-

Representatives from the business, academic, legal and other disciplines gathered on Capitol Hill to take aim at the many SEC rule proposals initiated under Gary Gensler's tenure.

November 2 -

Municipals closed out October in the red, the third consecutive month of losses for the asset class.

November 1 -

While some reliable options have emerged, market professionals remain hopeful the old advance refunding will return before the desire to bring it back loses any momentum.

November 1 -

October's total volume rose 29.3% to $37.156 billion in 661 issues from $28.738 billion in 614 issues a year earlier. New-money grew more than 30% while refundings were up by nearly 75%.

October 31 -

The relief means little for traditional municipal issuers but will have an effect on some conduit borrowers and issuers "adjacent" to the municipal market.

October 31 -

The application criteria for the grant programs handcuffs $5.5 billion in transportation spending to progressive priorities," said Texas GOP Sen. Ted Cruz.

October 30 -

This could be the first time the bond market has posted three consecutive negative total return years, according to John Hancock Investment Management Co-Chief Investment Strategist Matt Miskin.

October 30 -

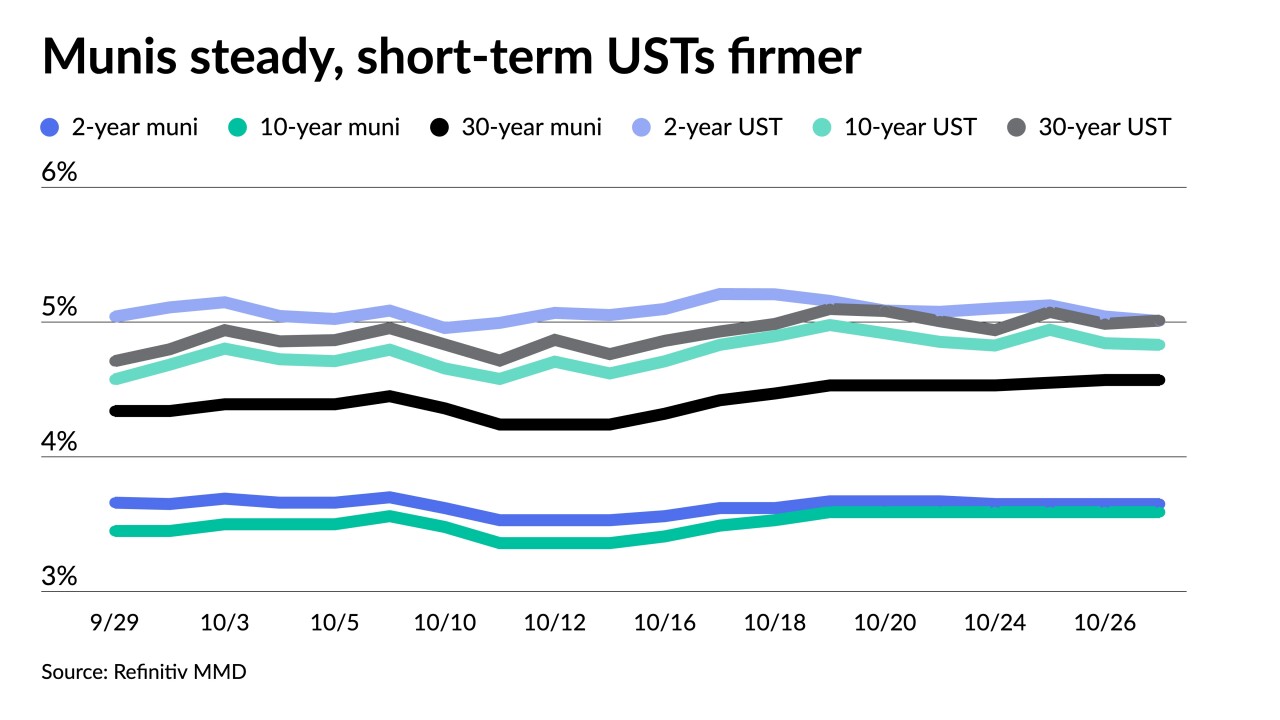

If Treasury rates become "more stabilized," it provides "a good reason to be somewhat constructive on munis for a while," BofA Global Research said in a report.

October 27 -

The Biden administration announces new emphasis on transit-oriented development.

October 27 -

The board expects to have FY 2024 fees filed with the Securities and Exchange Commission before Dec. 1.

October 27