-

Federal Reserve Bank of Minneapolis President Neel Kashkari said the spread of the Delta variant of COVID-19 could keep some Americans from looking for work, potentially harming the U.S. recovery.

August 2 -

Financial markets “are very well prepared” for the Federal Reserve to start tapering its massive asset-purchase program in the fall, St. Louis Fed President James Bullard said.

July 30 -

The two issuances under IRS scrutiny join an earlier debt issuance the county disclosed publicly late last year.

July 30 -

While the bipartisan deal includes some helpful provisions, it does not contain any of the top priorities of municipal bond market advocates.

July 29 -

The decision to create the facilities followed several years of discussion within the market about whether they are needed and what form they might take. The Fed already has temporary repo facilities.

July 28 -

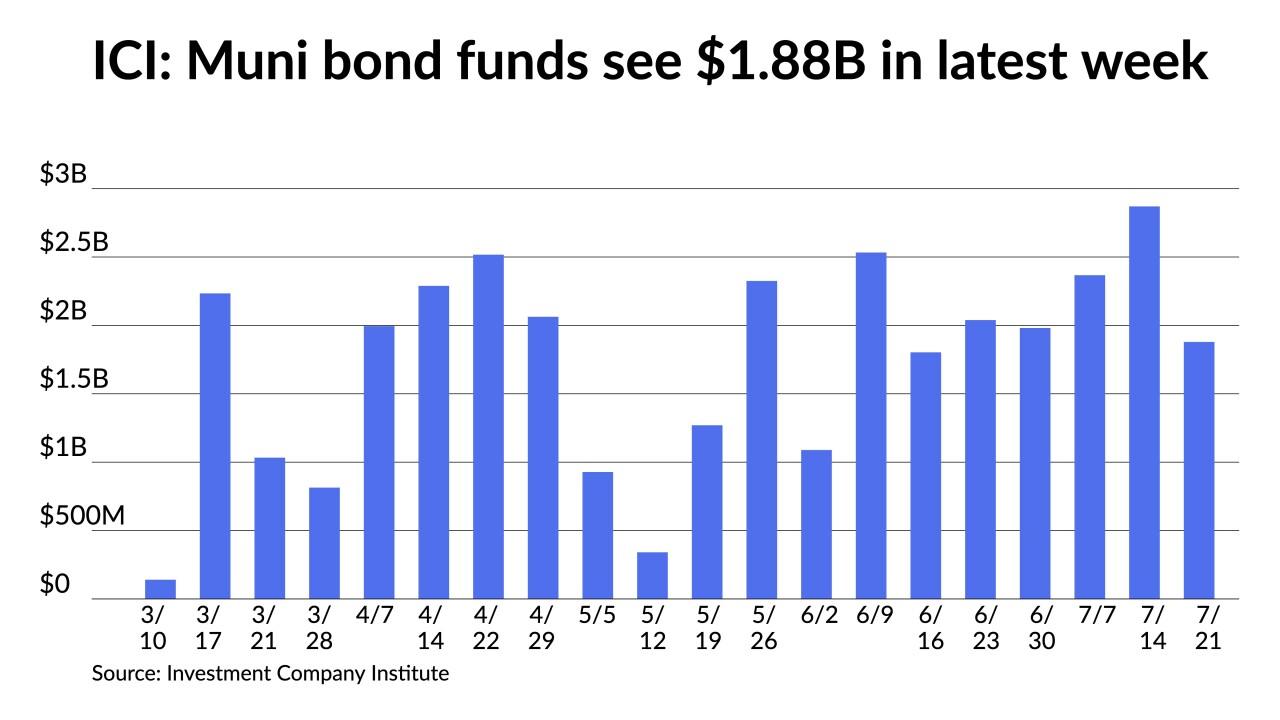

The massive summer reinvestment into municipal bond mutual funds continue and are both sustaining the strength of investor demand and solidifying the technical footing of the market.

July 28 -

Municipal issuers are missing the low-borrowing-cost opportunity to finance repairs and modernize infrastructure, says Merritt Research Services.

July 28 -

The economy continues to recover, with durable goods orders and consumer confidence suggesting strength, but concerns about the Delta variant of COVID-19 and continued supply-chain problems cloud the future outlook.

July 27 -

Federal Reserve Chairman Jerome Powell has won over a number of influential Senate Democrats who are prepared to back him for another term, though a key pair remain holdouts and are unhappy with his leadership on regulation.

July 27 -

The IRS is seeking comments on a change that may benefit many issuers.

July 26