SAN FRANCISCO — The epic real estate bust has hit property tax rolls across a wide swath of California, creating additional budget challenges for counties, school districts, and the state itself.

Despite a tax assessment system passed under the state’s famous Prop. 13 that cushions against volatility in assessments, property tax rolls in nine of California’s 12 largest counties declined for 2009.

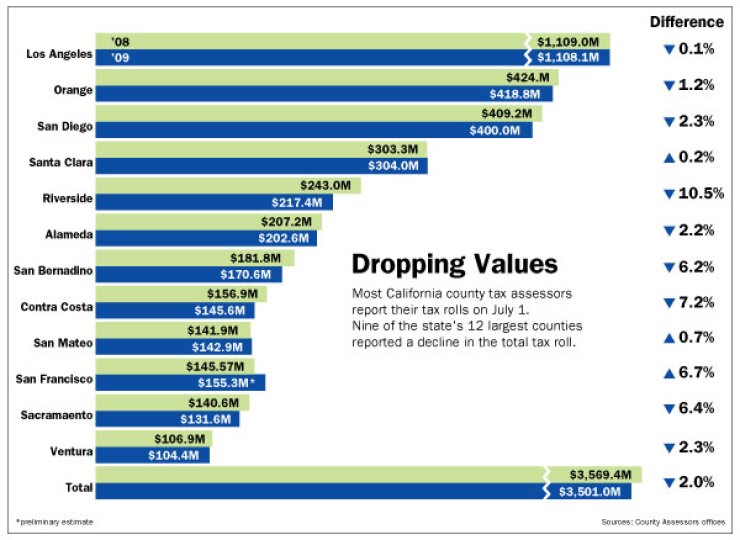

The overall assessed valuation in those 12 counties was down almost 2%, according to figures reported by the county assessors. Those counties represented more than three-quarters of the state’s total tax roll in 2008, according to California Assessors Association data.

“This cycle was perpetuated by a couple years of unrealistic credit availability,” said Ventura County assessor Dan Goodwin, president of the California Assessors Association. “We should have ran out of gas in ’05. If we’d have run out of gas in ’05 it would have been less steep a decline.”

Ventura County saw a decline of 2.34% — the county’s first recorded decline, Goodwin said.

Declining assessed valuations will have several impacts.

In the 12 counties surveyed, the tax roll was down more than $68 billion combined, which translate into at least $680 million in lost tax revenue at the state’s basic 1% tax rate.

Since that basic rate can’t be adjusted, a declining tax roll will impact general fund revenues for cities and counties.

A declining roll has the potential to affect local school districts and governments that have issued or plan to issue general obligation bonds, which are backed by voter-approved property tax pledges above the 1% rate. It could lead to potentially unpopular decisions to increase the tax rates, or to the deferral of issuance that has been authorized by voters.

A tax roll drop would also roll up to the state budget. The state guarantees minimum per-student spending levels for K-12 education that for the vast majority of school districts is higher than their property tax receipts, meaning lower school district tax receipts could increase the state’s funding share.

As with the property bust, and its associated rash of foreclosures and short sales, the impact of declining tax rolls is also uneven.

The worst affects are being felt in inland communities and areas of recent large-scale residential development.

Riverside County, east of Los Angeles, saw assessed value drop 10.5%, the worst of the big Southern California counties, though all reported declines, with the lowest drop in Los Angeles County, at less than a tenth of one percent.

San Diego County was down 2.3%, but the variances within the county highlight the uneven distribution of California’s real estate woes. The wealthy communities of Del Mar and Coronado each saw their tax roll increase more than 5%, while Chula Vista was down more than 10%.

The tax roll declines occurred even though the affects of falling property values are muted by the implementation of California’s 1978 Proposition 13 tax limits. That ballot measure set a 1% basic tax rate, and provides that properties are only reassessed, at market value, when they are sold. A property’s assessment can only go up 2% each year if it is not sold.

In most communities, there are a great many properties that haven’t changed hands for years, when property prices were much lower.

“Because many properties are already assessed at well-below-market prices, if actual selling prices decline, the effect on tax bills will be muted,” according to a report Standard & Poor’s issued in 2007, describing the “Prop. 13 cushion.”

The cushion is even evident in hard-hit jurisdictions like Riverside County, where the 10% decline in the tax roll is much milder than the 37.9% drop in median home sale prices that the California Association of Realtors reported in May.

Among the 12 largest counties, the only three reporting increased tax rolls were in the Bay Area, where San Francisco was expected to post an increase of more than 6%, according to a June budget document, and the assessors in San Mateo and Santa Clara counties reported gains of less than 1% each.

“Silicon Valley may end up being one of only a handful of California counties on the positive side,” Santa Clara County assessor Larry Stone said in a news release.

But it might not stay that way next year. “Next year may be worse, since most of the declines this year are attributed to the soft residential market,” Stone said. “The steepest decline in commercial property values is ahead of us.”

Ventura County’s Goodwin echoed Stone, saying that weakness in office, retail, and commercial space began showing up toward the end of 2008, well behind the downward residential cycle. The tax rolls coming out now reflect values as of Jan. 1.

Even the Bay Area saw regional disparities further away from the coast, where Alameda County was down 2.24% and Contra Costa County was down more than 7%, including three cities where the roll declined more than 20%. Contra Costa’s median home sale price in May was down more than 40% compared to a year earlier, according to the realtors’ association.

While Proposition 13 limits the upward trajectory of property assessments, assessors are required to adjust them downward if the market value of a home drops.

In Los Angeles County, assessor Rick Auerbach reported reviewing 473,000 homes and lowering the assessments for about 334,000.

If property values recover, such temporary reassessments can be recaptured until a property’s assessed value reaches the level it would have if it had gone up 2% each year.

“In a market that changes direction and begins to go up that potential restoration value is in the bank,” Goodwin said.

But when a property is resold at a lower price than an earlier sale, as in the case of so many foreclosure sales, than its assessment is capped at the new market price.

While assessors keep track of how much value is lost to temporary reassessments, they generally don’t have the tools to measure how much is lost to such lower-priced sales, Goodwin said.