Investors laden with cash and anxious about the potential for higher tax rates generated heavy activity in the municipal market, prompting another strong week in both the primary and secondary markets.

New deals cleared easily, as

Uncertainty surrounding the “fiscal cliff” and expectations for higher income-tax rates encouraged investor interest in the risk-off trade and tax-exempt munis. Robust buying and selling pushed municipal yields further into record territory in the 10-year and 30-year parts of the curve.

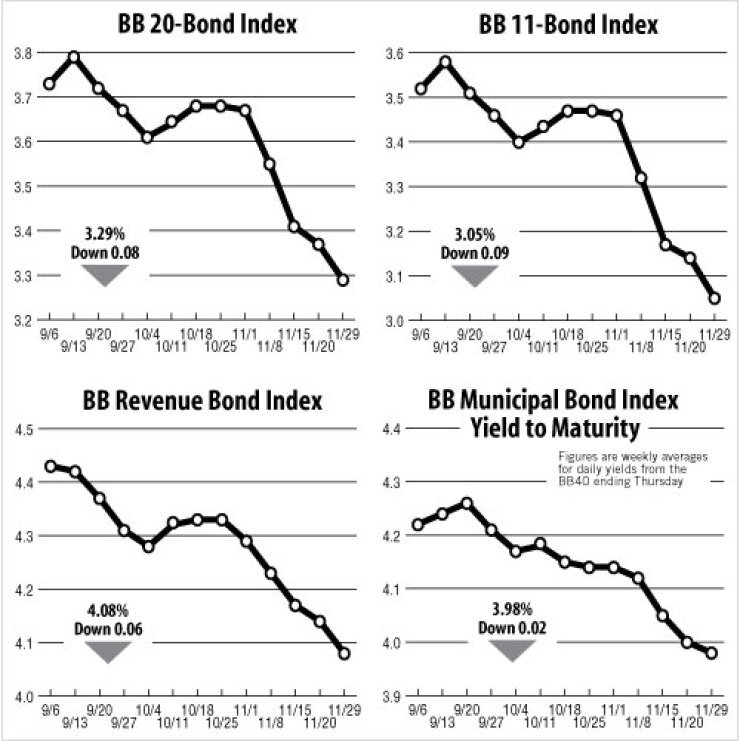

Muni bond indexes all fell as rates sank, some to lows they haven’t been at in more than 47 years. The 20-bond GO index of 20-year general obligation yields declined eight basis points this week to 3.29%, its lowest level since Sept. 2, 1965, when it was also 3.29%.

The 11-bond GO index of higher-grade 20-year GO yields dropped nine basis points this week to 3.05%. That is its lowest level since Feb. 18, 1965, when it was also 3.05%.

The yield on the U.S. Treasury’s 10-year note dropped four basis points this week to 1.62%, but remained above its 1.58% level from two weeks ago.

The yield on the Treasury’s 30-year bond fell three basis points this week to 2.79%, but remained above its 2.72% level from two weeks ago.

Several factors powered the rally in muni prices this week, said David Manges, managing director of municipal trading at BNY Mellon Capital Markets.

Leading off, money continues to flow into muni bond funds. In addition, there has been a positive acceptance of this week’s calendar, he said.

The general thought among participants is that tax rates could rise in 2013, and that the value of the tax exemption could be higher.

“The tax rates for other products could be higher,” Manges said. “Dividends could be taxed at a higher rate; capital gains could be taxed at a higher rate. Munis could be worth more for both of those reasons.”

Tax-exempt yields continued to shatter records this week at the intermediate and long ends of the curve.

From Friday through Thursday’s close, the benchmark 10-year triple-A dropped six basis points to 1.47%, Municipal Market Data numbers showed.

The 30-year triple-A stumbled seven basis points to 2.47% over the same period. The two-year remained frozen at 0.30% for a 44th straight session.

Muni ratios to Treasuries barely budged on the week from last Friday. Ratios at the intermediate and long ends of the curve reflect the degree to which munis are rich relative to Treasuries.

The 10-year ratio has remained just under 91%.

The 30-year dipped one percentage point on the week to just below 89%. The two-year ratio landed where it started the week since Friday, at 111%.

The Bond Buyer’s revenue bond index, which measures 30-year revenue bond yields, fell six basis points this week to 4.08%.

This is the fourth consecutive weekly all-time low for the index, which began on Sept. 20, 1979.

The Bond Buyer’s one-year note index, which is based on one-year GO note yields, declined one basis point this week to 0.22%, the same level as two weeks ago.

The weekly average yield to maturity of The Bond Buyer municipal bond index, which is based on 40 long-term bond prices, declined two basis points this week to an all-time low of 3.98%. It is the fourth week in a row and eighth time in 10 weeks that the weekly average has reached a record low.

The Bond Buyer first began calculating the average yield to maturity on Jan. 1, 1985.