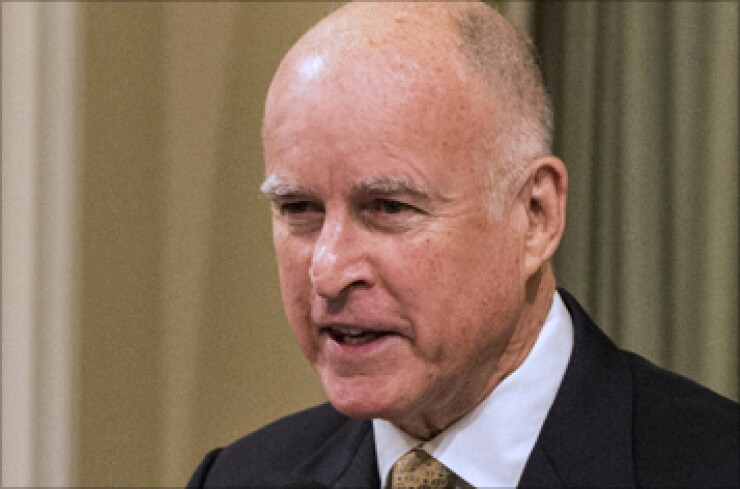

LOS ANGELES — The budget proposal California Gov. Jerry Brown submitted last week is fueling a conflict over state bond funding for K-12 education.

The $113.3 billion general fund budget Brown released Jan. 9 would provide a sizable increase in operating funding for schools.

But the budget documents demonstrate Brown's continued skepticism about whether the state should have a significant role in capital funding for local school districts.

The state's robust revenue figures trigger additional money under the state's school funding formula for K-12 schools and community colleges. The governor also budgeted nearly $1 billion toward paying down school funding deferrals made during lean budget years.

On the capital side, however, citing what he called in his

That program is almost out of money, and Brown signaled that he won't support a new school bond authorization under its current structure.

The program is overly complex with over 10 different state agencies providing fragmented oversight responsibility, said H.D. Palmer, a Department of Finance spokesman.

Educational lobbyists teamed with the California Building Industry Association in an effort to go around the governor.

Calling the effort

Supporters hope the measure will be cleared to start gathering signatures for a measure to be placed on the ballot in 2016, said Dave Walrath, president of Murdoch, Walrath & Holmes, a Sacramento-based lobbying firm that specializes in public education.

Polls conducted for the Coalition for Adequate School Housing found that more than 60% of voters would support a state bond measure, Walrath said.

"The school facilities program in existence works well," said Joe Dixon, the chair of the Coalition for Adequate School Housing and an assistant superintendent at the Santa Ana School District in Orange County. "Do we need to simplify? Yes. Do we need to change some eligibility pieces? Yes. But you don't shut it down."

If another bond measure isn't passed, Dixon said a crisis will occur.

Brown's Department of Finance held a series of meetings this past fall to discuss a new facilities program "that could provide districts with the tools and resources to address their core facility gaps and avoid an unsustainable reliance on state debt issuance," according to the governor's budget summary.

Voters have approved roughly $35 billion in statewide general obligation bonds since 1998 to construct or renovate K-12 schools, but it's all been issued.

The governor asserts that school districts have a wide variety of funding sources including Mello-Roos bonds, developer fees and certificates of participation, lessening the need for bond issuance on the state level.

The current state school bond program was designed before the 2000 passage of Proposition 39, which reduced the local school bond vote threshold to 55% and resulted in an 80% passage rate for local school bond measures, Brown said in the budget document.

According to a California Debt and Investment Advisory

Brown wants to expand local funding capacity by raising caps on local bond indebtedness, which have not been raised since 2000; that would allow many districts to issue bonds that their voters have authorized but are blocked by the caps. Brown would also simplify how schools receive impact fees from developers for new construction in their districts.

The governor envisions a new bond program that would only issue bonds for school districts demonstrating the greatest need.

Dixon questioned how that would be determined, given the state has about 1,000 school districts of various sizes.

The current system does not "compel the district to consider facilities funding within the context of other educational costs and priorities," Brown said in his budget summary. It incentivizes schools to build new schools to accommodate modest and absorbable enrollment growth, he said.

GO bond debt funded outside of Proposition 98 cost the general fund approximately $2.4 billion in debt service annually, according to the budget document.

"It is not that the administration wants to shut down school construction," Palmer said. "It is just that passing another $11 billion or $12 billion bond is tough for the state to do in terms of its capacity."

With funding the state provides to schools for operating costs, the notion of continuing the existing bond program means the state is dealing with sustainability issues, Palmer said.

"It is a question of whether the state can continue to shoulder that kind of debt service load," Palmer said. "We want to examine local flexibility to issue debt."

A

"Additional revenues in 2014-15 will go largely or entirely to schools and community colleges and could result in a few billion dollars of higher ongoing state payments to schools," the LAO report states.

That's very good for the schools, which had so many budget cuts in the downturn, but it means the state doesn't necessarily build up reserves, said Jason Sisney, a chief deputy legislative analyst.

The LAO report lauded the governor's push to not increase spending for other programs despite robust revenues, because the budget remains vulnerable to downturns that may re-emerge with little warning, according to the report.

"This is one of those moments in time when California is taking in a ton of revenue," Sisney said. "It may continue for a couple of more years, but history tells us it will not continue forever."

While the economy and the stock market are growing, Sisney said it is a good idea to prepare for the next downturn.

Brown's budget proposal provides a framework for the big issues he wants to see on the legislative agenda this year.

This year, in addition to pushing for local financing of school construction, he wants to tackle state employee retiree healthcare costs and transportation funding.

The governor is seeking a plan to prefund retiree healthcare obligations, in an effort to get a handle on annual pay-as-you-go costs that have risen to $1.9 billion annually from $458 million in 2001.

His proposals would divide the cost of pre-funding retiree healthcare costs between the state, the employer and employees in similar fashion to what has occurred through retirement reform in 2012, and for the California State Teachers' Retirement System last year, Palmer said.

The budget released Jan. 9 included what California Department of Transportation Spokesman Gareth Lacy described as a call to action to figure out how to pay for $59 billion in transportation needs for the state's highways over the next 10 years.

Last year, Brown asked the state transportation agency to form a committee to look at ways to pay for the needed improvements. On Feb. 5, 2014, the initial recommendations came out. The work group of 50 transportation stakeholders wrote three white papers.

At the work group's next meeting on Jan. 28, they will be reviewing proposals to come up with recommendations that could end up in a trailer due Feb. 1 attached to the governor's budget document, Lacy said.

The group looked at such methods as adopting a user tax instead of increasing the gas tax and expanding highway tolling.