DALLAS – Kansas' lagging economy would get a $600 million boost through a 15-cents per gallon fuel tax increase, an industry group told lawmakers.

Research by the American Road & Transportation Builders Association's chief economist Alison Premo Black cited cost savings for drivers, jobs, and the addition of long-lasting capital assets that would promote further economic activity for decades.

Black testified March 23 before a Kansas state legislature hearing about the report's findings. The study was commissioned by the Kansas Contractors Association.

"Research shows that the economic return for every $1 invested in transportation infrastructure improvements can range up to $5.20," Black said. "For drivers in Kansas, this could add up to as much as $1.3 billion in savings, not including the additional benefits of improving access to critical facilities like schools and hospitals or increases in business productivity."

After sharply cutting taxes in 2012, Kansas has sought additional sources of revenue to cover growing revenue shortfalls over the past five years. Lawmakers are facing a $280 million revenue shortfall in the current fiscal year that ends June 30.

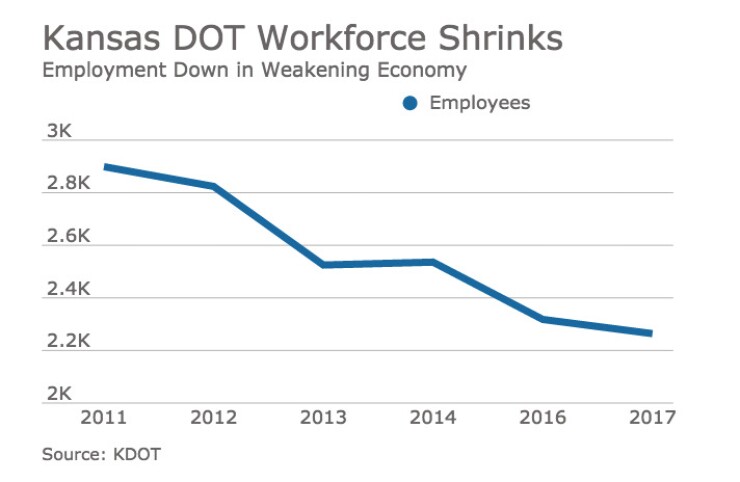

To make ends meet in previous years, lawmakers transferred funds from highways to the general fund for other needs. Since 2011, lawmakers cut around $1.2 billion in funding, forcing Kansas Department of Transportation officials to delay dozens of projects.

In April 2016, KDOT halted 25 projects because of budget cuts and a shift of $550 million to the general fund. This year, Gov. Sam Brownback is proposing transfers of $500 million in the next two fiscal years.

To make up for the lost highway funding, Senate Bill 224 would increase the motor fuel tax by 5 cents to 29 cents per gallon. The bill would provide $56.1 million to the State Highway Fund in fiscal year 2018 $61.3 million in FY 2019.

The increase would make the Kansas fuel tax higher than each border state's, which prompted opposition from Kansas retailers. Nebraska is currently the highest with a 28-cent rate for gas. Missouri and Oklahoma have 17-cent rate while Colorado taxes fuel at 22 cents per gallon.

Tom Palace, executive director of the Petroleum Marketers and Convenience Store Association of Kansas, said that nearly 38% of the Kansas population lives in a county bordering another state. He said current tax levels on gas and tobacco encourage customers to make those purchases at cross-border convenience stores.

Tom Whitaker, executive director of the Kansas Motor Carriers Association, said the industry already carries a high burden for road maintenance, including a $100 per year increase on vehicle registration fees for trucks larger than a pickup truck.

After hearing testimony on the bill, the state Senate Assessment and Taxation committee took no action.