Gary Siegel is a journalist with more than 35 years of experience. He started his professional career at the Long Island Journal newspapers based in Long Beach, N.Y., working his way up from reporter to Assistant Managing Editor. Siegel also worked for Prentice-Hall in Paramus, N.J., covering human resources issues. Siegel has been at The Bond Buyer since 1989, currently covering economic indicators and the Federal Reserve system.

-

Market volatility has led to munis seeing the worst performance to start the year since 2018 and the biggest monthly losses since March 2020.

January 31 -

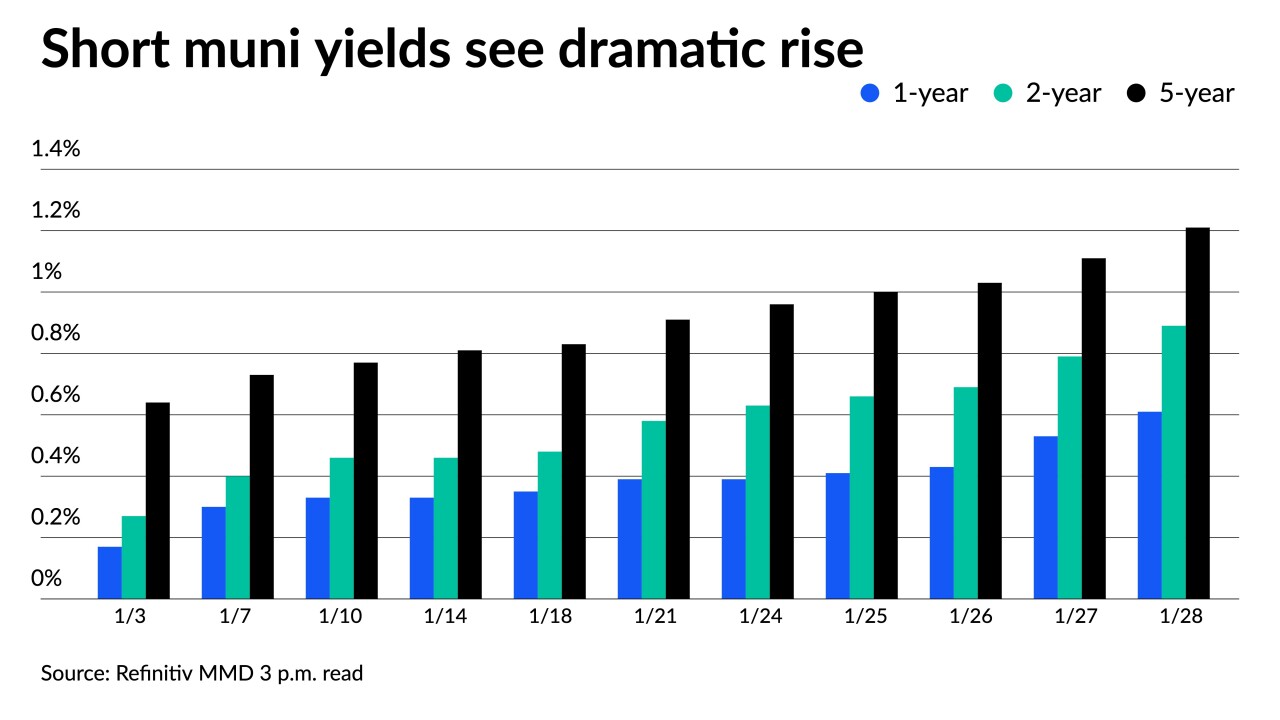

Short-end muni yields have risen more than 30 basis points on some triple-A scales over the past five trading sessions.

January 28 -

Returns are deep in the red with the Bloomberg Municipal Index at negative 1.85%, while high-yield sits at negative 1.81%.

January 27 -

The statement offered no surprises, but Fed Chair jerome Powell's refusal to denounce more hawkish scenarios hurt market sentiment.

January 26 -

Triple-A benchmarks were cut two to six basis points across the curve with the largest moves concentrated again on bonds inside 10 years, underperforming Treasuries once again.

By Lynne FunkJanuary 25 -

Munis are expected to underperform for another few weeks as markets remain volatile and investors reevaluate allocations.

By Lynne FunkJanuary 24 -

The combination of steady supply, heavy secondary selling and inconsistent demand have moved yields to their highest levels since May 2020.

January 21 -

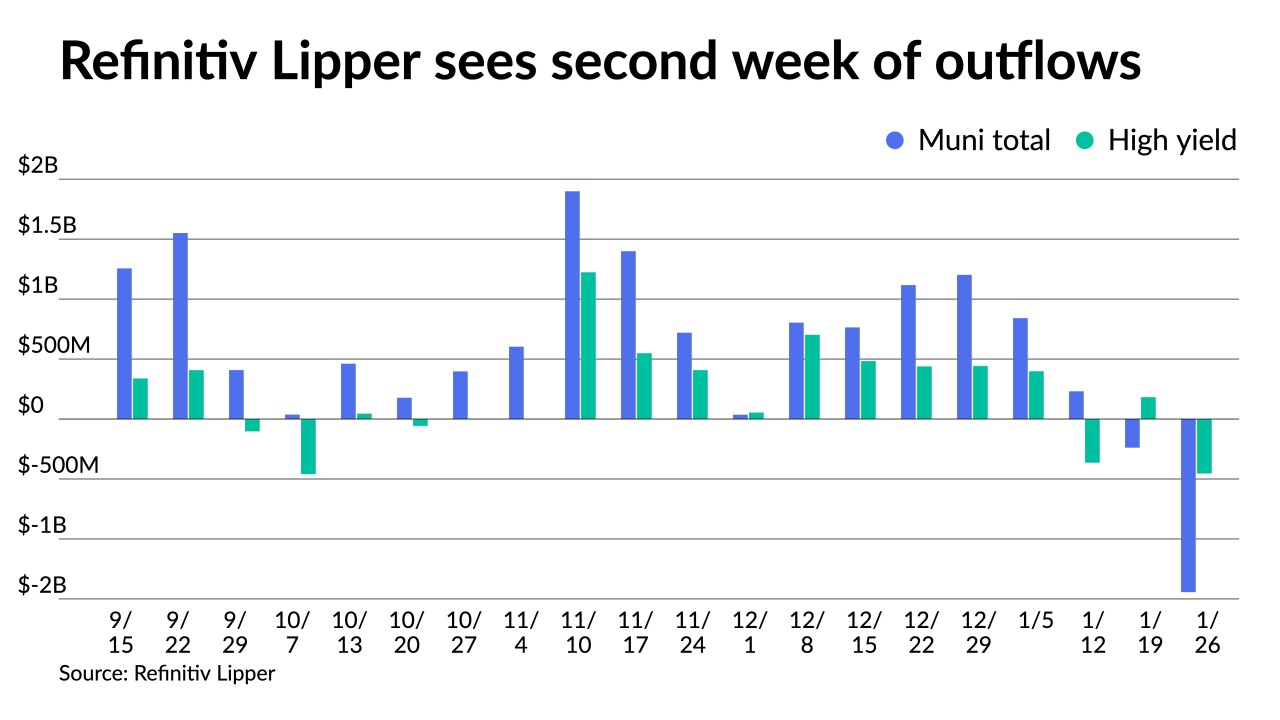

Refinitiv Lipper reported $238.926 million of outflows, but $182.035 million of inflows to high-yield, reversing last week's outflows. New-issues faced concessions.

By Lynne FunkJanuary 20 -

The Investment Company Institute reported a large drop of inflows into municipal bond mutual funds at $142 million in the week ending Jan. 12, down from $1.413 billion in the previous week.

January 19 -

The 2-, 5- and 10-year UST is higher than before the pandemic began as investors factor in a rate hike as soon as March.

By Lynne FunkJanuary 18