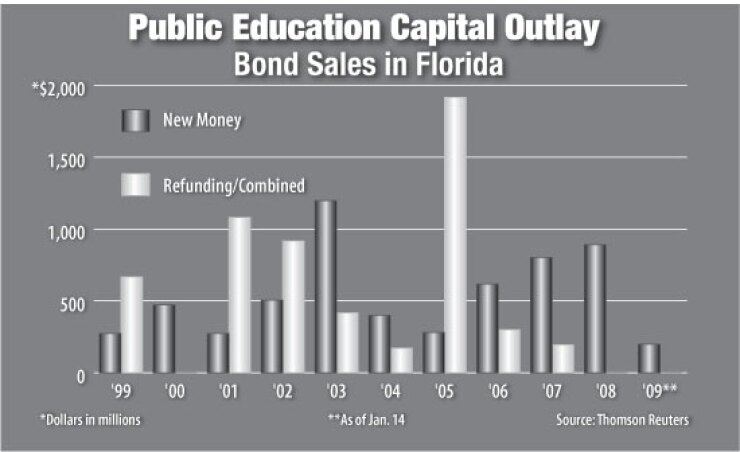

BRADENTON, Fla. - Despite a negative change to Florida's credit outlook as the Legislature worked to close a $2.3 billion budget gap, the Division of Bond Finance completed its largest competitive bond sale in several months - $200 million for public education capital outlay.

The 30-year PECO bonds sold to Merrill Lynch & Co. at a true interest cost of 4.71%, a rate comparable to those the credit received prior to the current market turmoil, said Ben Watkins, director of the division.

"I was very pleased with the sale," he said. "The municipal market has improved dramatically over the last couple of weeks and even the competitive market for high grades is functioning very well."

The uninsured, full faith and credit bonds priced Wednesday and were rated AAA by Standard & Poor's, AA-plus by Fitch Ratings, and Aa1 by Moody's Investors Service. Fitch and Moody's placed a negative outlook on Florida's credit last year, while Standard & Poor's changed its outlook to negative on the day of pricing.

Watkins said the change in outlook had no effect on pricing of the PECO bonds Wednesday, nor did he anticipate it to affect pricing of future sales.

"The main story there is the state retained its triple-A rating," Watkins said. "This wasn't a precursor to a rating downgrade. It reflects the deteriorating economic conditions and financial challenges confronting the state."

Standard & Poor's Wednesday affirmed the state's AAA rating and said the negative outlook was tied to increasing economic and financial pressures that could leave the state more vulnerable to a major hurricane.

The rating agency also placed a negative outlooks on the Florida Hurricane Catastrophe Fund, Citizens Property Insurance Corp., and the Florida Insurance Guaranty Association - three state-run insurance programs.

Watkins said there was strong retail and institutional demand for high-grade bonds on Wednesday, which may begin to signal a return to some normalcy in the market.

"High-grade bonds are pricing more aggressively and more effectively than in December, when the market wasn't characterized by a lot of sellers," he said. "I think it means a lot of people are looking at muni bonds as a good investment and that they don't have to worry about losing money."

Florida typically goes the competitive route with its debt offerings, but recently put together a team of underwriters to do negotiated deals if necessary, though it has not used the team yet. The last time the state sold a deal competitively was in December when it took bids for $60 million of university system revenue bonds.

Despite what seems to be a return of the market for competitive offerings, Watkins will have less debt to sell this fiscal year.

Lawmakers, concluding a special legislative session to plug a $2.3 billion deficit in the state budget on Wednesday, revoked the remaining bonding authority of $300 million approved this fiscal year for the Florida Forever environmental land acquisition program. That represented an appropriation of approximately $25 million on a recurring basis over 20 years for debt service.

While $156.7 million of Florida Forever bonds were sold in September, only $50 million of those bonds were secured by funds allocated in the current fiscal year. That means about $20 million of the original appropriation for debt service will be returned to the general fund.

Lawmakers sent budget bills to Gov. Charlie Crist that would make $1.2 billion in cuts largely to schools, social services, and Medicaid programs. They also cured a portion of the remaining deficit by taking $700 million from the $1.2 billion Lawton Chiles Endowment Fund that supports health care for children and the elderly, and using $400 million from the budget stabilization fund.

The Legislature did not go along with Crist's recommendation to bond $314 million for prison construction instead of using cash. The governor has until Jan. 29 to act on the budget-reduction bills.