-

The Thanksgiving holiday-shortened week, next-to-no supply and few economic data releases should keep munis steady.

November 19 -

The speculative grade bond sale is part of the financial process of returning the Phoenix-based university to nonprofit status after years as a for-profit.

November 15 -

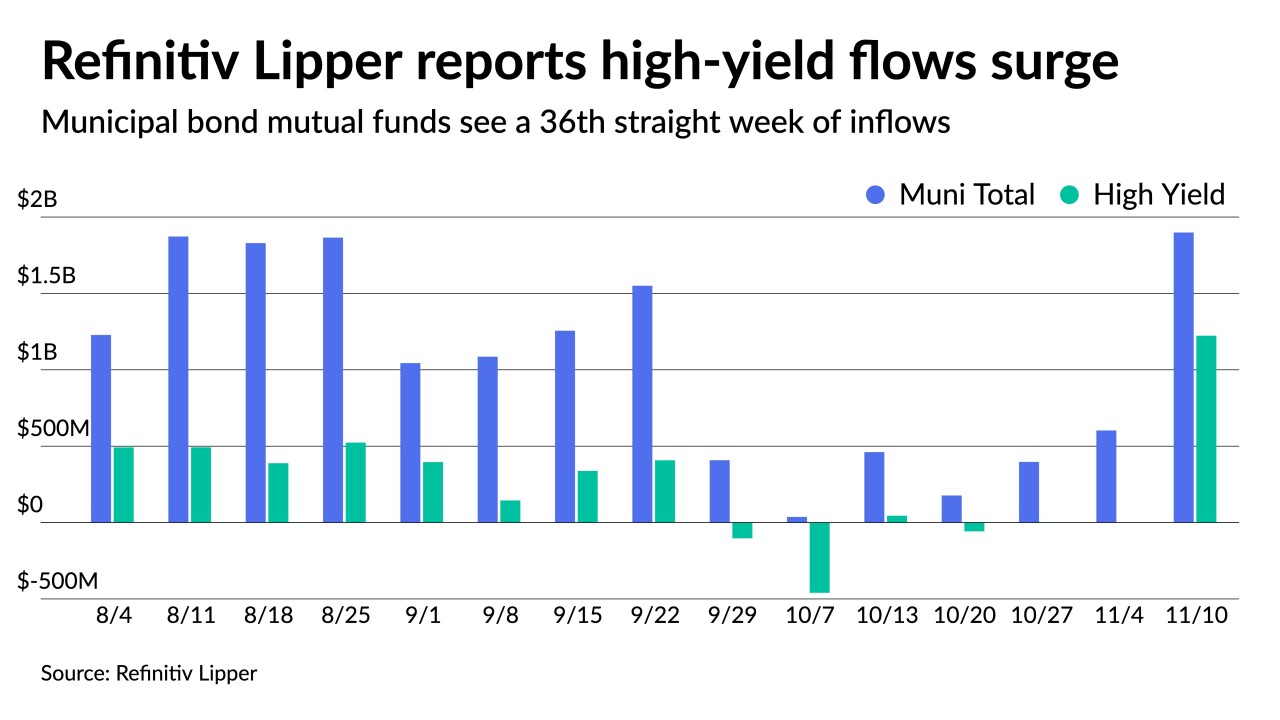

Investors put nearly $2 billion into municipal bond mutual funds for the most recent week with high-yield reversing a downward course to hit $1.2 billion following just $1 million a week prior.

November 12 -

A lighter, $5 billion calendar, heavy on healthcare, kicks off November. Most participants agree volatility in U.S. Treasuries will be a leading factor for municipal market performance. Uncertainty in Washington also isn't helping the asset class.

October 29 -

October has, on average, been the heaviest new-issue month of the year. Analysts said the lower volume, particularly taxables, was led by many issuers sitting on the sidelines, waiting for a potential package from Washington, D.C.

October 29 -

Seventy-seven percent of respondents to a Bond Buyer survey said there should be universal ESG standards and just over half said ESG is “critical” or “very important." Consensus on how to and who should create such a language is less clear.

October 19 -

The lion's share of the deal is taxable, with a $20 million tax-exempt new money series; proceeds from the taxables will refund outstanding debt.

October 6 -

The increase in yields and spread widening across municipal sectors has given some pause to high-yield investors after months of stagnation.

October 5 -

Municipals took a breather Monday, largely ignoring stock market volatility and softer U.S. Treasuries, ahead of a solid $9 billion new-issue week.

October 4 -

September issuance was down more than 32% from the same month in 2020; total issuance so far this year is at $346.48 billion, down 2.4% compared to last year.

September 30 -

The high-grade muni scales saw cuts of up to four basis points in a continued selloff Monday as the market faces a robust slate of new issues.

September 27 -

Month-to-date returns for municipals are in the red with the Bloomberg Fixed Income Indices municipal index returning -0.12%, high-yield at -0.15% and taxables at -0.32%.

September 24 -

Municipals continue to stay in their own lane. ICI reported $1.4 billion of inflows in the 28th consecutive week.

September 22 -

Several strategists estimate the municipal market will be 50% taxable in five years if a direct-pay bond option makes its way into law.

September 17 -

Ridership on the RTA's three service boards remains sharply below pre-pandemic levels but it benefits from coronavirus relief and stellar sales tax performance.

September 15 -

Market participants welcomed the municipal-related provisions in the reconciliation bill but are hesitant to start making bets on its passage.

September 13 -

Cheered by the inclusion of key muni market priorities in tax legislation unveiled over the weekend, muni market advocates must now battle to keep them there.

September 13 -

Boston-based Breckinridge will partner with Harrington Cooper to specialize in investment grade fixed-income and ESG integration for investors in the UK, Ireland, Continental Europe and Japan.

September 9 -

The taxable deal from Georgia's largest not-for-profit health system offers investors three index-eligible bullet maturities in 10, 20 and 30 years.

September 8 -

The nearly 40% year-over-year decrease is a result of various factors including rising interest rates, other financing tools, such as forward delivery bonds, and simply that refundings are in less demand from issuers.

August 31