-

The Federal Reserve might consider an interest-rate hike from near zero as soon as late 2022 as the labor market reaches full employment and inflation is at the central bank’s goal, Federal Reserve Bank of Boston President Eric Rosengren said.

June 25 -

State and local government groups want the focus on reinstating tax-exempt advance refunding bonds and expanding the current financing tools.

June 25 -

One big area of spending growth has been Medicaid health services for the poor, which is on track to jump by 12.5% in the current fiscal year.

June 24 -

The U.S. economy will likely meet the Federal Reserve’s threshold for tapering its asset purchases sooner than people think, said Dallas Fed President Robert Kaplan, who has penciled in an interest-rate increase next year.

June 23 -

Federal Reserve Bank of Atlanta President Raphael Bostic said the central bank could decide to slow its asset purchases in the next few months and he favored lifting interest rates in 2022 in response to a faster-than expected recovery from COVID-19 pandemic.

June 23 -

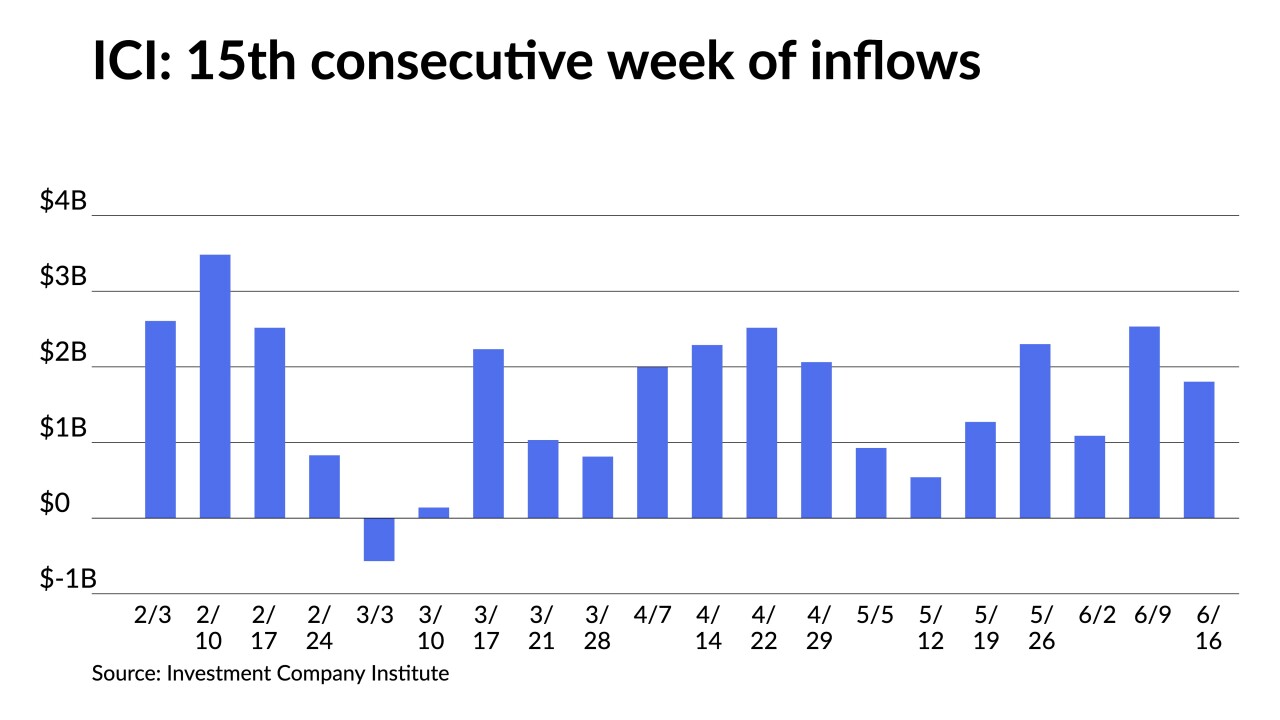

Triple-A benchmark yields moved higher by as much as five basis points while ICI reported another $1.8 billion of inflows and ETFs increase their share by $841 million.

June 23 -

As infrastructure talks unfold in Washington, the likelihood of higher taxes may be waning, at least in the short run.

June 23 -

Federal Reserve Chair Jerome Powell said the price increases seen in the economy recently are bigger than expected but reiterated that they will likely wane.

June 22 -

A discussion about raising interest rates is still quite a ways off as the Federal Reserve begins debating tapering its bond-buying program, New York Fed President John Williams said.

June 22 -

John Hallacy, founder of John Hallacy Consulting LLC, talks with Chip Barnett about the pandemic’s lingering credit impacts on state finances in a wide-ranging discussion of the many issues affecting the municipal market today. (17 minutes)

June 22