Chip Barnett is a journalist with almost 50 years of professional experience. He started his career at the Gannett Newspapers in Westchester County, N.Y., working his way up from back-shop compositor to Senior News Editor. Barnett later worked for Thomson Reuters in Manhattan, covering state and local government finance as a Reporter and later Executive Editor for TM3.com and as Editor in Charge of Municipal Finance for Reuters News. Later, he was the Editor of Municipal Finance Today at SourceMedia. Barnett has also worked for DebtWire/Municipals and has written about commercial real estate in South Florida and the Midwest for both The Real Deal and Globe Street. Barnett is currently a Reporter at The Bond Buyer.

-

Moody's Investors Service said the upgrade reflected the university's robust, sustainable operating margins supported by consistent growth in tuition revenue.

By Chip BarnettFebruary 23 -

Overall volume in the Southeast rose 1.8% last year even as taxable issuance plunged and refunding deals shriveled up.

By Chip BarnettFebruary 23 -

Credit strengths include strong market position and service area economic fundamentals and an expected continued strong finance performance.

By Chip BarnettFebruary 17 -

To help the city recover faster, former Lt. Gov. Richard Ravitch has proposed a dedicated state-approved revenue stream to provide additional funding for the transit system.

By Chip BarnettFebruary 17 -

Graceland drew on reserves to cover the Jan. 1 payment on two bond series and three other series were unable to make their interest payments.

By Chip BarnettFebruary 16 -

The proposed issuance would refinance some of the New York City Municipal Water Finance Authority’s outstanding bonds.

By Chip BarnettFebruary 15 -

Despite competitive and demographic headwinds, Villanova's strong academic reputation as a selective private university will support student demand, Moody’s said.

By Chip BarnettFebruary 14 -

The Volcker Alliance looks at the state’s outstanding municipal bonds and $83 billion in other obligations and suggests improved transparency and oversight.

By Chip BarnettFebruary 11 -

Gross savings from the transaction is expected to be $378 million, or about $11 million a year, which would result in around $250 million in net present value debt service savings.

By Chip BarnettFebruary 9 -

S&P Global Ratings has revised the outlook to positive from stable on the Bluegrass State and affirmed the A issuer credit rating.

By Chip BarnettFebruary 9 -

Bonds defeased include state GOs and securities from the New Jersey Building Authority and the Economic Development Authority.

By Chip BarnettFebruary 4 -

“We are working hard to secure the city’s financial health now and for future generations,” said Scranton Mayor Paige Cognetti.

By Chip BarnettFebruary 4 -

S&P said the action reflects the Orlando International Airport's financial resilience during the pandemic and its strong passenger recovery trends.

By Chip BarnettFebruary 2 -

Paul Daley, managing director at BondWave, talks about fixed-income trading in 2021 and looks ahead to what may be in store for trading in municipal bonds this year. Chip Barnett hosts. (12 minutes)

By Chip BarnettFebruary 1 -

“The firm was founded on the principle that there should be a high performing investment banking firm wholly owned by women and minorities," says president and CEO Suzanne Shank.

By Chip BarnettFebruary 1 -

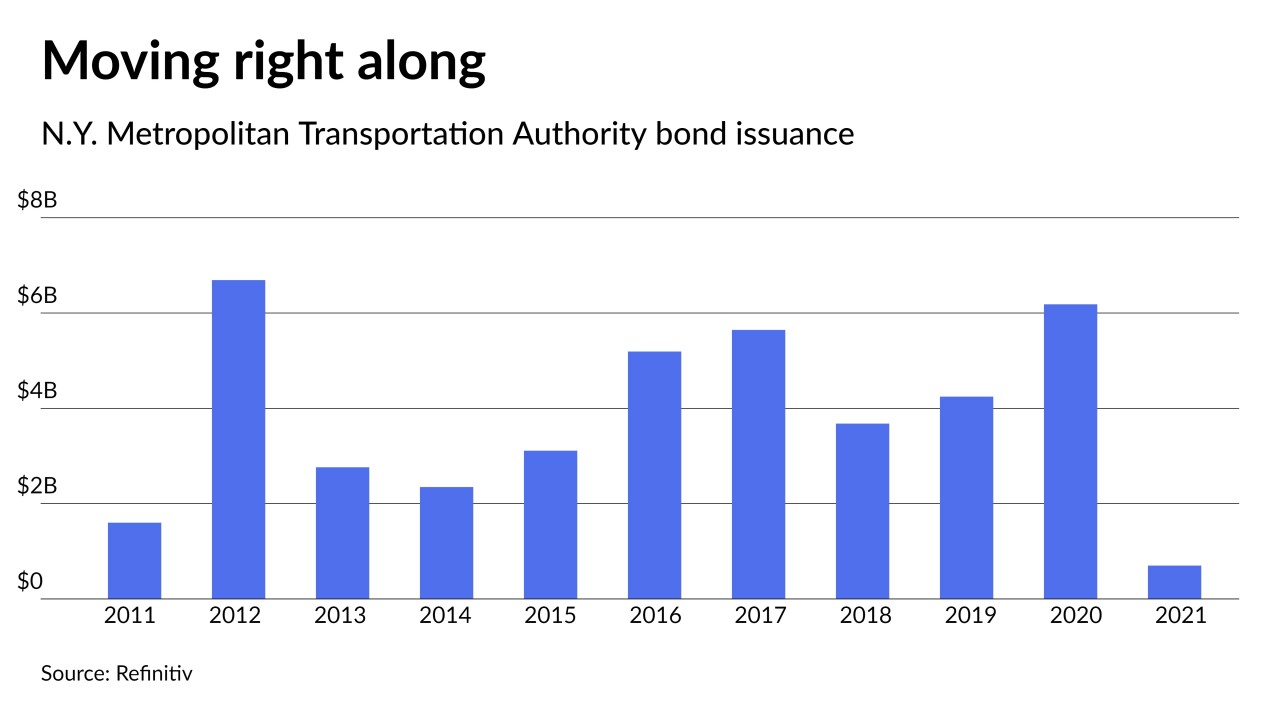

As the MTA works toward a post-pandemic future, Kevin Willens, formerly co-head of public finance at Goldman Sachs, becomes its chief financial officer.

By Chip BarnettJanuary 28 -

Moody’s also assigned an A1 to the authority's $950 million of forward delivery refunding bonds.

By Chip BarnettJanuary 27 -

S&P raised the Metropolitan Nashville Airport Authority, Tennessee's senior-lien airport revenue bonds issued for the Nashville International Airport to A-plus.

By Chip BarnettJanuary 27 -

Cancellations due to fears of omicron are putting a damper on cruise bookings, says Fitch's Emma Griffith, who adds there is still a lot of pent-up demand.

By Chip BarnettJanuary 26 -

John Hallacy of John Hallacy Consulting LLC sits down with Chip Barnett to talk about what the municipal bond market will face in 2022. He discusses inflation, new issuance volume, and the future of infrastructure this year amid the lingering effects of COVID and Omicron. (19 minutes)

By Chip BarnettJanuary 25