As part of a continuing effort to increase its municipal business, M.R. Beal & Co. has announced the hiring of public finance veterans Loren Carlson and Edward Chan, who bring more than 40 years of combined experience as managing director and vice president, respectively, to the New York-based investment bank.

Carlson, who came out of retirement to join the firm’s Charleston, S.C., office on July 26 and whose public finance career spans 30 years, is responsible for developing new business and deal execution in the Southeast region. Chan, a 10-year professional who joined the firm on Aug. 4, is concentrated on marketing, structuring and executing both tax-exempt and taxable bond transactions from its New York headquarters.

“Loren and Ed’s experience and innovative thinking will most certainly help us execute on more deals and grow our municipal business,” Bernard Beal, chief executive officer, said in a statement to earlier this week.

Before joining Beal Carlson was a managing director at RBC Capital Markets until he retired from the industry in 2008. Before that, he worked at William R. Hough & Co. from 1996 until 2003 when Hough was acquired by RBC Dain Rauscher, a subsidiary of Royal Bank of Canada. While at Hough, he served as a senior vice president, a board member and member of the firm’s executive committee.

During his career, Carlson has been instrumental in post-secondary education financing across the country and helped build the multibillion-dollar asset-backed securities market for federal and private educational loans, according to the firm.

His experience also includes positions in the public finance and asset-backed divisions at various firms that have since been acquired by others, such as Manufacturers Hanover Securities Corp., where he worked from 1982 to 1994; at Blythe, Eastman Dillon & Co. for six years, as well as a number of years at PaineWebber Inc. and Chemical Securities Inc.

A graduate of Drake University, Carlson also received an MBA from Adelphi University.

Chan, meanwhile, joined Beal after serving as vice president at Loop Capital Markets where he was involved in deal structuring and execution, cash flow modeling, credit analysis and innovative solutions for municipal issuers. He has covered some of the largest state and local government issuers, including the Dormitory Authority of the State of New York, Chicago, Philadelphia, the District of Columbia and Connecticut, and structured transactions for tax-backed, utility, airport, lease revenue, tax-increment and tobacco settlement bonds.

Chan graduated magna cum laude from Dickinson College, with a BA in economics.

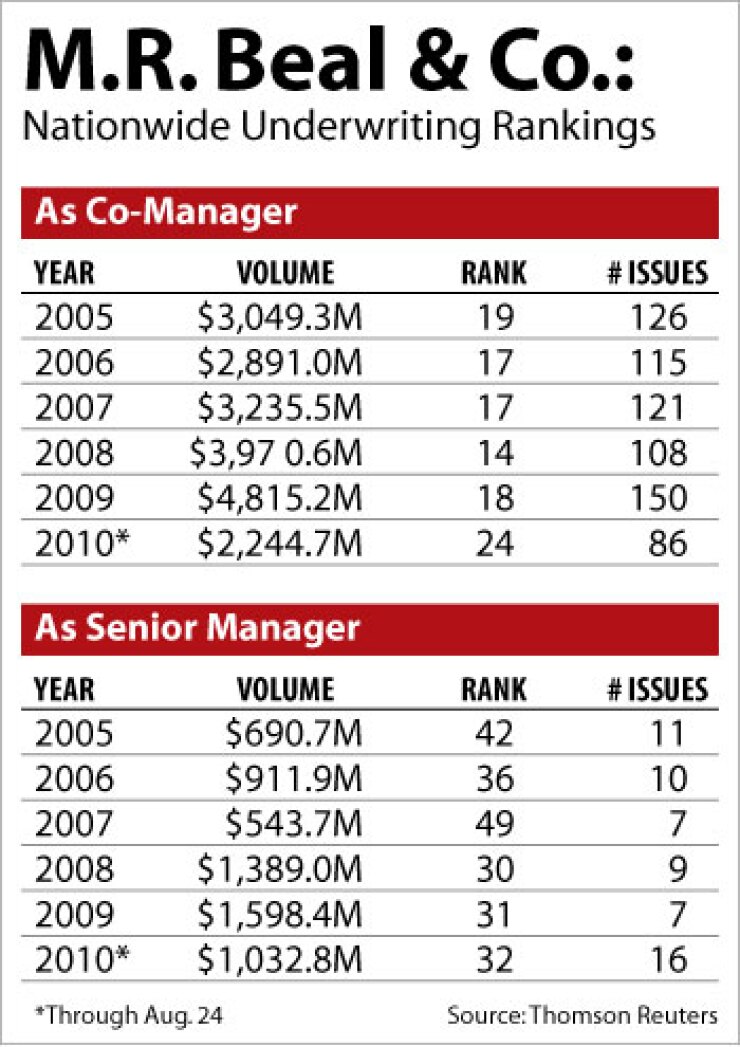

M.R. Beal has added seasoned talent in recent years in an effort to beef up its overall municipal presence.

One of its most recent coups was in June when it was named senior, book-running manager on a $1.3 billion personal income tax bond deal for DASNY — after 10 years on its senior management team. The deal, which is now scheduled to sell in October, would be the state’s largest ever municipal issue with a minority firm as book-runner.