-

Public finance attorney and NABL board member Johnny Hutchinson has left Squire Patton Boggs to join Nixon Peabody as a partner.

July 26 -

The court's decision leaves issuers back to looking for a legislative solution.

April 19 -

The Internal Revenue Service will permanently allow TEFRA hearings to be held remotely.

March 21 -

Industry advocates want to preserve allocation of private activity bonds to the states and help Congress understand the benefits of advance refunding.

December 27 -

Treasury may have some leeway when interpreting the new tax and buysiders say it's unlikely to hurt demand even if it becomes law.

November 16 -

Facing loss of their tax-exemption under 2017 tax legislation, rural electric and utility cooperatives lobbied for language in the new federal spending bill.

December 18 -

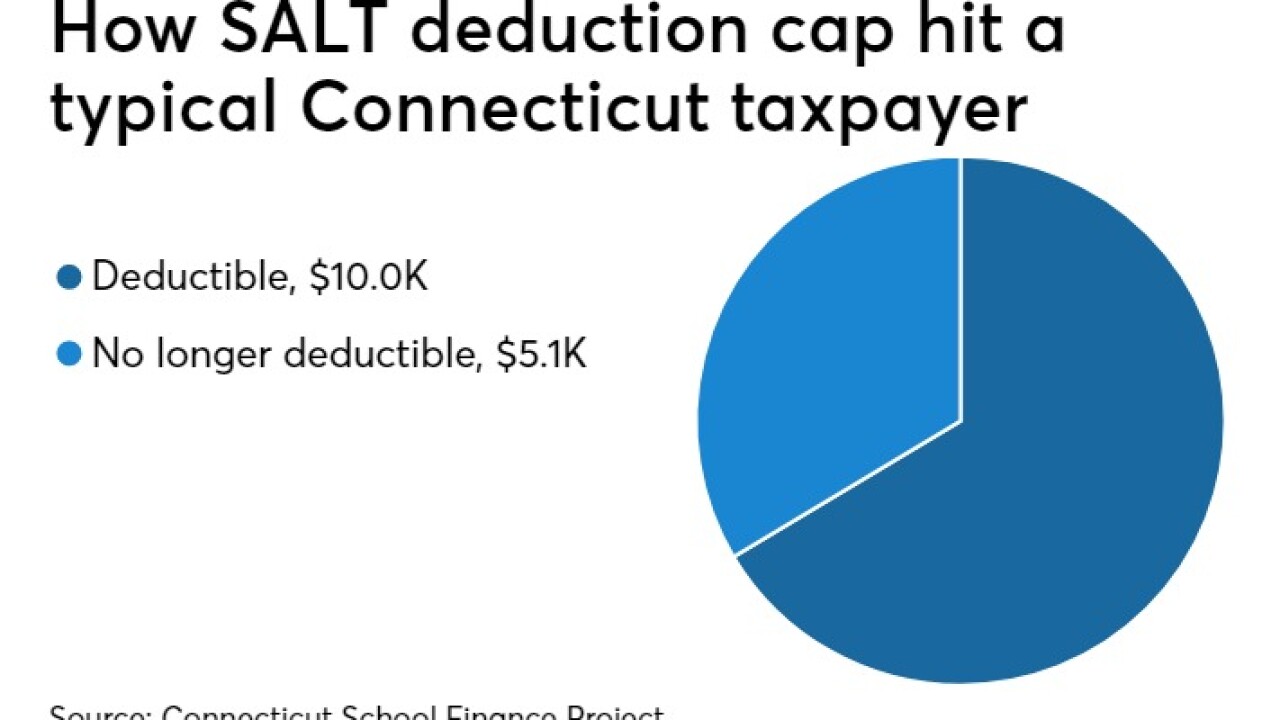

Four states in the eastern U.S. lost a legal challenge to a provision of the 2017 law that limited write-offs for state and local taxe

September 30 -

Gov. Ned Lamont and Connecticut lawmakers are studying a proposal to essentially exchange much of the state’s income tax for a payroll tax.

May 30 -

National Association of Bond Lawyers President Dee Wisor and President-elect Rich Moore discuss infrastructure, regulation, tax law and the group's educational efforts. Kyle Glazier hosts.

May 28 -

Following a late-2017 rush to market of advance refundings and private-activity bonds in the run-up to the implementation of new tax legislation, supply in 2018 -- particularly refunding issuance -- suffered a steep decline.

February 25 -

The household sector owned 42.2% of the nation’s $3.83 trillion in municipal securities in the second and third quarters of 2018, according to Federal Reserve data.

February 21 -

Emily Brock, director of GFOA’s federal liaison center, said restoration of advance refundings and increasing the limit on bank qualified debt to $30 million also are among the legislative priorities for 2019.

January 7 -

Rep. Steve Stivers plans to use the recruiting skills he honed as chair of the House GOP campaign arm to enlist new members of the bipartisan Municipal Finance Caucus in the next Congress.

December 11 -

Republican Rep. Randy Hultgren co-founded the group in March 2016 with Rep. Dutch Ruppersberger of Maryland, who will continue as the Democratic co-chair.

December 5 -

The lame duck session of Congress that convened this week may include passage of a tax bill released Monday night by Rep. Kevin Brady, R-Texas, the outgoing chairman of the House Ways and Means Committee.

November 27 -

California and New York City are showing us the path forward, as they often do, in the face of the new limits on the federal deduction for state and local taxes.

October 22John Hallacy Consulting LLC -

California government officials are trying to figure out how best to use the Opportunity Zones created in the 2017 federal tax bill.

September 20 -

The plan for a second tax reform bill is galvanizing municipal market groups to step up lobbying efforts to tout the importance and benefits of munis to lawmakers on Capitol Hill.

July 24 -

The proposed rules would clarify that an institutional investor could take part in a public-private partnership for a bond-financed project without making the bonds taxable.

June 11 -

The IRS has produced dozens of "issue snapshots" for the tax-exempt bond community, charities and non-profits, retirement plans, Indian tribal governments and federal, state and local governments.

May 25