Top shelf municipal bonds finished weaker on Friday, traders said, ahead of a more manageable new issue calendar for the upcoming week. Ipreo estimates volume at $5.6 billion, down from a revised total of $7.7 billion in the previous week, according to updated figures from Thomson Reuters.

The new calendar is comprised of $4.09 billion of negotiated deals and $1.5 billion of competitive sales.

"We were pretty quiet this past week, but we had a few deals sneak onto the calendar and price," Dawn Mangerson, managing director and senior portfolio manager at McDonnell Investment Management, said on Friday. "And I'm hopeful that the market will stay where it is and some of those deals that are on the day-to-day list will again come onto the calendar."

Mangerson added she heard that several of the past week's deals, such as California and Oregon, got a very strong reception and were way oversubscribed.

"The fourth quarter [of 2016] was very volatile, so I think investors are in a wait-and-see mode," said Jim Grabovac, senior portfolio manager at McDonnell. "The muni curve has steepened very dramatically, reversing last year's trend."

Mangerson agreed, saying that right now there was "not a lot to get excited about – there's nothing to spur the market to be move active."

Some market observers said that Federal Reserve Chair Janet Yellen's appearance before Congress during the week could be causing wariness among investors.

"Muni primary issuance continued to be sub-average, estimated at $5.4 billion versus a weekly average around $8 billion," Randy Smolik, Municipal Market Data Senior Market Analyst, wrote in a market comment on Friday. "Some claim this coming week's modest supply could be due to Yellen's semi-annual Congressional testimony. Certainly there is some fundamental risk in this testimony with talk of the Fed tightening as many as three times this year."

Grabovac said he doubted "there would be any fireworks coming out of this meeting."

Rather he said he felt the market was more concerned about how President Trump fills the two currently empty spaces of the Fed board, as well as the one that Dan Tarullo announced Friday he would be leaving in April.

"The politicization of the Fed is a live possibility," he said.

Bank of America will dominate underwriting in the negotiated sector during the week.

Headlining the supply slate will be the San Francisco Bay Area Toll Authority, Calif.'s $552 million of Series 2017A, B, C & D toll bridge term- and index-rate revenue bonds.

BAML is set to price the deal on Tuesday. The bonds are rated Aa3 by Moody's Investors Service and AA by S&P Global Ratings and Fitch Ratings.

BAML is also expected to price the Delaware River Joint Toll Bridge Commission of Pennsylvania and New Jersey's $438 million of Series 2017 bridge system revenue bonds on Tuesday after a one-day retail order period on Monday. The deal is rated A1 by Moody's, A by S&P and A-plus by Fitch.

And BAML is expected to price the New York Metropolitan Transportation Authority's $350 million of Series 2017A dedicated tax fund green bonds which are climate bond certified. The issue is slated to be priced on Wednesday after a one-day retail order period on Tuesday. The deal is rated AA by S&P and Fitch.

Additionally, BAML is set to price the Connecticut Housing Finance Authority's $210 million of Series 2017 Subseries A-1, A-2 (AMT) A-4 and A-5 housing mortgage finance program bonds on Wednesday after holding a one day retail-order period on Tuesday. The CHFA said that if there is strong demand the deal could be all wrapped up on Tuesday. The deal is rated triple-A by Moody's and S&P.

In the competitive arena, the Long Beach Unified School District, Calif., is selling $450 million of general obligation bonds in two separate sales on Tuesday.

The offerings consist of $300 million of election of 2016 Series A unlimited tax GOs and $150 million of election of 2016 Series E unlimited tax GOs. The deals are rated Aa2 by Moody's and triple-A by Fitch.

The Las Vegas Valley Water District, Nev., is selling $152.77 million of GOs in two separate sales on Tuesday. The offerings consist of $129.33 million of Series 2017A limited tax GO water refunding bonds additionally secured by pledged revenue and $23.44 million of Series 2017B limited tax GO water refunding bonds additionally secured by SNWA pledged revenue. The deals are rated Aa1 by Moody's and AA by S&P.

Secondary Market

The 10-year benchmark muni general obligation yield rose two basis points to 2.30% from 2.28% on Thursday, while the yield on the 30-year GO increased one basis point to 3.07% from 3.06%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were narrowly mixed on Friday. The yield on the two-year Treasury rose to 1.19% from 1.18% on Thursday, while the 10-year Treasury gained to 2.41% from 2.39%, and the yield on the 30-year Treasury bond was unchanged from 3.01%.

Week's Most Actively Traded Issues

Some of the most actively traded issues by type in the week ended Feb. 10 were from New York and California, according to

In the GO bond sector, the New York City 5s of 2028 were traded 57 times. In the revenue bond sector, the New York Metropolitan Transportation Authority 2s of 2017 were traded 106 times. And in the taxable bond sector, the California 7.55s of 2039 were traded 17 times.

Week's Most Actively Quoted Issues

Oregon and California names were among the most actively quoted bonds in the week ended Feb. 10, according to Markit.

On the bid side, the Portland, Ore., taxable 6.046s of 2020 were quoted by 374 unique dealers. On the ask side, the Los Angeles Unified School District, Calif., 5.755s of 2029 were quoted by 73 unique dealers. And among two-sided quotes, the California taxable 7.55s of 2039 were quoted by 25 unique dealers.

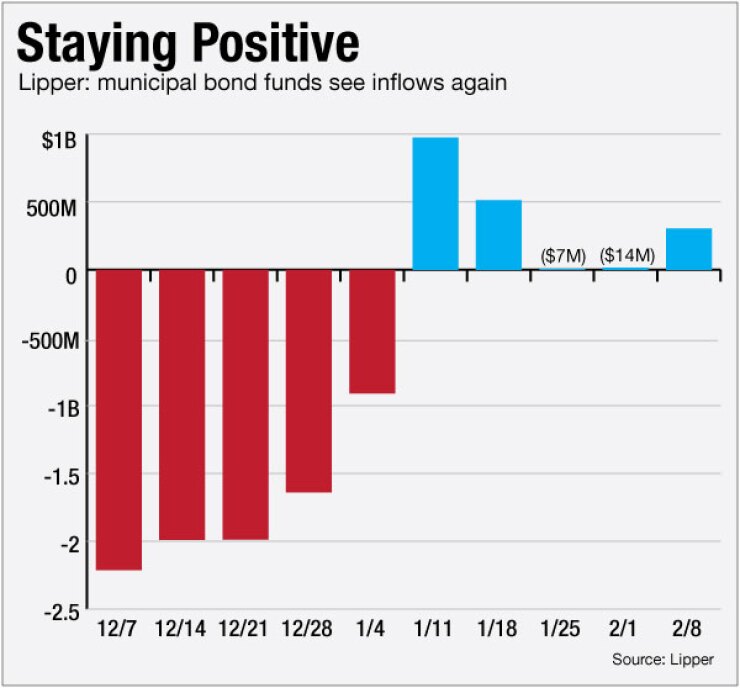

Lipper: Muni Bond Funds Report Inflows

Municipal bond funds attracted inflows again as investors continued their return to the market, according to Lipper data released late Thursday. The weekly reporters saw $304.200 million of inflows in the week ended Feb. 8, after inflows of $14.047 million in the previous week.

The four-week moving average remained in the green at positive $209.241 million, after being positive at $376.734 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also had inflows, gaining $274.984 million in the latest week after gaining $17.375 million in the previous week. Intermediate-term funds had inflows of $60.887 million after inflows of $18.018 million in the prior week.

National funds had inflows of $293.215 million after inflows of $31.490 million in the previous week. High-yield muni funds reported inflows of $286.427 million in the latest reporting week, after inflows of $187.718 million the previous week.

Exchange traded funds saw outflows of $62.055 million, after outflows of $70.187 million in the previous week.

Gary Siegel and Paul Burton contributed to this report.