For the second straight quarter, Bank of America Merrill Lynch nabbed the top spot for municipal underwriters, increasing its lead for the 2015 overall and creating some distance going into the final quarter of the year.

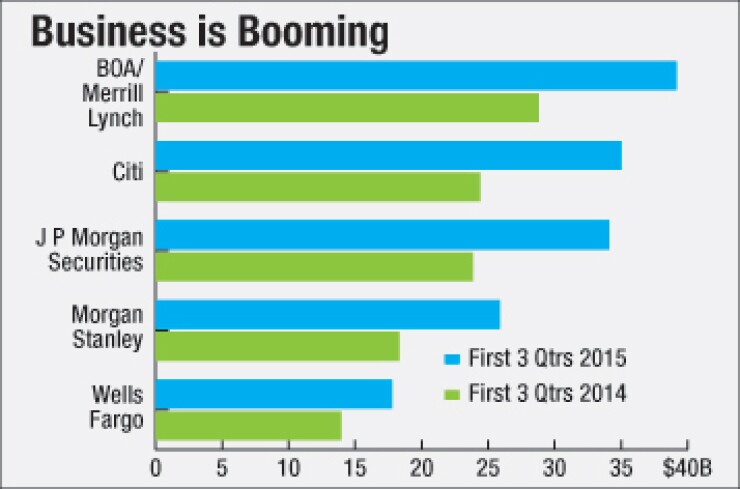

BAML finished the third quarter with a par amount of $11.35 billion 104 issues and closed out the first three quarters with a par amount of $39.17 billion in 366 issues, way up from the $28.79 billion in 265 deals for the first three quarters of 2014, according to data from Thomson Reuters.

Citi completed the quarter at $9.64 billion in 111 transactions and $34.98 billion in 390 for the year so far.

For the quarter, JPMorgan finished in third place, coming to market with $9.48 billion over 75 deals and year to date with $34.08 billion in 318 deals. The rankings for the third quarter are exactly the same for the year so far, for rankings first through fifth.

"While volume was down approximately 23% from a very strong second quarter, the third quarter was still very active and we are pleased with our overall market position heading into the final quarter of the year," said Jamison Feheley, head of banking and public finance at JPMorgan.

All top 11 firms had a much higher par amount and number of deals in the first three quarters of this year than they did during the same period last year, but Feheley expects to see a drop off in volume in the fourth quarter.

"We expect new issue volume in the fourth quarter to be the lowest volume quarter of the year and likely half of the volume we saw in the fourth quarter of last year. That said, the forward calendar still looks very favorable and the persistent low interest rate environment will continue to promote refunding opportunities," he said.

Feheley also said that one growing trend JPM is experiencing is the increasing volume of taxable corporate issuance among their not-for-profit clients in the healthcare and NFP higher education sectors.

"In not-for-profit healthcare alone, the percentage of taxable corporate bond issuance has climbed to 20% of all not-for-profit healthcare offerings. A similar trend is developing for not-for-profit higher education institutions. JPMorgan is very active in the taxable corporate market for our not-for-profit clients and while this new issue volume is not reflected in the traditional municipal league tables, it contributes almost another full point of market share to our overall public finance business."

Morgan Stanley is comfortably in fourth place but a good distance away from cracking the top three. They finished the quarter with $7.88 billion in 93 deals and have written 345 deals for a par amount of $25.87 billion so far this year.

Wells Fargo rounds out the top five with $6.21 billion for the quarter and $17.77 billion for the first three quarters.

For the third quarter, Raymond James was sixth with $4.59 billion and the most number of issues with 227, RBC was seventh with $4.53 billion, Barclays was eighth with $4.28 billion, Stifel was ninth with $3.59 billion, Piper Jaffray placed 10th with $2.96 billion and Goldman, Sachs came in 11th with $2.53 billion.

For the year, RBC is sixth, Stifel is seventh, followed by Barlcays, Raymond James, Piper and Goldman rounding out the top 11.

PFM Comfortably on Top of FA Rankings

Public Financial Management was firmly in the top spot for FA rankings, both for the third quarter alone and for the year. PFM finished the quarter with $12.79 billion in 224 transactions and $48.44 billion and 773 transactions for the year thus far.

Public Resources Advisory Group finished second for both the quarter and for the year so far with $8.34 billion and $25.51 billion, respectively.

FirstSouthwest is very close behind in third place, as they closed the quarter with $6.03 billion in 185 transactions and finished the first three quarters with $24.15 billion and 629 transactions.

For the quarter, Acacia Financial Group Inc., was fourth and Piper rounds out the top five.

For the year so far, Piper is fourth with $8.24 billion and Acacia is fifth with $7.84 billion.

Negotiated Underwriting

Bank of America Merrill Lynch claimed the top spot for underwriting negotiated deals, with a par amount of $8.63 billion. Citi was close behind in second for the quarter, with $8.17 billion and JP Morgan finished third with $7.26 billion. Morgan Stanley finished fourth with $6.73 billion and RBC rounds out the top five with 4.42 billion.

Stifel who finished sixth in par amount with $3.45 billion in the third quarter, did have the most numbers of deals with 176.

For the year to date so far, the top five for negotiated deals only is Citi with $27.23 billion, JP Morgan with $26.61 billion, BAML with $26.38 billion, Morgan Stanley with $19.58 billion and RBC with $16.75 billion. Stifel is sixth and has the most number of deals with 631 transactions.

Competitive Underwriting

BAML finished the third quarter atop the competitive only deals with $2.72 billion, closely followed by JP Morgan with $2.22 billion for the third quarter alone. Wells Fargo was third with $1.87 billion, Citi was fourth with $1.47 billion and Morgan Stanley was fifth with $1.15 billion.

For the year so far, BAML leads the competitive league tables with a par amount of $12.79 billion, Citi is second with $7.75 billion, JPM is third with $7.48 billion, Morgan Stanley is fourth with $6.29 billion and Wells Fargo rounds out the top five with $5.81 billion.

Robert W. Baird, which finished in sixth for the quarter and year so far, has had the most number of issues with a total of 430 for the year and 112 in the third quarter along.

New York State of Mind

Four of the top ten issuers and two of the top three come from the Empire State. Topping the list is the New York State Dormitory Authority with a par amount of $7.87 billion in 30 issues. DASNY has the highest par amount among issuers and the most number of issues so far this year.

"DASNY, along with the entire municipal sector, has seen increased volume in the current year," said Gerrard P. Bushell, DASNY's President and Chief Executive Officer. "Given the low interest rate environment, DASNY has undertaken a large number of financings including sizable refundings as we have sought to take advantage of historically low interest rates on behalf of the State of New York, as well as our other public and private clients."

The state of California is second with $4.96 billion, the New York City Transitional Finance Authority is third with $4.47 billion, the Regents of the University of California finished fourth with $3.35 billion and the Texas Transportation Commission is fifth with $3.30 billion.

New York City is sixth with $3.07 billion, the Metropolitan Transportation Authority is seventh with $2.73 billion, followed by Washington state with $2.41 billion, then the New Jersey Economic Development Authority with $2.37 billion and then the Michigan Finance Authority rounding out the top ten with $2.29 billion.