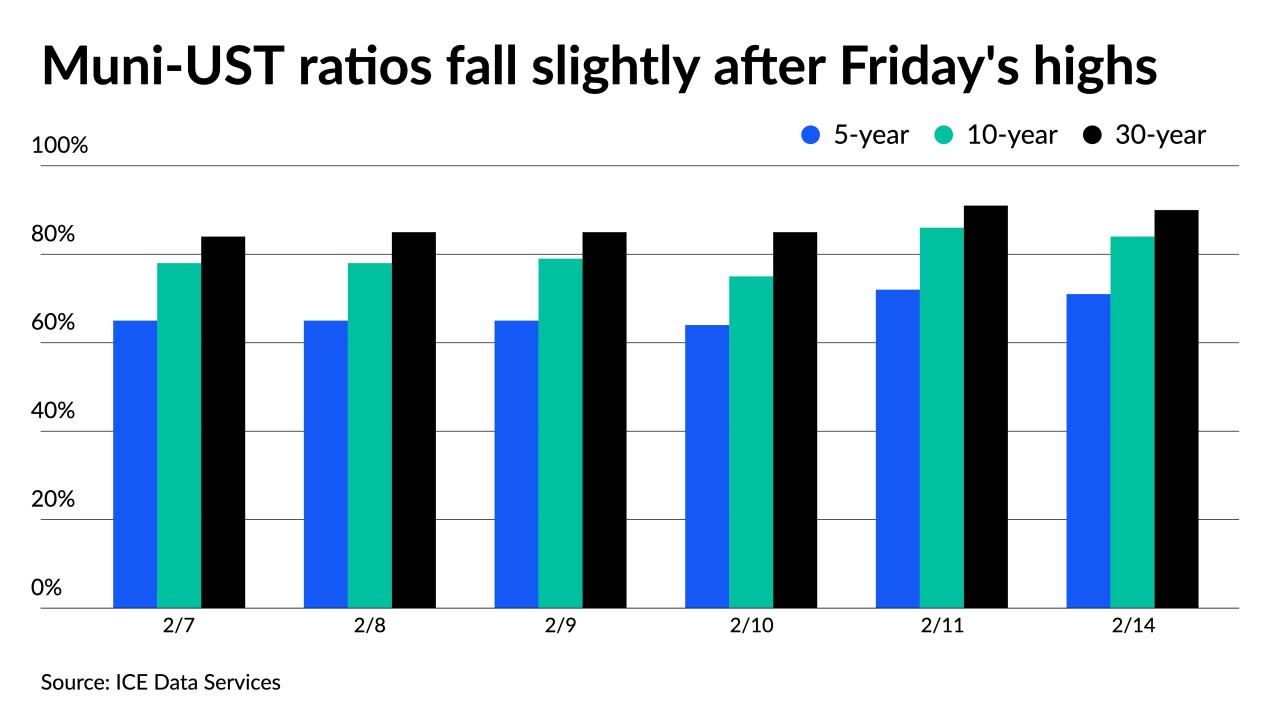

Municipal bonds' relative value has increased dramatically as rates have risen and credit fundamentals have improved, with municipal-to-Treasury ratios now on par with their five-year averages.

February 15 -

Inflation remains under market scrutiny, with Monday’s data suggesting consumers expect price pressures to cool later this year.

February 14