-

While some reliable options have emerged, market professionals remain hopeful the old advance refunding will return before the desire to bring it back loses any momentum.

November 1 -

October's total volume rose 29.3% to $37.156 billion in 661 issues from $28.738 billion in 614 issues a year earlier. New-money grew more than 30% while refundings were up by nearly 75%.

October 31 -

The relief means little for traditional municipal issuers but will have an effect on some conduit borrowers and issuers "adjacent" to the municipal market.

October 31 -

The application criteria for the grant programs handcuffs $5.5 billion in transportation spending to progressive priorities," said Texas GOP Sen. Ted Cruz.

October 30 -

This could be the first time the bond market has posted three consecutive negative total return years, according to John Hancock Investment Management Co-Chief Investment Strategist Matt Miskin.

October 30 -

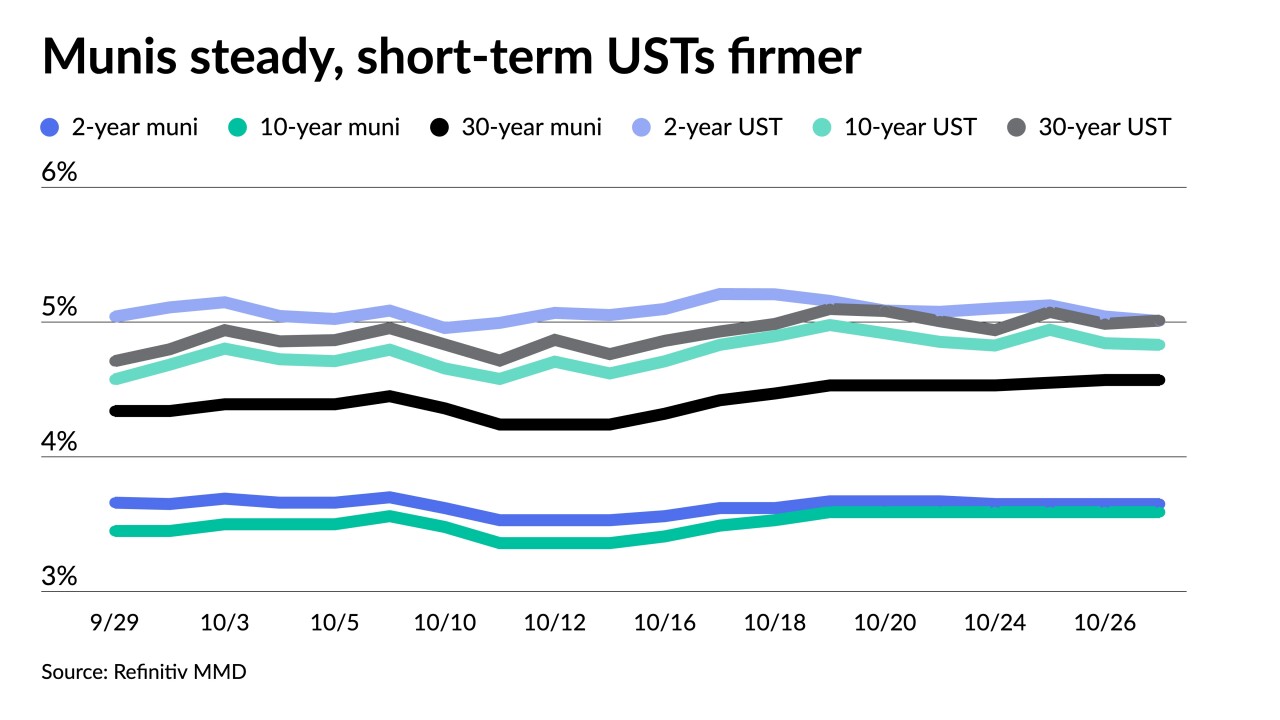

If Treasury rates become "more stabilized," it provides "a good reason to be somewhat constructive on munis for a while," BofA Global Research said in a report.

October 27 -

The Biden administration announces new emphasis on transit-oriented development.

October 27 -

The board expects to have FY 2024 fees filed with the Securities and Exchange Commission before Dec. 1.

October 27 -

With nearly two years of volatility, The Bond Buyer wants to know your expectations for the year to come, from interest rates and bond volume to ESG and technology.

October 26 Arizent, The Bond Buyer

Arizent, The Bond Buyer -

New House Speaker Mike Johnson has laid out an aggressive calendar to avoid a government shutdown.

October 26