Outflows from Bond Funds

The Taper Tantrum

The Fallout Begins

Muni to Treasury Ratios

Supply Adds Additional Pressure To Selloff

Bond Buyer Indexes Break Records

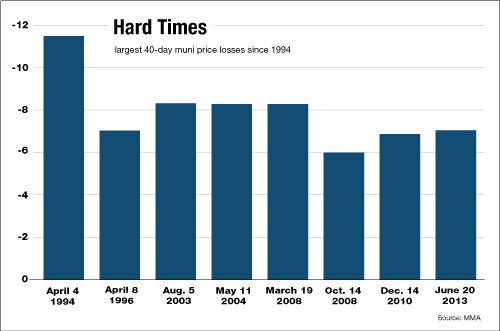

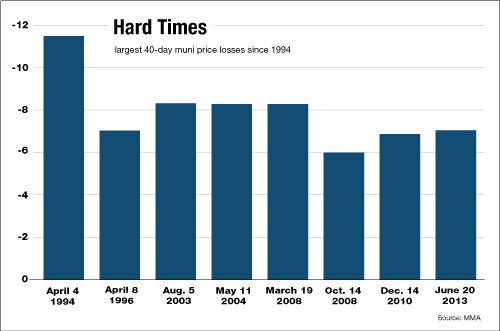

Three-Day Selloff Worst In Quarter Century

Trading Activity Sets New Record

Next week's issuance is slated to be "substantial" — an estimated $13.1 billion — although that is expected to be met with "solid" November reinvestment capital, J.P. Morgan strategists said.

States have spent weeks preparing for how they would cover the $8 billion shortfall in food stamps for the month of November.

The rating agency expects the school to post an operating deficit this year.

City Manager Oliver Chi unveiled a plan to invest $60 million to change the city's current trajectory.

"Illinois is just pure mismanagement," Ryan Frost, managing director of the Reason Foundation's Pension Integrity Project, said.

Issuance year-to-date is $493.063 billion, up 9.3% from $451.079 billion over the same period. With issuance estimated at $13.118 billion in the first week of November, 2024's $500-plus billion record should fall within the next week or two.