WASHINGTON - Delaware finance officials are hoping the state's natural triple-A ratings will spark retail investor appetite for $225 million of general obligation bonds they plan to bring to market next week.

The state will offer up to $115 million in a retail-order period on Jan. 12 and 13, with a competitive offering of $110 million to follow on Jan. 14.

"I think probably since September or so, the primary activity in the muni market has been from retail, so this sale is sort of tailored to meet the needs of those investors," said Stephanie Scola, director of bond finance for the state.

Scola said the deal was split to "make bonds available to individual investors and Delaware residents would be our priority. But given the state of the market, we're also selling to a national audience."

State law requires Delaware to sell new-money bonds competitively. But officials changed the epilogue language in the Delaware code a few years ago to allow the state to sell a certain percentage of bonds each year in a sale geared to individual investors, and have been doing so since 2005.

Public Financial Management Inc. is financial adviser on the deal. Saul Ewing LLP is bond counsel.

Morgan Stanley is leading the retail selling period, along with Banc of America Securities LLC, Barclays Capital, Citi, Edward Jones, Janney Montgomery Scott LLC, JPMorgan, Merrill Lynch & Co., Stifel, Nicolaus & Co., and Wachovia Securities LLC.

Standard & Poor's, Moody's Investors Service, and Fitch Ratings all give the deal a triple-A rating.

"This rating reflects Delaware's strong financial management and our ability to maintain the state's good financial health even in tough times," Gov. Ruth Ann Minner said in a statement.

Delaware has maintained a triple-A bond rating from all three major rating agencies since 2001.

Proceeds of the bonds will go to school construction, which is typically where the proceeds of the state's GOs are directed, Scola said.

"There will be some money available for court houses and libraries, but primarily it's for schools," she added.

The 10- and 20-year serial bonds have maturities out to 2029. Although the state is authorized to issue all its GO debt as 20-year bonds, it will sell only $90 million of the bonds out to that maturity and the remaining $135 million will mature in 10 years, according to the preliminary official statement.

Daily yield curve data provided by Municipal Market Data showed 10-year Delaware GOs yielding 3.76% as of last Wednesday. Bonds due in 20 years yielded 4.85%.

Even though Delaware has been selling a hefty portion of its GOs to retail for several years, transaction participants expect this deal to do especially well with small investors.

"Now with the collapse of the monoline bond insurers, retail does like the safety and security of a natural triple-A because there are so few of them out there, so we're hopeful retail will be a significant part of this transaction," a person familiar with the deal said.

Rapid amortization has benefited Delaware's bond ratings. The state's tax-supported debt is about $2.3 billion, or 6.6% of personal income, according to Fitch. But its above-average debt burden is tempered by a rapid rate of amortization, Fitch said. Delaware is committed to retiring debt quickly and has about 79% of its GOs due in 10 years, according to the POS. The state has about $1.4 billion of outstanding GOs.

And while the state, like many others across the country, is facing lower-than-anticipated revenues due to the national recession, Scola said Delaware will not issue bonds to deal with any budget shortfalls.

"These securities are rated triple-A by all three rating agencies, and part of the reason we are rated highly is that we don't bond for shortfalls as other states are sometimes forced to do," Scola said. "We may be in better health than other states."

The Delaware Economic and Financial Advisory Council reviews revenue forecasts at least six times each fiscal year and the most recent forecast from mid-December showed the general fund revenue estimate for fiscal 2009 to be $3.2 billion, 3.9% below the prior year, and projected an additional 4.3% decline in fiscal 2010, Fitch said. The estimate includes a 0.3% decline in personal income tax withholding revenue in fiscal 2009, which is a significant deterioration in expectations compared to the November 2008 forecast.

The December forecast projects a $109 million fiscal 2009 shortfall, but that is assuming the budget reserve fund remains fully funded at 5%, Fitch said. The governor has announced agency spending cuts and other measures to address the fiscal 2009 gap and is expected to present an executive budget by the middle of next week, which will incorporate significant spending cuts to address an even larger gap of $560 million projected for fiscal 2010.

Even with that, Delaware gets good marks for strong fiscal management.

"Delaware's premier credit standing centers on its considerable economic and financial resources, as well as institutionalized protections designed to ensure surplus operations," Fitch said. "The state's economy, diversified through deliberate policies that created a climate attractive to banking and related business services as well as pharmaceuticals, has slowed like much of the nation."

Delaware's personal income per capita ranks 14th in the country at 104% of the national average, although recent personal income performance has been weak. The state's unemployment levels are well below the U.S. average, at 5.4% in October 2008, although, like the nation, the rate is markedly increased from a year ago when it was 3.5% in October 2007.

Scola said the state will likely come back to market in the fall when it needs funds again.

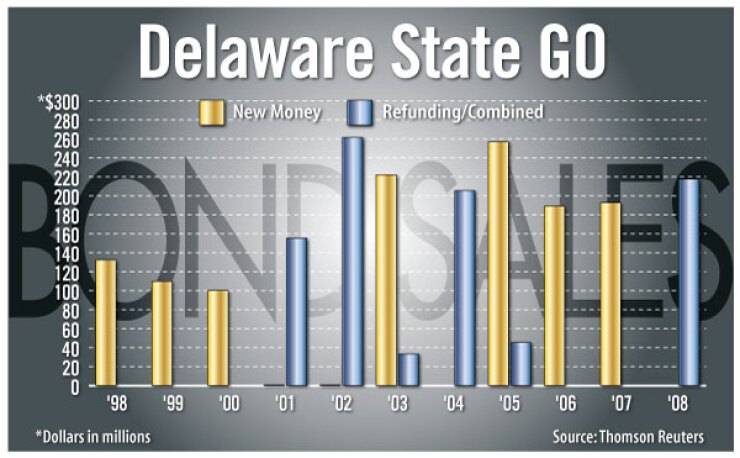

Delaware last came to market in March with a $217 million offering of fixed-rated GOs. Merrill Lynch spearheaded a $45 million retail offering, while JPMorgan won the bid for the rest of the bonds with a with a total interest cost of 4.0164%.