Gary Siegel is a journalist with more than 35 years of experience. He started his professional career at the Long Island Journal newspapers based in Long Beach, N.Y., working his way up from reporter to Assistant Managing Editor. Siegel also worked for Prentice-Hall in Paramus, N.J., covering human resources issues. Siegel has been at The Bond Buyer since 1989, currently covering economic indicators and the Federal Reserve system.

-

Municipal yields rose up to 10 basis points on the short end, playing catch up to the volatility of Treasuries' moves on Thursday. Rising UST rates will inevitably be more significant for munis until they settle into more stable levels.

February 11 -

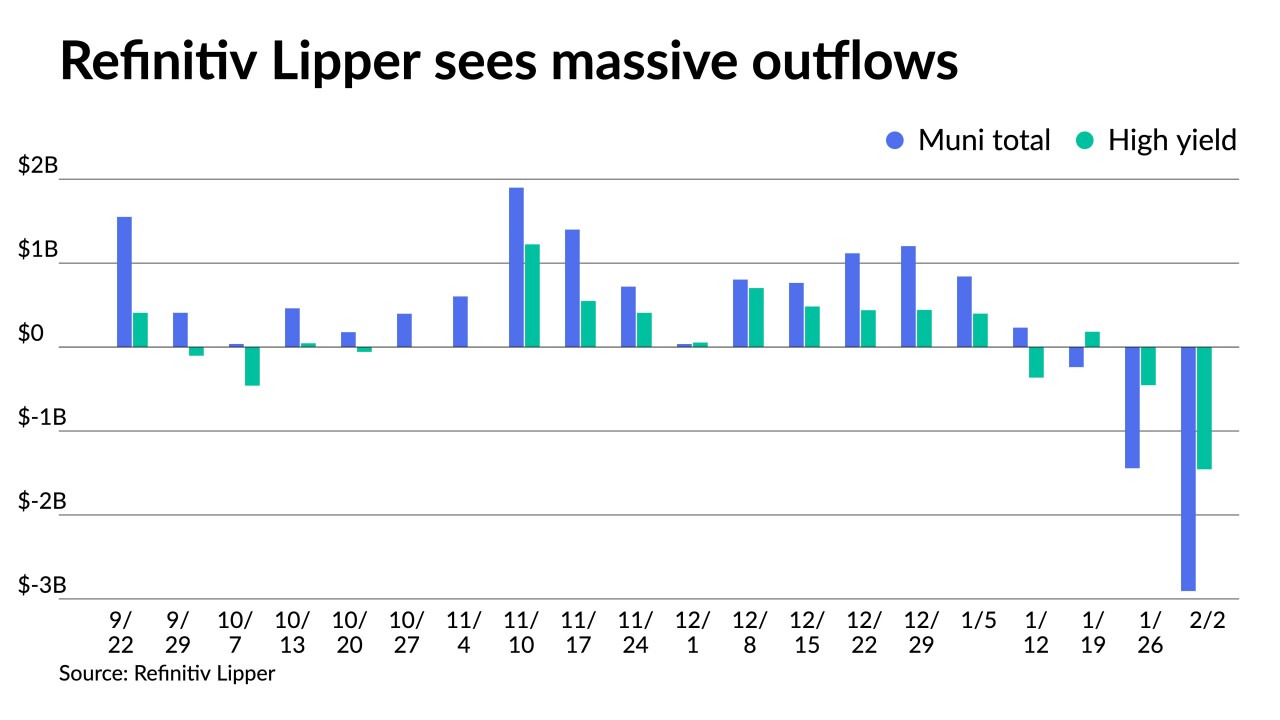

Refinitiv Lipper reported the first inflows into municipal bond mutual funds at $216 million after three weeks of large outflows while high-yield saw small outflows. Exchange-traded funds reported $755 million of inflows.

By Lynne FunkFebruary 10 -

Markets were somewhat comforted by Federal Reserve Bank of Atlanta President Raphael Bostic’s comments suggesting the Fed will not be as aggressive as the markets suspect.

February 9 -

The Federal Reserve Bank of Boston announced Susan Collins, provost and executive vice president for academic affairs at the University of Michigan, will become its next president effective July 1.

By Gary SiegelFebruary 9 -

The state of Washington sold $743 million of general obligation bonds in the competitive market at similar spreads to its November sale while some issuers have moved to the day-to-day calendar.

February 8 -

Washington will bring $742 million of general obligation bonds in competitive sales Tuesday, providing guidance for triple-A benchmark yields.

February 7 -

Municipal to UST ratios hit highs earlier in the week, creating entry points for buyers to return to the market even as ratios fell on the week. The primary will see a smaller calendar at $5.4 billion.

February 4 -

Municipals were stronger again on the day, though, and new-issues were repriced to lower yields.

February 3 -

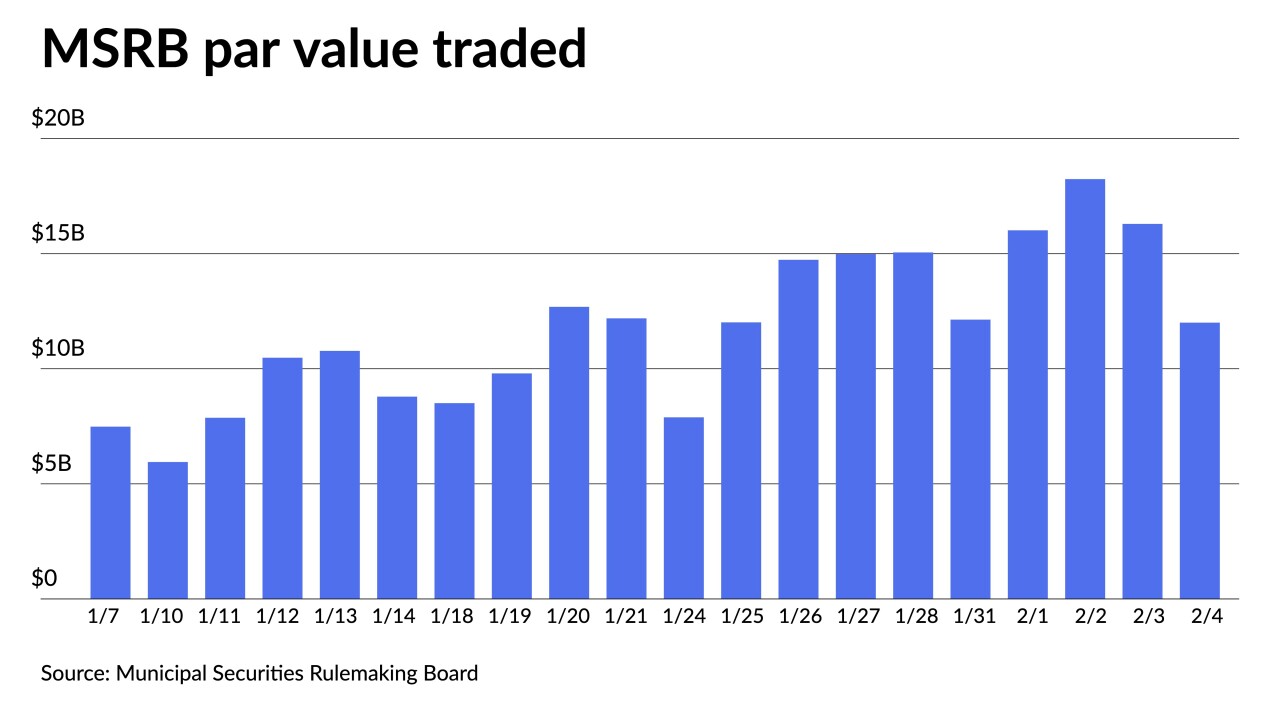

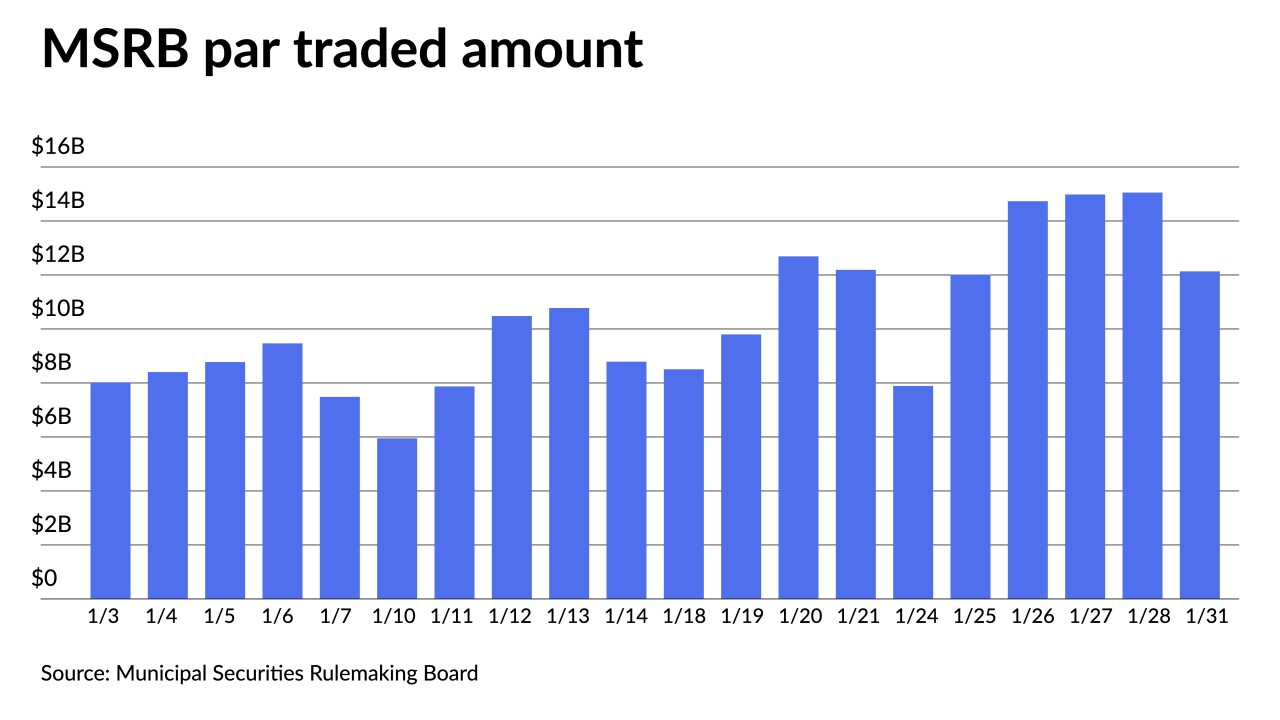

Buyers appeared to return to the market the past two sessions after the January correction moved yields and ratios higher. Secondary trading was up again on Wednesday and new deals were well-received.

February 2 -

Triple-A benchmark curves were bumped two to five basis points outside of five years as markets calmed to start February.

February 1